FOOLED BY RANDOMNESS SUMMARY (BY NASSIM TALEB)

ฝัง

- เผยแพร่เมื่อ 14 พ.ค. 2024

- Support the channel by getting Fooled by Randomness by Nassim Taleb here: amzn.to/2VsZKfh

As an Amazon Associate I earn from qualified purchases.

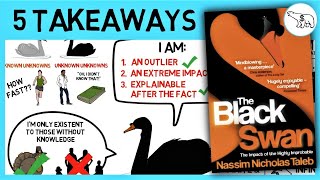

5 great takeaways from Nassim Nicholas Taleb’s Fooled by Randomness - the first book in the Incerto series.

A playlist of Nassim Taleb's greatest works: bit.ly/2Op6AA5

Top 5 takeaways:

0:00 Intro

0:46 1. Survivorship Bias

04:12 2. The Skewness Issue

06:33 3. The Black Swan Problem

07:48 4. Pascal’s Wager

09:05 5. The 5 Traits of The Market Fool

![🔴 [TRỰC TIẾP] U20 Thái Lan VS LPBank Ninh Bình | Cúp VTV9 - Bình Điền 2024 | JET STUDIO](http://i.ytimg.com/vi/3wRNdAy3DXs/mqdefault.jpg)

A playlist of Nassim Taleb's greatest works: bit.ly/2Op6AA5

What was his gripe with the last video? ))

"You never know, a black swan may be lurking around the corner" - spoken 2 years ago 😂

Yess absolutely! Covid-19 was the biggest black swan!

Covid-19 should not be considered as a black swan, but as a grey swan; an event with high impact that occurs with a low probability but could be predicted beforehand.

@@jobstekelenburg3554 we only "predict" it after it happened tho

@@9words40 we kinda could. We were due a market crash and we got one.

Great video. Highly necessary because Taleb isn’t the best at explaining his own ideas.

Great observation!

Indeed

U know why? Coz he follows Nietzsche’s ideas. He makes it confusing and hard so you concentrate harder to know better. Kinda crazy but thats how NNT operate.

🙏

yes I agree with you. His way of explaining is not the most intuitive

I saw a full 17 minute ad on this video

That's how I like to say thank you for your efforts

Just finished the book and this is a very well done summary!

Just finished the book - The summary was much better than I expected , nice job keep doing sir !

Just want to say thank you for your efforts- you have helped our family become investors. My children’s lives will be better because what we have learned from your analysis and method.

Thank you for this brilliant video, I tried to read this book but was unable to understand it, this video really helps!

Thank you, 2-3 years since reading the book and good with a recap:)

Awesome book. Nicely explained. Thank you sir for sharing this.

Holy shit, that message at the end though!! This was right before that massive bounce on xmas!!!

Probably the best channel I've ever encountered on youtube...

Vykintas Glodenis cheers man! I'm glad you enjoy it!

Randomness? ;)

Merry Christmas to you. Listening to this on the last few days of 2019 whch is uncanny

Great summary, thanks so much!

Thanks for the summary!

Loved the summary. I gotta read this book.

This way of thinking is so logical and yet so rare. Great summary man! you are killing it . This book reminds me of another awesome book which is the art of thinking clearly.

That is because Dobelli plagiarized Taleb.

I really wanted to read this one... Thanks for the summary..

Good job ✌🏾 ✌🏾.... by far one of the best summaries of this book. 💯💯💯✔️✅.

Thank you n keep it up.

thank you man...this is a great video....

🙌

Great video! Thanks for keeping it simple and with examples ;)

No worries, glad to hear that you enjoyed it! 😁

If you believe you are 30% smarter because your stock goes *up* 30%, what do you think of yourself when your stock goes *down* 50%?

Bad luck

@jeffbezos

Sounds like you need to ask the question to our dear leader.

But stonks only go up? I don't comprehend

My ex-wife is behind it to screw me.

I love this series Erik! Thank you so much for putting it together, you inspired me to goo ahead and make a series of videos on Nassim Taleb as well that I just published on my channel. Fortsätt det fantastiska arbetet bror!

Thanks alot my bro!

Beautiful

Merry Christmas.2020..i am watching it today .

When i got lucky on options trading one day i knew fundamentally that the market is a predictable and i knew i got lucky but i still felt an ego boost like i had put in the work and came to the right conclusion and recocnized it for what it was

AWESOME 👍😊

Thanks for sharing 🙌🌼🌹🌻🌺🏵

Another excellent video, thank you SI.

Eric! Glad that you liked it 🙌

I just started following you. I am a fan! Way to go

Welcome to the channel Paulson Anthony, and thank you for the support! I appreciate it 👌

Really appreciate your work !

This one is on TH-cam as an audio book.

Great video 👏💯👍

Thank you.

Excellent

Thank you Swedish investor ❤ 🤗😊

Notifications ON!

I will be proud of myself on the day I understand this book and apply .

what do u not understand

Thank you

Very nicely made and informative videos, thank you. Which software do you use to make the videos

I like this book quite a bit more than the others, because it doesn't lie through implication. It doesn't tell you a trading strategy implying it will work, it instead tells you some of the pitfalls many traders face. The only thing this book is missing at the end is the statistics brokers release saying what percentage of traders make money and what percentage of investors make money. (Most years 96% of traders come out even or lose, yet roughly 94% of years investors come out ahead.)

Wish I could like twice!!

5 traits are very interesting

Very very nice video sir 👌

Please make video on trading book summary

Thanks

Swedish investor you are smart chap to Learn from do you sumarise by reading your self or you use a computer program to this am really amazed to have this information.

Interesting ideas. Better to watch this video than read his convoluted book.

It took me 30 mins to get through the video after hearing “Russian roulette with the Swedish mafia” was on the floor dying. 🤣🤣🤣

Great video. Now I don't need to spend hours reading the book.

Regarding your intro to #3 the black swan problem:

It would actually probably be correct to argue that the Dow can't go down 23% in a single day. The S&P 500 circuit breakers would trip first and halt trading. Its far less likely than your example explained

Hello, the Great Swedish Investor. I like the work you are doing. Please can you also make summaries of psychology books?

Have you considered doing video about Mandelbrots book misbehavior of markets?

I have not, but it could indeed be an interesting one. Thanks for the suggestion Piotr!

This was published in April 2019. There was indeed a black swan was lurking around the corner.

💖

How did u get to 11% standard deviation?

❤️

Guys read this book ASAP, it's fantastic, and in the trading domain, it's more impressive than The Black Swan book.

When you say expectancy do you mean expected value?

Ow!🙏👌

Nice video, thanks!

Could you please help me?

I live and work in Sweden but I want to use USA broker for investment, like IB.

How I should pay taxes in this case in Sweden?

Can I register account in Interactive Brokers as ISK in Sweden?!

Hey Olek, do you still want to open an IB account?

Can someone explain me the math in the Russian Roulette example? How can it be 42 %?

The chance of surviving a single game of Russian Roulette is 5/6. If you play it 3 times (separate occasions), the chance of survival is (5/6)^3=58%. Therefore, the probability of dying is 1-58%=42%. Hope this helps Jacob!

The Swedish Investor Thanks a lot Erik! I couldn’t figure out the simple math, but I looked in up on this homepage. Bullet or dice didn’t matter (theoretical that is): www.omnicalculator.com/statistics/dice

What's the probability of the example company having such a diverse set of individuals? 😀 Enjoy your work, nice job!

Haha, thank you man! 👍

But Pascal's wager is so easily shown to be wrong that I would never use it as a premise. Otherwise very good points

When we make decisions, we consider the pain of regret if we are wrong. Regret is an unpleasant emotion that we avoid if possible. The greater the loss if one makes the wrong decision the more painful the regret. But because we can only feel regret if we are alive and cannot feel it if we are dead we will never be dead and have regret we didn't believe in God. We can only feel regret if we didn't believe and be still 'alive' notwithstanding our death after not believing.

Keep a limit on the amount of pain you are willing to take while following Pascal's wager strategy.

i think the black swan problem doesn't exist anymore in the U.S. b/c the stock exchange closes when the market goes down X%.

Watching this with Dark Mode, the BRIGHT WHITE SCREENS are overwhelming!

Note to developers: today's large screens encourage many users to use Dark Mode,

so try to avoid all-white, bright videos! - j q t -

@theswedishinvestor - For take away no. 1 - How can we say that all 2.5% got higher returns, just by chance? can't it be like they had some SKILLS to identify and prefer Ericsson over SKF? Please enlighten..

All true. But you are missing an even bigger fact many traders ignore, which is that pure financial trading is a negative sum game, you are not creating any real value, someone loses on every financial trade. The only ethical investor is one who invests in _real goods_ production. Arbitrage is a fair exception, one can claim the arbitrage trader is helping to eliminate price mismatching, even if their motive is still pure greed. One thing all great economists agreed upon (the _only_ thing they all agree on, including Marx and Hayek) is to "euthanize the rentiers." In a fiat currency tax-driven demand system the Treasury bond market really just has to go, it is a regressive anachronism --- _basic income but only for people who already have money._

👍

Someone show this to Tesla's stockholders.

Valley bank all those yrs ago... People with no collateral coming off ships just giving out loans? Still to this day? Probably not

Ouch on the closing comments :(

Santa brought something very special... :D

The black swan is called.... Corona

I don't understand the skewness issue

8:11

It's very difficult to understand this book

Pascals wager has always been a bit of a false dichotomy fallacy.

Taken in the original concept, the issue is that you must choose the correct God to be rewarded. Believe in Jehovvah and it turns out Allah is the true God? Burned. Maybe the real God is Zeus? Perhaps it's Jesus, or maybe its the flying spaghetti monster. Regardless, the risk now becomes wasting your life studying, believing in, and devoting yourself to a deity when you could have used that time for better things, especially considering there's a very low probability that you pick the right God to worship.

In terms of trading or investing, the actual risk is doing worse than the market average, or even taking a loss when the market is up if you learned a strategy that historically, 'worked' but no longer does

But you can only know that you were "wasting your life studying, believing..." after you die. You can only feel regret in making the wrong decision regarding believing in God if you are somehow still alive to feel the emotion of regret since emotions are an operation of your still living organic brain but at the same time be dead as there is no way to know conclusively if there is a God before you die.

Seems Taleb can be a bit random himself:

Fooled by randomness: Don't fall for the Survivability bias

Antifragile: Lindy effect y'all!

Fooled by randomness: Outcomes don't tell the whole story, there are reasons behind it

Antifragile: Forget narratives, outcomes is what matter!

Hmm, quite observant! I wouldn't say that survivorship bias and the Lindy effect contradicts each other though. Survivorship bias is about quantity and Lindy is about time.

Note that Taleb himself suffers from a couple of misconceptions. He rants often about how debt is bad. He is right, debt is bad for households and firms. They want to be in surplus position (net savings). Taleb however has a distinctly neoclassical view of macroeconomics, so he fails to apply basic arithmetic on balance sheets, because he _also_ regards government debt as bad. Well... you cannot talk out of both sides of your mouth! They cannot both be bad, because they are equal opposites: every dollar of government debt equals a private household or firm surplus, to the last penny. Basic sectoral balances (Charles Goodwin) absent rampant accounting fraud. Lesson: government deficits are good (up to sustainable energy full employment of idle resources limits), while government surpluses (tax return greater than government spending) are very bad and have always preceded the dozen or so major crashes (US data, but similar for all other major nations). The best historical account of this is Richard Vague's book _A Brief History of Doom._

Traders who get paid to be right will always count on a bias toward increasing GDP when the government deficit rises. It is a simple rise in effective demand story (more sales, and firms avoid price hiking by bringing on idle capacity --- that is Alan Blinder's research). I have never heard Taleb acknowledge this, he always groans that government debt is unsustainable, when in fact government (currency-issuer) debt is the _only debt that is forever sustainable,_ in perpetuity, government debt = private net dollar surplus, to the penny. You erase government currency denominated debt, then you erase private financial wealth. Their red ink is our black ink.

The only real debt of a government is the obligation to provide guaranteed employment for _all workers_ that its tax liabilities caused to be unemployed. With full employment all the real goods that pensioners need are maximally available for sale, any involuntary unemployment (people seeking to earn a tax credit) is a waste of real resources, and essentially a human rights atrocity, it decreases the goods available for the elderly retired who are in the trust of the government. Compared to this injustice inflationary biases are trifling (and with a fiat currency inflation is just currency re-gauging, so is always sustainable provided the base minimum wage income retains equal purchasing power, then the _real_ inflation rate is zero --- what matters is how much your entire income can purchase, not what $1 can purchase --- this is something inflation hysterics fail to grasp).

This of course (zero default risk for government) only strictly applies to a fiat non-convertible currency (aka. a tax credit money system). It is inapplicable to a commodity currency, since for a commodity currency the government debt is redeemable to gold (or the commodity) and so then national debt _is_ a burden: on a commodity currency the government _can_ be forced to default (which is essentially what Nixon did, or what any country that goes off the gold standard does, they default on prior obligations to convert to gold, as they probably should, because gold has superior engineering uses and should not be hoarded as a currency) and if they choose not to default when placed under creidt risk they have to either regressively raise taxes or raid pension funds. This is why you never want to use a commodity currency system, it is highly regressive, has a deflationary bias, and favours the rich over the poor and indebted.

The government cannot be _forced_ to default on a fiat currency debt obligation (except at gun point). This is because a fiat currency acts as a mere numeraire for relative pricing, i.e., a record of units of credit and debt. The _records_ are what are valuable, highly valuable, not the intrinsic currency. Taleb seems to not understand this, I think because he read too much Marx (Marx was writing in an era of gold standard adoption, and he failed to understand the underlying chartalist money system --- any nation finding itself in a major war would suspend the gold standard, revealing they were really chartalist all along).

Basically, I am waiting for Taleb to acknowledge MMT is correct (as a description of legal and institutional realities of most sovereign monetary systems --- tax liabilities drive _demand_ for the otherwise worthless currency, not _supply_ for the issuer.) When Taleb finally admits MMT was right all along, then my respect for him (which is already considerable) will immediately double. Not holding my breath though. Failed paradigms (here neoclassical and monetarist fantasy economics) die one funeral at a time, and Taleb is one of the holdouts. Correct me if I am wrong and show me where he has changed his tune on sovereign debt?

And only 3 years later we had 2 black swans: COVID and the Ukraine war.

fools in a bull market believe themselves geniuses

These are not so highly intellectual ideas. I implement them everyday in trading and I haven't read any Nassim.

If you are watching this during the pandemic in 2020 and thought Pandemic was a Black Swan. You are wrong ! Black Swan will be here sooner or later.

Existence of black swans doesnt eliminate the fact that most swans are white.

Never take advice from superstitious pigeons.

such an awful theory. I really dont like the way he thinks or his market theory.

Thanks

👌

❤️