All About REAL PROPERTY TAX Philippines / Pagbabayad ng AMILYAR

ฝัง

- เผยแพร่เมื่อ 7 ก.ค. 2024

- 00:00 In this video, we'll talk about the following:

✔️ What is real property tax or "amilyar?" 01:01

✔️Real property tax exemption 01:25

✔️How to compute real property taxes / Amilyar computation 02:17

✔️How to compute idle land taxes 09:25

✔️When to start paying for real property taxes? 10:53

✔️When are real property taxes due? 12:34

✔️Discount on real property taxes 13:38

✔️Consequences when real property taxes are not paid 14:58

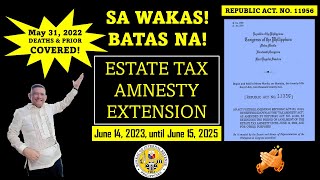

✔️Amnesty for real property taxes 16:21

✔️How to pay real property taxes | Paano magbayad ng amilyar 16:56

♪ Tiktok: / ownpropertyph

📷 Personal Instagram: / curlymean

📚 Facebook Page: / ownpropertyph

For real estate service inquiries...

📧 hello@ownpropertyph.com

Viber/ Whatsapp/ Telegram: +639177086527

#realestatephilippines #ownpropertyph #realestateph #amilyar #realpropertytax

Thank you for this!❤️

Maraming salamat po sa malaman at makabuluhang pagbabahagi ng impormasyon. Padayon!

Salamat po sa mga update na pagbabayad ng real propety tax,ingat po kayo palagi at God bless always

Very detailed. Thank you! This will help me for my report tomorrow 🥰

Glad it was helpful 😊

I appreciate your videos so much. ❤ Will binge watch this holy week 😅

Thank you so much for appreciating my videos 💕 I hope you learned a lot after binge watching 😊

Thank you so much ❤

Thank you you explained well

Thanks for this great information.❤

I’m glad you found the information to be great. A comment like this motivates me to create more helpful videos. Thank you for watching 😊

Thank you for all the knowledge you shared to us. I am planning to buy a private resort in Tabogon Cebu. This helps me a lot in budgeting my finances.

Grabe! I learned a lot!!! Thank you for this. ❤ I just came across this video of yours while I was browsing kanina about "Schools in Metro Manila that offers BS REM" and video mo lumabas also I just noticed na hindi ka na naguupload (yata) ng new videos?

Wherever you are, I hope you are safe and okay. Thank you so much for all your videos ❤ God bless.

Thanks!

thank you ma'am! very informative! keep it up :)

Thank you so much for your comment po 😊

Thanks po sa kaalaman

Thank you Po.

thank you

Good day po madam Meron po akong natutunan about sa pagbabayad ng tax Thank you so much po God bless!

God bless din po 😊

About Real property tax vs real estate tax naman po maam.

Mam very clear po explanation, clarification lang po dapat po pag magbayad ng amilyar january to march of 2023 for the year 2023

Kasi po sinasabi ng kapatid ko ang pagbayad daw ng amilyar nov 2023 for the 2023, bago mag 2024 para advance daw ang 2023, ano po ang tama. kasi po laging may penalty ang agricultural land na aming binabayaran sa marinduque.

Hi, paano po for example nag advance payment ng amilyar like for say 2023-2025 yung coverage ng payment. Then nagkaroon ng major renovation yung bahay year 2024 that triggered re-assessment of the building. Magkakaroon po ba ng re-calculation from year 2024-2025 kahit na bayad na ito? Or magstart po ba yung implementation ng bagong building assessement sa year 2026? Thank you in advance 😊

Pretty na, magaling pa

😅 salamat po 😊

Maganda na magaling pa.

more videos madam!

Good day po! Ask ko lang po if like me nakakuha ng property housing loan. Pero yung TCT Hindi Pa nakapangalan sakin, entitled na po ba akong mg pay ng real tax property?

Good morning Mam...Pano po pag classify na RESIDENTIAL OR COMMERCIAL ANG LAND AND BUILDING PROPERTY PO?

Paano po icheck kung updated ang pag babayad ng amilyar ng previous owner ng bahay?

Hi mam. Ask ko lang po. If lot only lang po (in house financing, hindi pa na move in) knino pong obligation ang pagbabayad ng property tax? Sa developer po ba or yung buyer po?

Hi, meron po ba kayong books recommended for real state investing

Mam ask ko lang po...do you have any idea kung magkano po yung penalty si di nabayran ng tax? kasi yung lupa lang nabayran yung house di nasama sa assessement..may 13 yrs kmi na bababyran sa penalty..gusto ko lang po malaman nagkano po ang penalty..

hello po, for clarification lang, yung sa idle land tax po ba dapat 400 pesos yun? since 1% po ang basic property tax sa province so 1% lang po ng 40,000 ang dapat

Hello maam, pag na assess ang property mo ng 2024, pwede ka bang singilin ng 10yrs ago dahil nabago n yung structure ng property mo, note that updated at bayad ang property tax mo every year.

Thanks for the video! Very informative! If I pay online, how will I get a copy of the official receipt that serves as proof that I actually paid? I live in makati btw

Hello po Ms. Ask ko lang po. Paano po pag ang amilyar ay pinaghatihatiang bayaran ng magkakapatid? Paano po ang register ng payment?

Thanks po.. Sana po masagot

Hi po! Ask ko lang saan po naka base ang start ng computation sa realty tax ng new house. Sa completion certificate po ba or sa occupancy permit date po? Thank you po.

Mam e ang lupa po sa cemetery may tax po ba yon?

Your vlog is very important po, big help!

Ask ko lang po pano kaya kapag hindi nabayaran since 2017 ung buwis po sa lupa, then 2021 may binigay po sakin na paper ng tax po at yung assesed value nya na po is (19,440), pano po ung penalty po? Simula 2017 po ba mag uumpisa ung penalty? Per month po ba ung penalty? Sana matulungan nyo po ako, wala po talaga ako alam po about sa pag babayad po ng amilyar 😢

After po magbayad ng amilyar, pag ibig housing loan po, saan ko po isesend ang receipt? Thank you

Good Afternoon ma'am I had tax declaration of my house but I am exempted because the value marketing of my house is only 65900pesos may I know the value marketing of house for to become a tax PAYOR and thnks alot ma'am

Yes your perfect excellent blogger to be followed continues vlog ma'am license broker too..have a nice day and more blessings to your successful day always and business.thanks

Thank you so much po 😊

Bat ang hirap hanapin ng mga fair value na yan ng lgu? san po kaya makikita fvm ng house& lot sa lipa batangas. At considered ba sya sa rpt na 1%?

Goodmorning po.

Paano po ba yung samin?

Pag-ibig loan xa

Pero instead saamin, kay pag ibig nakapangalan yung property.

Sabi po kasi ni pag-ibig since sa kanila nakapangalan ang bahay at lupa hindi kami magbabayad ng real property tax until mkafull payment kami.

Ang problema is hnd na pumapayag si LGU ng gensan n walang tax na mkuha kaya naglabas sila ng memo na magbyad ang borrower ng tax.

Paano po ba kung bigla sila maglagay ng penalty for all the year n walang tax ung property?

At paano rin kung magkakaron dn ng payment kay pag-ibig pag fully paid n kmi?

maam ask ko lang. kapag low cost housing sa pag ibig kailangan na ba mag bayad ng real property tax kahit hindi pa tapos bayaran sa pag ibig?

Mam,, namatay po ang lolo ko ng 1991. Ang tax dec. Po ng lupa na minana ko noong 1991. 97,000 thousand ngayon 2023. 1M na gusto ko ibinta mga magkano kaya ang babayaran ko sa BIR. Salamat po...

Bakit ang Taas ng tax ng bahay today? I paid last time 3200 pesos tapos now 4k plus agad one year lang agad?

salamat very informative buo na desisyon mag squatter na lang ako habamhuhay taena mahal ng tax kada taon sa binili at pinag ipunan mong bahay.

Kahit makatipid po sa amilyar, hindi po magandang solusiyon ang maging squatter dahil una, illegal po iyon, pwede kayong mapalayas kahit kailan kaya nakaka-stress po at challenging mag-set up ng utility connection depende sa lugar po

Also want to know if Tax dec no. could be change or not? Tax dec # is permanent, will not change even they say they have revision? confusing please advise.Thanks

Kasama ba sa tax maam yung sasakyan at bakod saakin malaki masyado computed nila

Do you need to pay Income tax if you buy and sell real estate on a regular basis and already pay capital gains tax on each transaction?

In paying 2024 property tax in philippines, is month of May considered late and has penalty?

Mam good morning po ang binabayaran po nmin 10k per year paano po yan pag wala na kming negosyo pano nmin mabayaran un?

Dami ko nlaman talga sayo maam.nagulat kasi ako ngayon..17k bayaran ko sa bahay sa provence. 1st time palang nalipat na kasi ang pangalan sa tac dec.sa pangalan k

hello po! Nice educl video. keep them coming pls. Tanong ko lng po, if my property is mortgaged, am I required to pay the property tax po ba ? Thx!

Hi, opo, you are required to pay the real property tax. Binanggit ko rin po sa video 😊

pag Senior Citizen ba exempted na to pay RPT?

Mam good morning.

Every year nagbabayad kami ng amilyar but now may tinanggap po kami ng taxation ano po ibig sabihin nito. Salamat po eager po akong marinig ang payo mo po.

Sana mapansin.

Dito sa Cebu po sa province 1% rin ba?

May lupa ako sa 250 sqm sa halagang 150k sa province at napatayoan ko ng Bahay tapos sinabi nya nakakuha daw sya ng certificate of no improvement.. Tanong po legit po ba Ang 50k sa tax declaration?

Hi po mam n fully paid ko n po yung house and lot n nbili ko sa pg ibig under negotiated sale sino po ang mg bayad ng Capital Gains Tax

Hi, ma'm, regarding amilyar po itong video. Dahil "as is, where is" basis po ang pagbili, mas maganda tanungin niyo po yung Pag-IBIG mismo kasi depende po kung kanino po nakapangalan ang titulo 😊

Mam ask q lng po kung panu nmn po ung step pag closure of tax po?salamat po

Sa pagkakaalam ko po, mag-rerequest ng Tax Clearance Certificate sa BIR, submit ng attachments at magbayad ng lahat ng tax obligations na hindi pa nabayaran 😊

Tanong ko lang po Ma'am about ATS sino po bang peperma yung owner po ba na naka name sa title or yung may SPA, and what if patay na si owner na naka name sa title however buhay pa mga anak nya for example tatlo silang anak sino sa kanila po ang peperma sa ATS? Thank you po

Pwede pong pumirma ang Attorney-in-Fact ng ATS kapag valid ang authority niya from owner po.

Kapag patay na si owner, wala ng makakapagbigay ng SPA at kung meron mang SPA bago namatay, nagiging invalid po iyon.

Kung may last Will and Testament yung deceased, yung executor na po yung may authority na magbenta ng property bilang parte ng kaniyang tungkulin na mangasiwa nung estate. Kaya sa madaling salita, kung sino man sa anak ang executor at nakakuha ng court approval na ibenta ang property dahil naaayon sa kagustuhan nung namayapa, siya yung may authority po 😊

hello po, paano po pag walang assessed value yung land, yung house lng ang meron sa real property tax declaration, house and lot po kasi sa pagibig yung amin, so yung house assed value lng po icoconsider?

Hi, nakakapagtaka po na walang assessment yung land. If ever pa-update niyo po yung tax declaration niyo kasi dapat meron po 😊

Hi yung nabili ko pong lupa ay 1,086, 000 at 8 percent ang assessment level normal lang ba to?😮magkano po kaya tax nito hindi ko po magets😢

Hello, totoo po 8% ang assessment level? Pag ganun, mababa na po iyan.

Ang maximum assessment level ay ang sumusunod po:

residential - 20%

agricultural - 40%

commercial - 50%

Pero hindi po selling price ang basis sa pag-multiply ng assessment level ha, Fair Market Value base sa Schedule of Fair Market Values. Kindly rewatch po ulit yung video since na-explain ko po yung computation 😊

Mamm d2 po sa San Jose Batangas bakit po 2 % ang tax rate .ito provincial. computation ng tax.

Hello po Mam, pano po ba ung pagclassify ng Residential or Commercial Both sa Land and sa Building property?

Hello po, paano po yung nakuha sa Pag-Ibig Housing Loan,Maam?Anu po yung gagamitin yung Appraisal Value or yung Bid Value?Thanks Madam

Hi, labas po yung appraisal value o bid value kasi ang basis po ay Fair Market Value na naka-indicate sa Tax Declaration po 🙂

Hi - if you buy a parking in a condominium unit - even thought it is only a right purchase

Should we be the one to pay the tax?

Hello, since you have interest with the parking and you may have already been using it, it is ideal for you to pay the RPT so you'll always have a better claim to it 😊

Hi maam, ask ko lng po, if 1yr lng po ang hindi nabayaran, every month pa din po ang penalty? Hope you can answer me madam, Thank you so much. God Bless 🥰

Opo, every month po talaga ang penalty regardless kung 1 year hindi nagbayad o lumampas lang ng ilang araw sa pagbayad po. God bless po 😊

Hi thanks. Question po, if naka loan sa pagibig ang property dapat pa rin po bang bayaran yearly ang tax? Or kapag matapos nang bayaran ang loan? Salamat

Babayaran niyo po every year ang amelyar pag naka-transfer na sa name niyo ang title kahit naka-loan ito. Pag hinde pa na-transfer ng developer sa name niyo, sila po ang dapat magbayad ng amelyar

Magbabayad parin po ba ng tax,kung ang resedential lot,ay ginawang church?

Pagkatayo nung simbahan at pag-declare po nung structure, dapat magbigay ng documentary evidence within 30 days na gagamitin yung property bilang simbahan para makakuha ng exemption sa pagbayad ng amilyar po 😊

Madam, isa po ako sa subscriber nyo. Tanong ko lang po, kung pwede po ba akong mag utos ng kamag anak ko para bayaran ang amilyar ko? Nasa ibang bansa po kasi ako. At kung pwede po akong mag utos sa kamag anak ko, ano po ang kailangan ng kamag anak ko, para po mabayaran ang amilyar ng property ko? Sana po masagot nyo po ako madam. Maraming salamat po. Mabuhay po kayo.

Pwede po iba ang magbayad. Dalhin lang po yun resibo nun last payment and copy of latest tax declaration

Bkit dito prov at liblib pa eh 5% grabe pla dito sa cabanatuan?

Hello, standard po ang 1% RPT rate, baka po yung tinutukoy niyo pong 5% ay para sa idle land tax 🙂

Hello, kahit ba under bank finance ang property magbabayad pa din ng amilyar?

Same question 🙋♀️

Hello poh madam under bank finance poh yung property poh but yung nag email poh yung developers na need daw ako mag bayad so pinuntahan po nang papa ko but ang dami g binigay sa BIR na requirements for us to pay na kailan daw kunin sa developers.since SPA ang papa ko.

Hi, gaya po ng sabi ko sa video, kapag mortgaged na or under bank financing, kailangan niyo na pong mag-start magbayad ng amilyar lalo na at ni-rerequire rin ng bangko 😊

mam ..

pwde ba mag start ng bayad kc po ung una po ..

pasalo lang un ..2018..

kaso po hindi pa ako nakabayad ng amiliar

Ma’m, kapag binili mo via pasalo at wala ng paki ang owner, dahil mapapasayo ang property, dapat ikaw na talaga rin po ang magbayad ng amilyar taon taon

Pota kaya nga bumili ng lote para matirhan para wala n renta ganud din pala para walang buwanan renta papaano n lang walang pambayad yun naka pundar ng barya tapos bumile ng lote palalayasin din pala papaano kung tumanda na makahanap ng trabaho walang penson palalayasin pa ba yun sa lote na nabili niya

ang creepy naman ng video akala ko may white lady sa likod mo..haha😂

anong profile mo sa fb

Hello, it's better to comment here in TH-cam po for questions 😊