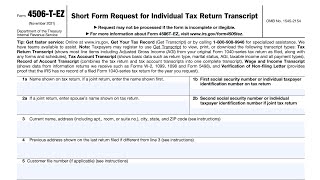

IRS Form 14039 walkthrough (Identity Theft Affidavit)

ฝัง

- เผยแพร่เมื่อ 24 เม.ย. 2023

- This affidavit is for victims of identity theft. To avoid delays do not use this form if you have already filed a Form 14039 for this incident.

The IRS process for assisting victims selecting Section B, Box 1 below is explained at irs.gov/victimassistance.

Get an IP PIN: We encourage everyone to opt-in to the Identity Protection Personal Identification Number (IP PIN) program. If you don’t have an IP PIN, you can get one by going to irs.gov/ippin.

If unable to do so online, you may schedule an appointment at your closest Taxpayer Assistance Center by calling (844-545-5640). Or, if eligible, you may use IRS Form 15227 to apply for an IP PIN by mail or FAX, also available by going to irs.gov/ippin.

Submit this completed and signed form to the IRS via Mail or FAX to specialized IRS processing areas dedicated to assist you.

In Section C of this form, be sure to include the Social Security Number in the ‘Taxpayer Identification Number’ field.

Help us avoid delays:

• Do not use this form if you have already filed a Form 14039 for this incident.

• Choose one method of submitting this form either by Mail or by FAX, not both.

• Provide clear and readable photocopies of any additional information you may choose to provide.

• Submit the original tax return to the IRS location where you normally file your tax return. Do not use the following address or fax number to file an

original tax return.

![[Full Episode] MasterChef Junior Thailand มาสเตอร์เชฟ จูเนียร์ ประเทศไทย Season 3 Episode 5](http://i.ytimg.com/vi/g5wpgeAIzMs/mqdefault.jpg)

Please feel free to check out our article, where we've written step by step instructions to help you walk through this tax form! www.teachmepersonalfinance.com/irs-form-14039-instructions/

Your dog just had to leave his own message too. Thanks, helpful video

Yeah this is a nightmare. Someone filed taxes under my identity a month before I did my return. My filing got rejected as I was told from my Preparer and been on the phone with IRS for the past two days. Finally get some instructions on how to proceed.

The letter of Identification that the IRS said they sent out I never got and from what I was told it went to a different address from where I've lived for the past 5 years AND the amount whoever tried to file in line 1a is totally different from my W-2.

They couldn't tell me the address or the amount filed but you can tell from the reps response it was incorrect.

I’m so sorry to hear that. Has the IRS indicated what the next steps look like?

@@teachmepersonalfinance2169 Get a copy of the filed taxes with mine, my preparers signature on it and send it to IRS along with Form 14039. I know the form state sending it to CA but any IRS location is doable.

I suggest enrolling with an identity program from Experian, etc. to protect yourself just in case someone is trying to open up a credit line under your name in a different state. Yes that's happen to me as well.

@@Night--Shift File a report to FTC agent Focusutensil for help on your case .

it is IRS trap, they screw up everyone who sign the identity theft protection. i got screw from them too. this ridiculous

Question here, our refund was rejected because one of our dependents was claimed by someone unknown. My husband I are married and file jointly and no one else would have claimed them. On the 14039 form it only has space for 1 dependent but we are not sure which dependent was used fraudulently. Do we do two forms? Or how do we go about this. We just are not sure which child was fraudulently claimed.

I do not know the answer to that question, with confidence, so I will defer to the guidance on the IRS website:

www.irs.gov/identity-theft-fraud-scams/identity-theft-dependents

You might need to submit that documentation for more than one dependent, but you might not need to file IRS Form 14039.

do we need to attach supporting documents (SS card, childcare records, birth certificate) to form 14039 when filing it along with the return? Thank you

I don't see anything in the form instructions indicating that you need to submit supporting documentation for your identity theft claim.

Thanks to the support team of #FOCUSUTENSIL who helped me in sorting my case I was a victim as well as my children .