How a Mathematician Became the Greatest Trader of All Time

ฝัง

- เผยแพร่เมื่อ 14 พ.ย. 2023

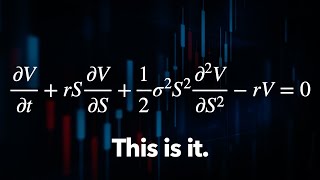

- Jim Simons used his coding skills to become the greatest investor ever. Try brilliant.org/Newsthink/ for FREE for 30 days, and the first 200 people will get 20% off their annual premium subscription.

Follow Newsthink on X x.com/Newsthink

Newsthink is produced and presented by Cindy Pom

x.com/cindypom

Grab your Newsthink merch here: newsthink.creator-spring.com

Thank you to our Patrons, including:

John & Becki Johnston

Igli Laci

Support us on Patreon: / newsthink

Highly recommend the book: The man who solved the market by Gregory Zuckerman: www.amazon.com/Man-Who-Solved...

Special thanks to the following for permission to use their material:

0:36 The Abel Prize: www.abelprize.no

1:19 Photographer David Eisenbud. Image first appeared in The Promise of Berkeley in 2016: light.berkeley.edu/p/promise-...

Select images/video supplied by Getty Images and Alamy.

Sources:

0:20 Bradford Cornell statistics: www.cornell-capital.com/blog/...

1:22 Archives of the Mathematisches Forschungsinstitut Oberwolfach, Creative Commons licence Attribution-Share Alike 2.0 Germany (creativecommons.org/licenses/b...)

2:27 Kenneth C. Zirkel, CC BY-SA 4.0 creativecommons.org/licenses/... via Wikimedia Commons

2:30 Kenneth C. Zirkel, CC BY-SA 4.0 creativecommons.org/licenses/... via Wikimedia Commons

2:43 IBM Research, CC BY 2.0 creativecommons.org/licenses/... via Wikimedia Commons

3:35 Leonard Banks, CC0, via Wikimedia Commons

5:39 German ledger: RaphaelQS, CC0, via Wikimedia Commons

7:18 Medallion Fund average returns in 1990 by Cornell Capital: www.cornell-capital.com/blog/..., rest of data sourced from Gregory Zuckerman's book

7:27 Data derived from both Greg Zuckerman's book and Cornell Capital Group (58% net return)

8:12 1166 Avenue of the Americas, CC BY-SA 3.0 creativecommons.org/licenses/... via Wikimedia Commons

8:48 Gleuschk, CC BY-SA 3.0 creativecommons.org/licenses/... via Wikimedia Commons

8:50 Government of Thailand, CC BY 2.0 creativecommons.org/licenses/... via Wikimedia Commons

9:36 S&P data by MacroTrends www.macrotrends.net/2526/sp-5..., Medallion data by Gregory Zuckerman's book

11:53 respres, CC BY 2.0 creativecommons.org/licenses/... via Wikimedia Commons

11:56 User:Brendel at en.wikipedia.org, CC BY-SA 3.0 creativecommons.org/licenses/b... via Wikimedia Commons

12:29 Gage Skidmore from Peoria, AZ, United States of America, CC BY-SA 2.0 creativecommons.org/licenses/... via Wikimedia Commons

12:47 Gage Skidmore, CC BY-SA 2.0 creativecommons.org/licenses/... via Wikimedia Commons

12:52 - 12:56 Gage Skidmore, CC BY-SA 2.0 creativecommons.org/licenses/... via Wikimedia Commons

12:57 Michael Vadon, CC BY-SA 4.0 creativecommons.org/licenses/... via Wikimedia Commons

13:06 Gage Skidmore from Peoria, AZ, United States of America, CC BY-SA 2.0 creativecommons.org/licenses/... via Wikimedia Commons

13:22 Gage Skidmore from Peoria, AZ, United States of America, CC BY-SA 2.0 creativecommons.org/licenses/... via Wikimedia Commons - วิทยาศาสตร์และเทคโนโลยี

*If you enjoyed this, check out my video on the outsider who turned $2M into $20 BILLION, the greatest trade ever* th-cam.com/video/1IMsHJI7WjM/w-d-xo.html

Try brilliant.org/Newsthink/ for FREE for 30 days, and the first 200 people will get 20% off their annual premium subscription

I realize George Sorrows is very controversial, but I would be very interested in watching a biography on him. Or maybe your take on whether he manipulates or not.

Do an autobiography on yourself! I would definitely watch that video and I'm sure many others would as well.

Can you do one about Jordan Belfort??

Pplo

I’m

It's a common misconception that when a stock you buy skyrockets, the smart thing to do is sell it (or at least sell some of it) to lock in your profits. But the context matters. If the stock has increased sharply because the business is performing exceptionally well, it could still be a bargain. I'm still looking for companies to make additions to my $350K portfolio, to boost performance. Here for ideas...

I think the next big thing will be A.I. For enduring growth akin to META, it's vital to avoid impulsive decisions driven by short-term fluctuations. Prioritize patience and a long-term perspective consider financial advisory for informed buying and selling decisions.

A lot of folks downplay the role of advlsors until being burnt by their own emotions. I remember couple summers back, after my lengthy divorce, I needed a good boost to help my business stay afloat, hence I researched for licensed advisors and came across someone of utmost qualifications. She's helped grow my reserve notwithstanding inflation, from $275k to $850k.

Glad to have stumbled on this conversation. Please can you leave the info of your investment advisor here? I'm in dire need for one.

Elisse Laparche Ewing is the licensed fiduciary I use. Just research the name. You’d find necessary details to work with a correspondence to set up an appointment..

She appears to be well-educated and well-read. I ran an online search on her name and came across her website; thank you for sharing.

Stock market’s historical performance estimate that over time, the payment (and reinvestment, and compounding) of dividends have contributed anywhere from 30% to 90% of the S&P 500’s total returns. I want to spread $400,000 into profit yielding dividend equities but unsure of which to get into.

Explore the option of engaging financial advisors, estate planners, or tax experts. Their specialized expertise can assist you in navigating intricate financial decisions.

A lot of folks downplay the role of advisors until being burnt by their own emotions. I remember couple summers back, after my lengthy divorce, I needed a good boost to help my business stay afloat, hence I researched for licensed advisors and came across someone of utmost qualifications. She's helped grow my reserve notwithstanding inflation, from $275k to $850k.

How can I participate in this? I sincerely aspire to establish a secure financial future and am eager to participate. Who is the driving force behind your success?

Vivian jean wilhelm is the licensed fiduciary I use. Just research the name. You’d find necessary details to work with a correspondence to set up an appointment..

Thank you for this Pointer. It was easy to find your handler, She seems very proficient and flexible. I booked a call session with her

I can never catch a break in the stock market. I was up by nearly $4000 but I regret not selling sooner. I think I am too impulsive and not fast enough at the same time.the Market is too volatile.

True, the market makes you feel stupid

With my demanding job, I lack time for investment analysis. For seven years, a fiduciary has managed my portfolio, adapting to market conditions, enabling successful navigation and making informed decisions. Consider a similar approach.

Wow, I bet that you cannot recommend anyone.

Kristin Amy Rose is the licensed coach I use. In doubt? Just research the name. You'd find necessary details to work with a correspondence to set up an appointment.

Thank me later.

@@RickMckee-nq4ni you actually gave out that rec for free. You're far too kind!

The problem we have is because Most people always taught that " you only need a good job to become rich. These billionaires are operating on a whole other playbook that many don't even know exists.

Money invested is far better than

money saved, when you invest it gives

you the opportunity to increase your

financial worth.

It is remarkable how much long term

advantage people like us have gotten by trying to be consistently not stupid,

instead of trying to be very intelligent.

The wisest thing that should be on

everyone mind currently should be to

invest in different streams of income

that doesn't depend on government

paycheck, especially with the current

economic crisis around the world. This is still a time to invest in Stocks, Forex and Digital currencies.

I also keep seeing lot's of people

testifying about how they make money investing in Stock, Forex and Crypto Trade(Bitcoin) and I wonder why I keep loosing. Can anyone help me out or at least advice me on what to do.

Even with the right technique and

assets some investors would still make more than others. As an investor, you should've known that by now that nothing beats experience and that's final. Personally I had to reach out to a stock expert for guidance which is how I was able to grow my account close to $35k, withdraw my profit right before the correction and now I'm buying again.

I feel investors should be focusing on under-the-radar stocks, and considering the current rollercoaster nature of the stock market, Because 35% of my $270k portfolio comprises of plummeting stocks which were once revered and i don't know where to go here out of devastation.

Safest approach i feel to tackle it is to diversify investments. By spreading investments across different asset classes, like bonds, real estate, and international stocks, they can reduce the impact of a market meltdown. its important to seek the guidance of an expert.

A lot of folks downplay the role of advlsors until being burnt by their own emotions. I remember couple summers back, after my lengthy divorce, I needed a good boost to help my business stay afloat, hence I researched for licensed advisors and came across someone of utmost qualifications. She's helped grow my reserve notwithstanding inflation, from $275k to $850k.

@@VigneshRishab Glad to have stumbled on this comment, Please who is the consultant that assist you and if you don't mind, how do I get in touch with them?

Her name is 'Michele Katherine Singh’. Just research the name. You’d find necessary details to work with a correspondence to set up an appointment.

@@VigneshRishab Thanks for sharing. I curiously searched for her full name and her website popped up after scrolling a bit. I looked through her credentials and did my due diligence before contacting her. Once again many thanks

“How this investor made millions”

“Their ways are kept secret and all employees need to sign an NDA”

Bernie 2.0

@@iamFSRL ong probably

How he made milions? Call this a cumulated revenue paid by losers (so called traders).

Yep, smells like BS. If any, they had insider information.

definitely@@captaingabi

Hit 200k today. Thank you for all the knowledge and nuggets you had thrown my way over the last months. Started with 14k in last month 2024

Wow that's huge, how do you make that

much monthly?

I am 65 and have been looking for ways to be successful, please how??

Honestly speaking.... I will continue to trade / and stick to Sonia/ daily analysis and guides as long as it works well for me.

Ms. sonia christen was my hope during the "bear summer" last year. I did so many mistakes but at the same time learnt so much from it, and of course from Sonia

Woah for real? I'm super excited. Sonia christen strategy has normalized winning trades for me also. and it's a huge milestone for me looking back to how it all started

Medallion fund capped out decades ago at ~$10B working capital, so their returns are not *compounding* returns, and they have to take extra cash out. This is because they do short-term trading and there is only so much alpha to capture in that timeframe. So you cannot compare a 34% non-compounded return with a 25% compounded return. Heck, even a mere 10% compounded return will eventually beat a 34% non-compounded return given sufficient time. That said, yes he is probably the best trader out there. They call him the Quant King for a reason.

HOLD ON. This man was accused of being a fraud. Possibly a Ponzi scheme runner.

At that size there is no way to scale further. The only way to outscale the dropoff in beating market inefficiencies is to control the inflow and outflow. Enter Citadel who oversees 70% of all broker volume before it even hits the market. The only problem is that Citadel is also in the hedge fund game and uses that market foresight to take trades before the market actually moves. There is no way to beat that monopoly. Government Anti-trust should have broken up Citadel years ago. Now they're too big, too integrated with market operations, they became part of the too big to fail group..

What you mean? Compounded return is the only real return, the only that makes sense for analizing and comparing returns.

@@michaela7759 Analizing? Oh my!

Two key differences:

1. You will often only get to enjoy your compounded gains after you're old and frail.

2. Compounding takes time to grow money...and inflation also takes time to eat away at your money.

Going the distance matters, but so does the speed. There's far lesser utility for $5 million dollars when you're 80yo versus $100K when you're 35yo.

The level of excellence in this video is insane. Thank you

Absolutely mesmerizing! This video brilliantly encapsulates the extraordinary journey of Jim Simons, from a mathematician to the greatest trader of all time. His innovative approach to investing, rooted in data, algorithms, and a relentless pursuit of patterns, redefines the landscape of Wall Street. Truly inspiring

The current economy is unnecessarily tougher for some most people, myself included. I’m used to just buying and holding assets which doesn’t seem applicable to the current rollercoaster market. Plus inflation is already catching up with my $310k portfolio. I’m really worried about survival after retirement.

The government has let us down; just buy gold.

How can one find a verifiable financial planner? I would not mind looking up the professional that helped you. I will be retiring in two years and I might need some management on my much larger portfolio. Don't want to take any chances.

Thank you for sharing, I must say, Debra appears to be very knowledgeable. After coming across her web page, I went through her resume and it was quite impressive. I reached out and scheduled a call

@@traviswes7082 the Melissa is goose....the bitcoin it make me millionair

thanks for changing my life and that of my family I will continue to preach about your goodness Foley

WOW, I'm a bit perplexed seeing her been mentioned here I also didnt know that she has been good to a lot of peoples too

this is wonderful, I'm in my fifth trade with her and it has been super.

amazingly she's my family personal broker and broker to many families in the United States, she's licensed broker and a FINRA AGENT in the United States.

You trade with Elizabeth Foley too? WOW that woman has been blessing to me and my family

help me wanna reach her

using telegram

Fascinating insights! Jim Simons' transition from academia to finance highlights the importance of following your passion, even in the face of doubt. His belief in the predictive power of data paved the way for unprecedented success. Truly a masterclass in leveraging expertise to defy expectations!

Title says 'Trader'. But commentator say 'Investor'. Trading and investing aren't the same. Simmons is the greatest trader Not the greatest investor.

The title says greatest trader where did you see investor?

😅 how you say so? He invested money at the beginning to compound for 30+ years , in that sense he's a investor too

Bunch of poor people arguing over a couple of words

If your investment matures early, you become a trader. And if your trade returns is delayed, you become an investor. This breed of humans is called “swing traders with a lot of patience”.

Short-term trading and long-term trading are different forms of investing or speculation.

A math teacher, a gambler and a financial investor entered the stock market.

fairy tale told by $$$

After so much struggles I now own a new house and my family is happy once again everything is finally falling into place!!

I'm 37 and have been looking for ways to be successful, please how??

Yes she works with people all over the world, she's the best you can ever come across.

@harrisonryder No you've never heard of her.

@lukavincent No she isn't.

@beccamartin223 No, don't.

Its so dumb that medallion solved the market but refuse to announce their findings. Imagine the ground breaking discoveries waiting in Medallion doors

Renaissance Technologies being "under review by the IRS over a loophole that saved their fund an estimated $6.8 billion in taxes over roughly a decade. In 2008 Medallion made 80% profit while RIEF lost 16%. “Learn the rules like a pro, so you can break them like an artist.”

Look up the money hidden in Bahamas trusts and the whole story, from Colombia to funding the elections. Look at the media strategists and paid articles to create an image that does not minimally correspond to any factual and checkable reality. People really think the guy really knew something about trading ? lol, an exercise in pure gullibility: do not complain if you lose money in the mkt with this level of intelligence 🙂

As a beginner, educate yourself, Learn the basics of investing and the stock market. There are many resources available online, including books, articles, and online courses. It’s a good idea to diversify your portfolio across different stocks and sectors to minimize risk. I’ve heard of people accruing over $550k during recessions and inflation, its important to do your own research.

Remember that investing in the stock market carries risks, and it’s important to do your own research and consult with a financial advisor before making any investment decisions.

I've been able to scale from (50K to 189k )in this red season because my Financial Advisor figured out Defensive strategies which help portfolios be less vulnerable to market downturns

Would it be okay if I asked you to recommend this specific advisor or company that you used their services? Seems you've figured it all out.

'Vivian Carol Gioia' is the licensed advisor I use. Just research the name. You’d find necessary details to work with a correspondence to set up an appointment.

Thank you! I entered her full name into my browser, and her website came out on top. I filled her form and i hope she gets back to me soon.

Hey!! Love your videos!!! They are of such a high calibre!! Love your mission to spread science to everyone!! Keep it up!! ❤🎉

Her Subscribership climbed really fast when She started her channel from Toronto where I am. She's Great! She did it all SOLO too!

The quality of her speech must be helpful for those learning English as well. She can handle any kind of subject matter with apparent ease. TH-cam prefers you stick to one area. They got to put you in a slot.

As a Canuck living down the street from Cindy, I guess, I wish more Americans would be more aware of the horrible dangers of re electing trump to the free world.. She is a fine journalist. One of the best I think. I worry about her discussing politics but very much appreciate her great intelligence and maturity. She really does make that guy look dumb and immature by comparison. I almost wish she could start another channel without affecting this one, maybe even save the World.

You just got yourself a subscriber, the level of details and work that went into this, make any other TH-cam channel pale in comparison

This was so interesting, I had never heard of him. Thank you!

There's probably a lot of folks out there like him that we'll never know of.

PLEASE ADVISE ME.

I was told to spread my money across different things like stocks and bonds to protect my retirement savings.with the markets being shaky,I'm considering going into Trade. options like Trade Bitcoin or Trade Forex?

I HAVE INCURRED SO MUCH LOSSES TO TRADE ON MY OWN,I TRADE WELL ON DEMO BUT I THINK THE REAL MARKET IS MANIPULATED.BE CAREFUL OF BOTS.THEY'RE MAKING IT DIFFICULT TO FIND A LEGIT MENTOR.

I always advice new members to have an orientation on how it works before getting involved. Trade offers more benefits than just holding.

Kate Floretta

in stagram

Kate Floretta

Face book

She Trade for Celebrities & could Mentor you.

This should be a movie

I'm sure, that Market Makers are having fun when they hear something like this)

Market Makers love volume.

Stories like this inspire people to go into trading and investing. Keep it up

I keep loosing in real trade but win in Demo.

Should I give up on Trade?

What should I do?

How may I do better?

What I'm I doing incorrectly?

I HAVE INCURRED SO MUCH LOSSES TO TRADE ON MY OWN,I TRADE WELL ON DEMO BUT I THINK THE REAL MARKET IS MANIPULATED.

I always advice new members to have an orientation on how it works before getting involved. Trade offers more benefits than just holding.

Kate Floretta

in stagram

Google "katefxfloretta" anywhere take classes and learn to trade.

having a mentor is also very important when it comes to Trade, with out that, it can be very frustrating.

I like this lady's voice and story flow

Thanks

A brilliant mind with a good heart. He definitely deserves what he has achieved.

The introduction of a Bitcoin ETF marks a groundbreaking moment in the cryptocurrency world, merging digital currencies with traditional investment methods. This innovation could stabilize Bitcoin prices and broaden its appeal to a wider range of investors, potentially increasing demand and value. At the heart of this evolution is Sarah Jennie Davis, whose deep understanding of both cryptocurrency and traditional trading has been instrumental. Her holistic approach to investment and commitment to staying abreast of market trends make her an invaluable ally in navigating this new era in cryptocurrency investment

The wisest thought that is in everyone's minds today is to invest in different income flows that do not depend on the government, especially with the current economic crisis around the world. This is still a good time to invest in gold, silver and digital currencies (BTC, ETH... Stock)

I have heard about her excellent trading expertise in CNBC news, guess she's more popular in United States

YES!!! That's exactly her name (Sarah Jennie Davis) so many people have

recommended highly about her and am just starting with her from Brisbane Australia

I thought I'm the only one that knows her well I guess her good reputations speaks for her now

I've completely stopped working all thanks to Sarah

This guy is actually awesome. Not being sarcastic. He’s chill.

Nope.

I rely on understanding the algorithm that actually runs the market.

gSuper i like n your strategy Amazin

I frequently hear people discussing the returns they earn from investing in Bitcoin and Forex. As a beginner, how can I get started with it?

Investing without a thorough understanding of the market is not recommended. I suggest consulting with Expert Rosie for guidance.

Rosie excels in market analysis. Her signals are accurate.

My friend has been mentioning this woman Rosie to me. I'm considering giving her a try to see what she can achieve in the market.

When someone is direct and proficient in their work, others will always advocate for them. In my opinion, I would recommend giving expert Rosie Harley a chance, and you'll be glad you did.

I'm not here to converse for her but to testify just for what I'm sure of, she's trust worthy and best option ever seen

They charge 44% fee over performance and the Medallion fund is restricted to employees and a small number of people.

Their fund open to the public, Renaissance Institutional Equities Fund (RIEF) is not that good and experienced losses.

It's all very strange.

Ponzi maybe?

I remember finding a guy on TikTok about 2 - 2.5 years ago who said he felt like Simons wasn't really doing anything all that impressive, but he didn't go into great detail. He planned to do multiple parts on Simons and his own personal research into Renaissance and the Medallion fund but I lost track of his account - he may not be all that hard to find if I look. I say all that to say I think things aren't quite what they seem with Medallion and there's likely more of us that view Simons' success with suspicion than is known, just because he's a fairly non-public figure.

RIEF tries to capture alpha on a different (*longer) timescale, which is way more difficult. Medallion's core time scale is high frequency, where those returns are plausible, given how much leverage the consortium of banks gave them (10x), but there's gotta be very little of that alpha left now. We will never find out, given the veil of secrecy around Medallion now (no 'external' shareholder)

Thats a bad sign...

RIP Jim, 1938-2024

If anyone’s looking for any specifics, this is just a general overview

I lost over $70K when everything started to tank. Not because I was in an exchange that went belly up. I was just stupid to hold and because that's what everyone said. I'm still responsible. It just taught me to be a better investor now that I understand more of what could go wrong. It took me over two years of being in the market, I'm really grateful I find one source to recover my money, at least $9k profits weekly. Thanks so much Expert Johnson Nikon.

Bitcoin doesn't need any action to boost the price. It is a unique coin as well as the mother ship of cryptocurrency which is considered as digital gold, and is used as an asset store for big investors. So as long as the digital world still exists, bitcoin will continue to be king.

Don't believe this

There are no good advices when it comes to random walk..

Expert Johnson Nikon is a joke 🙂

Your reports are always so original. This, for example, was never mentioned before, anywhere...

Actually I remember seeing a video about Simons very similar to this back around 2017. Many of the same images, timetables, everything. But alas, TH-cam can be very algorithmic in deciding what and when they will show you things. I'm sure if you dug deep enough you will find more like this. Hope that helps. :)

It's crazy how your tone changed when discussing Trump.

Отличная информация, попробую обязательно!

Since Simons become master of the Universe with Math, we introduce Brilliant courses about Math.

*immediately runs to the library and borrows all the maths textbooks they have*

One of the reasons is that they capped their fund size. As the fund grows, it becomes increasingly difficult to maintain its performance level. You need to adjust the size for every transaction and every underlying asset. You need to diversify the asset class and minds for liquidity risk. So, of course, growth will slow down.

why is it we never heard about this back in 1988, I was looking for a way back then to learn to invest. Back then you needed a minimum of 5000$ to trade...

I'm favoured, $30K every week! I can now give back to the locals in my community and also support God's work and the church. God bless America

Please how do you achieve this?

I usually go with registered representatives. Faith Reece has the best performance history (in my opinion) and does offer 1v1 consultation to her capitalists which I think is amazing.

Wow.... She has really made good name for herself, she's also my account manager

Since meeting Expert Faith, I now agree that with an expert managing your portfolio, the rate of profit is high, with less risk.

I agree with you. I'm not here to converse for her but to testify just for what I'm sure of, she's trust worthy and best option ever seen..

You're a very good storyteller and your voice is soothing.

Great video, trading come with a lot of benefits And I have just bought my first house. As a beginner I was scared of loosing but I’m glad I took the bold step that is now favoring me

As a beginner, it's essential for you to have a mentor to keep you accountable. I'm guided by a widely known crypto consultant

Mrs Nancy almodovar

Mrs Nancy was my hope during the bear summer last year. I did so many mistakes but also learnt so much from it, and of course from Nancy. She is my number one when it comes to crypto and TA.

This is a series of stock video clips.

“This is why you’re in debt”

The first step to attaining wealth is figuring out your goaIs and risk toIerance - either on your own or with the heIp of a financiaI pIanner, and foIIowing through with an inteIIigent pIan, you wiII gain financiaI growth over the years and enjoy the benefits of managing your money.

I am fortunate I made productive decisions that changed my finances (gathered over 1M in 2years) through my financiaI planner. Got my 2nd house in Feb, and hoping to retire soon. Give this a try and attain good-returns. .

For more lnfo

Financial -Planner Rebecca Mart-Watson (in fuII)

Absolutely love the way this video was formatted and the visuals were on point. Answered all quesitons which is way better than what most teachers are doing these days Swaggy. Massive thumbs up. And hats off to the production team. As a videographer I know what it takes to make videos like this.

Thank you Cindy this was very informative.

3:23 no socks because it takes time...... But wearing a tie...

*I didn't become financially independent until I was in my late 40's, and I'm still in my 40's. In addition to having purchased my second home and earning money on a monthly basis through passive income, I've also achieved three out of five goals. I just hope this inspires someone to realize that it doesn't matter if you don't have any of these things yet, you can start today no matter your age. Change your future by investing! I made a rather big decision by investing in the financial market.*

Investing in many sources of income that are independent on government paychecks is the prudent thing that everyone should be thinking about right now, especially given the global economic crisis. Stocks, forex, and digital currencies are still good investments at this time.

Sure, investing is essential for maintaining your financial stability, but making any kind of legitimate investment without the correct advice of a professional can result in a significant loss as well.

It's really not easy investing or trading the financial market. I read a lot of books, tried to study, watch some tutorial videos, did a little demo before funding my account and I still lost a lot. The financial market could be very tricky

Yeah I have same issue also, sometimes I feel like the market is being manupulated

Trading under the guidance of an expert is the best strategy for beginners.

Medallion returns aren’t compounded. This is very misleading.

The fund is capped at an est. $10bn, and every year profits are taken out, they technically can’t be compounded or else Medallion would be managing hundreds of trillions by now.

So no, if you invested in a BRK, you’d be better of

I currently participated in a liquidity mining and earning 2-3 % as daily passive income, Strongly recommend,

Your presentation is very professional. Thanks for the good explanations!

i think $1 to $1 Billion. that thumbnail. HAHAHAHA

Zuckerman's book is a great read. Def worthwhile. Simons NOT the only person to solve the Markets. Another fellow by the name of Ed Thorp "A Man for All Markets" also developed a very successful algo that had a impressive win rate. Simons surrounded himself w very smart ppl that built the systems of Jim's vision. Simons personal life very tragic in many ways. Went through some very tough family crisis and loss. Money is Not everything. But it certainly beats being poor!

Yes, I agree. I've always found it interesting that so many stories about "life's tragedies" come out regarding the uber-wealthy. Their stories are always meant to inspire, but it's such a tough pill to swallow for poor, or working class families who deal with the same kinds of tragedies, but don't have millions or billions of dollars to coast on. There are countless inspiring stories of those who are able to put their boots on following a horrific loss of a loved one, and return to their mundane jobs, just so they can continue to pay bills and feed their families. And alas, because they are so average, so numerous, and because they've never focused on becoming famous and/or wealthy, their stories are rarely written about. But, if one stops to smell the roses, and talks to a neighbor or two every now and then, you can hear and share such stories with many of the people who actually give economists like Simons the opportunity to extract their wealth.

I don't want to take away from Zuckerman's book, but what i will say. He had some personal family tragedies that shook him greatly. Wasn't sure he'd make it back to RenTech

are there any funds like medallion which are started by Ex Renaissance Technologies employees

Oh, so he’s Madoff without fraud

His real returns are literally higher than Madoff's fake returns lol

Simons knew WAY before any of the Federal Agency's that Madoff was a scammer and a fraudster.

And yes.

RIP King

Thanks Cindy was desperately Waiting for this ?

I currently participated in a liquidity mining and earning 2-3 % as daily passive income, Strongly recommend,

A true pioneer of the game, there are now AI applications being used the trade ES/NQ using algorithms originally pioneered by Renaissance.

Really? What are they? I thought Renaissance's algorithms aren't public?

Very informative episode.

Thank you!

One of my regrets in life is that I did not major in Mathematics in college even though I loved math so much.

I currently participated in a liquidity mining and earning 2-3 % as daily passive income, Strongly recommend,

When every fund will be using the same techniques (and that day is coming), then a stalemate will happen and there will be a need of a new, different kind of genius.

There will never be a stalemate as the market is so complicated it will never be a perfectly solved problem as there are so many unknown variables. It will be nearly impossible for the average joe to make money trading however.

I hear what you're saying. But we must remember, AI. That is going to create very clever (and FAST) trading strategies. And do other things to spoof (manipulate) the market.

ie, move the bid/ask spread around, flooding the market with buy/sell orders (they immediately cancel). Do this a couple million times a day.... a nickel and dime a trade, etc.

Of course, you and I will be at a great disadvantage.

Naked short selling.... Since the SEC doesn't enforce their rules, you can expect shenanigans.

etc...

That elderly driver would've gotten arrested anyways lol

Do not underestimate the power of getting in early. If you are not in Xeventy now, you are lagging behind.

Sounds like a smart guy and best trader but that fact he canned a partner for political views is crazy I wouldn’t fire or ask someone to resign over politics or bribes he could have easily made that money later since he was so good I put morals and integrity over money

I currently participated in a liquidity mining and earning 2-3 % as daily passive income, Strongly recommend,

Ok enough. I've reviewed his assets. The 'majority' of his growth was from retained assets not from growth. Currently his fund is losing growth and he has closed off purchases into his fund.

The robospeech rumbled my tummy

lol. It’s real person talking

30 years? I'm already 50. I don't know if I'm gonna be around another 30 years.

The ad at the end is brilliant

it ruined it for me. It went from a deep thought on how on one side there is so much potential in what we can do with our lives and on the other, the reality of our mortality and how after earning a certain amount, does it really matter?

@MubashirullahD What a great point. My wealth is my loved ones. Stay safe.

He can be the richest person if he invested more and not sharing to his employees. What a humble guy.

nope.

I would like to ride a chariot pulled by running horses instead of running by myself. you understand what I mean. Key of growth and success is to hire brilliant horses.

@MRBEYG that is all billionaires do, but few will share a chunk of stocks to its employees.

For not wearing socks, i like him

GOOD LUCK WITH THAT ORIGINS OF THE UNIVERSE THING...!

No doubt this man would have discovered the cure to cancer had he stayed in the medical field.

He probably needed to, Man is a habitual smoker!

Doubtful, his medical work would have likely suffered due to mind always drifting towards the mathematics of how to become rich. It's like thinking that a warrior like Joan of Arc would make a great politician, or that Nikola Tesla could have become a composer to the likes of a Richard Wagner. Some people may just be born to do what they love to the best of their extent. Interesting thought experiment though.

Extremely well done ❤

"Don't blow it. Keep it simple. Count your money."

11:50 Is the RIEF trading anywhere? Or is it through select brokerages for Institurioinsl Investors/Accredited Investors only? Anyone? Much appreciated.

One day the real truth will come out until then keep pushing that 100 bucks story

Hi. I'm interested in knowing the real story,care to share? Thanks!

I always click instantly and come to comment "1st", but there's always someone 😅

I currently participated in a liquidity mining and earning 2-3 % as daily passive income, Strongly recommend,

Nice guy too..often see him walking in a park that he dedicated to his late son

Ex glowie. 100% inside trading.

I currently participated in a liquidity mining and earning 2-3 % as daily passive income, Strongly recommend,

Warren Buffett net worth $118 billion. Jim Simons net worth $30 billion!

In what amount of time?

Buffet was more lucky than good. He rode the general market and hit on a couple of mega stocks. He does not diversify well at all. Basically he is a gambler.

@@OldLion64 Actually no, he's an economist - looks at the business, analyzes the income/expense ratios and that's about it. The speculation is the gambling part.

Make a video on ray dalio next time please

Coinbase listing comming soon fo Xeventy.

I turned $1 into $4 !

😲 wow

in his public hedge funds, he is losing billions for pention funds and private investors . this at least smells bad as his closed fund dose great . some thing is wrong

I forgot where to find that information.

I currently participated in a liquidity mining and earning 2-3 % as daily passive income, Strongly recommend,

The algorithm that works for 10 billions doesn’t work for larger funds

@@IR-xy3ijwhat type of trading do you do?

He buys out every legislator. Easy to win when you are on the side that make the rules.

RIP TO THE LEGEND

My heart bleeds for his cycling son that got hit by a car and the driver who also died days later. And for the second son that drowned and died. 😭😭💔💔

Why did all of that happen? 😭😭

That elderly driver would've gotten arrested anyways lol

@frommarkham424

I guess it wasn't intentional, and that's probably why she was traumatised.

@@frommarkham424

I guess it wasn't intentional, and that's probably why she was traumatised.

It shows you that even if you are very smart and become rich, tragedy can still strike without warning.

@@terry_willis

So sad. 😔

He could have collected data about behaviour of old car drivers and cyclists in Stony Brook.

He could have collected data about fatalities free divers in Bali, and

Could he have created a mathematical modelling to predict outcomes &.....prevent them.

But alas, everything is not mathematical...... There's much more to this Universe than just mathematics.

He gained by logic lost out on emotions......

I currently participated in a liquidity mining and earning 2-3 % as daily passive income, Strongly recommend,

One fact - the most profitable product / portfolio was only owned by a small circle of JS and senior RT employees.

Technical analysis FTW

He s the greatest trader ever is debatable! First trading and investing are not the same. 2nd he should take part in Robin cup to see if he really is the man!

If hes the goat, why is he only worth 30bn ?

Probably because he got bored 😂

It states in the video that the funds were capped at 10bn, which means he would be worth a lot more if this were not the case.

Because what he does only works with smaller liquidity. When there is too much money, their models push the markets which break the models they use. This is what they have said in interviews.

How wonderful 👌💃 Good on you Jim Simons 💪🏼👏🏻💜

jim had gained more returns than buffett. buffett is a very over hyped person.

Buffett never hypes himself tho . . . other people do.