BASIC FOREX TRADING STRATEGY (anyone can trade)

ฝัง

- เผยแพร่เมื่อ 26 ก.ย. 2020

- DOWNLOAD THE FULL INSTRUCTIONS INCLUDING IMPROVEMENT FILTERS BY CLICKING HERE:

www.thetransparenttrader.com/...

INSTANTLY IMPROVE YOUR TRADING BY ENROLLING IN MY COURSE:

www.thetransparenttrader.com/...

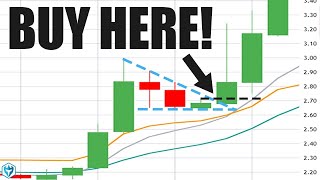

Learn a basic forex trading strategy for USD/JPY using a kangaroo tail setup.

Easy to spot the trading set ups and place the orders.

Taking only 5 minutes per day.

Grab 3 favourite strategies for FREE in my new 22 page Beat the Markets Strategy Guidebook here: www.thetransparenttrader.com/...

WEBSITE: www.thetransparenttrader.com/

EMAIL ME: jarrod@thetransparenttrader.com

DISCLAIMER:

I am not a financial advisor and I am not offering you financial advice. I am not regulated in any way. The purpose of the content I provide is for educational purposes only.

Any information you receive is based on my own knowledge and experience in the financial markets and how you act on the information provided is your own responsibility.

I cannot be held responsible for any losses you may incur as a result of ideas taken from my content provided.

![ฉันจะ "แพรี่" ให้หมด - ผู้แข็งแกร่งที่สุดในโลกอยากจะเป็นนักผจญภัยให้ได้ - ตอนที่ 04 [ซับไทย]](http://i.ytimg.com/vi/PvmuP8y9IPk/mqdefault.jpg)

Great content. Thanks.

Thanks again for all your efforts👍👍👍

Brilliant thank you

Thanks Jarrod any lower time frame strategies

Hello Jarrod, thanks for your video. I just wanted to know what the starting capital of the backtest was

This is a really simple strategy anyone can trade. Hope you can get some use out of it! If you want to know how to improve it even more then go over to my website here: www.thetransparenttrader.com/kangaroo-tail-breakout-pdf-access/

Yes I experienced that I can't remember the guy's name old guy gray hair I fell for it essentially when it came down to is he had 10,000 ways to buy pullbacks and no testing to back it up whatsoever and if you didn't get it right it wasn't because the trade was bad it was because your instincts were wrong

I love this - super simple and straight-forward. I had one question, though: should the entry order not be triggered by the EOD, do we cancel it? Are there any other conditions in which we would cancel the entry order?

Just cancel at the end of the session if prices haven't broken out.

I think we can enter at the opening of the 4th bar with less stoploss and more potential profit. Right?

Good afternoon, I have studied the document and I have noticed that you mention that the graphs should be 5 daily bars per week, if the graphs include Sunday, does it not work?

Hey thanks for the video! Do you trade futures or forex?

Forex for the most part.

@@TheTransparentTrader do you think you can do a video on how to re sync your positions w your real time net position after you turn off your computer or disconnect from the broker (multicharts). I can’t find anything on this online ):

Hi Jarod,

do you think you can please share the Max drawdown per each year for your Kangaroo tail strategy? I have been backtesting it but I got some disturbing max drawdown but I am suspecting it due to the way my broker emulator works. I would like to benchmark my result with yours for checking the quality of my data.

Hi Alessandro, here you can find the run up, drawdown, profit and loss for each year using the improved strategy. Obviously, prices are in Yen and trading 1 full lot / 100,000 units. Hope that helps. www.thetransparenttrader.com/wp-content/uploads/Screenshot-2021-01-28-at-10.36.01.png

Hey Jarrod, it’s been a while since you uploaded this video. Is the performance of the strategy still strong after almost 8 months later? Would like to know, since I’d like to code it myself. Cheers

Hi Stefan, I'll get the results together and post an update video.

Hi Jarrod, I am interested to know too, how have this strategy being so far and compared to the enhanced trend trading setup you uploaded recently

hi jarrod , do you offer a trade copy service ?

Hi, no I don't actually. Sorry. I prefer to show traders a successful way they can trade their own strategies rather than copy someone.

you mention this strategy not working so well for other pairs -- do you know of other once-per-day strategies that might work well with other pairs? also, is there any benefit in attempting to catch multi-day runners? A methodical trailing stop or similar?

I have found very few strategies with exactly the same rules which will work across multiple pairs.

Have you seen this exit modification I tried out on this strategy? You might find it interesting.

th-cam.com/video/zMCTzSnsyNA/w-d-xo.html

I don't understand at all how this strategy could work when he market is in a bear trend. You would accumulate losses.

ahh, an additional question... all the charts that you show in your strategies are of 5 daily bars per week?

Yes that's right. 1st daily bar is built starting 17:00 EST Sunday - 16:59 Monday

How much accuracy does it provides sir?

If you skip t o 8:45 in the video you can see the improved version has accuracy of 52.47% as seen in the performance report under "Percent Profitable" I hope that answers your question.

Hello Jarrod, I just read your PDF on this setup and have a question - i am gonna try to use this on stocks and will use normal candles (green and red), does it matter if any of the 3 candles are green or red to enter above the PDH ? also you said in the PDF that close of candle 3 shouldnt be more than 0.5% of candle 2, does this mean close of candle 3 could be less than that of 2?

thanks

I'm sorry i dont understand range bars but in your setup is the 2nd bar red (O>C) and 1 & 2 (O