HOW I MADE 2 MILLION IN THE STOCK MARKET SUMMARY | NICOLAS DARVAS

ฝัง

- เผยแพร่เมื่อ 3 มิ.ย. 2024

- Support the channel by getting How I Made 2 Million in the Stock Market by Nicolas Darvas here: amzn.to/37UhMwt

As an Amazon Associate I earn from qualified purchases.

In this animated video summary, I will bring you the top takeaways on how Nicolas Darvas made 2 million from trading in the stock market.

A playlist of the greatest beginner’s books on day trading: bit.ly/2RRmXrs

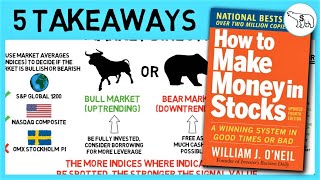

Top 5 Takeaways from How I Made 2 Million in the Stock Market:

0:00 Intro

0:21 1. Kill Your Darlings

1:03 2. Buy on Strong Positive Trends & Rising Volumes

2:02 3. Cut Your Losses Short. Let Your Winners Run.

5:05 4. Create Your Own Stock Log Book

6:46 5. Be the Lone Wolf - Stay Detached

TL;DW:

- The first takeaway is that you should never allow yourself to fall in love with any particular stock. Marry a person you like, not your investments.

- The 2nd advice is to buy when a stock is showing signs of a positive trend and rising trading volumes at the same time as the underlying company has potential for earnings growth.

- Tip number three is to cut losses short and let winners run.

- Number four is to keep a log book of your transactions. This way you’ll learn from your mistakes quicker.

- Advice number five is that only dead fish follow the stream. Don’t be a dead fish!

My goal with this channel is to help you make more money and improve your personal finances. How to become a millionaire? There are many ways to get there - investing in the stock market, becoming a stock trader, doing real estate investing, or why not becoming an entrepreneur? But whether you are interested in how to invest in stocks or investing strategies for creating passive income with rental properties - I hope to be able to provide you with a solution (or at least an idea) here. Warren Buffett - the greatest investor of our time - says that you should fill your mind with competing ideas and then see what makes sense to you. This channel is about filling your mind with those ideas. And in the process - upgrading your money-making toolbox.

A playlist of the greatest beginner’s books on day trading: bit.ly/2RRmXrs

No...it is not useful in todays markets

I am die heart fan of your book summary 🙏

Peter you are awesome! Thank you for the support! 😀

I love your channel!

The best investing channel ever!!!!!

This is one of the best educational trading videos I've seen.

You're doing a very good job simplifying the books. Love from India😍

Thank broo, what a good resume... Strong detail.

Love your videos. I request a summary of Irrational Exuberance

I love this book, the key that should be remembered is that he made this fortune in a major bull market. Someone who bought from 97-00 could do similar, same with someone who bought something good in 2009 and flipped in 2012 and traded agressively during the Trump years if they called the Covid crash and recovery. My covid picks went up 600%, but I was looking to rule a few out and missed it. Doing ok w/baseball cards though.

Or 2023. Once it crashes down.

I think that's the whole point thought or rather what the book wanted to really emphasize. What Nicolas Darvas and Jesse Livermore experience has taught us is that there's no point in being contrarian against the current market trend. For example by being on long position trade when the market is clearly crashing right now is foolish play because no one knows the bottom is and it's more wiser to just follow the trend by being short especially when the "general condition" supports it. What I mean by general condition is the factor that really drive the market trend like for Nicolas Darvas example is when a company have earning increase and that company pays regular dividend. The stock price will naturally increase on that fact alone.

That is only part of it. His method got him into the market and investing aggressively during the bull market BUT it also got him OUT of the market when it turned bearish. In fact he was stopped out, and completely out of the market a couple of months before experts recognized that the trend had turned. Then when the market turned bullish his method got him back in again. This is one of the most valuable things to know.

I think " How I Made $2 Million in the Stock Market" us the best book on trading stocks. I must have read it 30+ times.

Not for the system.....it was his mindset.

He basically was a trend follower. In a great bull market.

Any decent trend following method will do this.

@@mrdanforth3744

Great summary! Thank you sir!

The sooner you realize this game is counter-emotional the sooner you’ll realize the importance of risk and volatility control the sooner you’ll reach the promised land.

Unless you predetermine these things your emotions will run you.

Thank you for all your work!

Finally had to subscribe ... content is too valuable not to hit subscribe

I watch your book summary to decide if i should read the book; saves time 😂

Great book this and Jesse Livermore I have both. Thanks for the summaries

Nice summary

Good stuff, thanks for posting.

Oh man, it's so damn hard to kill the "darlings". I dunno know, I like so much the ideia of embarking on a winner and let it run wild... specially the ones with some competitive advantage.

Very helpful. Thank you very much.

Hey Your SUMMARIES are EXCELLENT and VERY Informative, can you please make a summary for TRADING IN THE ZONE ?

Thank you Sir.

This is awesome

Cool video, i really enjoyed the content

best book so far

Great series!

U r doing a great job and I like ur videos a lot...

One suggestion for u is that please decrease the sound of background music or stop it totally because it affects the voice clarity...

Great summary. Sounds very similar to Jesse Livermore's strategy!

Quality!!! Thanks a lot my Swedish Friend

Thank you Michael for your support! Glad you liked it 👌

wonderful and easy to learn....thanks a lot

🙌

You're amazing. subscribed!

😍

A video on how to keep drawing these boxes will help.

Does this book teach how to draw these boxes ? if yes, I am gonna get it.

I love your channel !!

Loving all of your box summaries Erik, keep up the amazing work!! Just wondering if you have any suggested links or reading advice about the box theory? Yes, I know what you are thinking, just buy the Stock Market by Nicolas Darvas via your link (which I probably will) - just thought I would see if there is any additional advice! Thanks again, J

Thank you!

Very very nice video sir 👌

Sir please make more videos on trading book summary

easy to understand, very very hard to DO!!!!!

Thank you

I am the most avid fan to sir swedish investor. Keep uploading. You help save money. Since I am planning to buy those books but too costly for me and I am glad I found this channel. I even send your videos to my gmail so that I can review anytime. Thanks for the devotion for this particular field. Kudos to you bro.

PPM CHANNEL your words make my day 😁 Thank you for your support man 🙌

Thank you for sharing. Let's make some money

Great video. As for stop loss. I can really recommend a volume stop loss. Most software packages will have them. It is exactly like you said a stop loss that gets a little wider when volatility is high and gets tighter when it’s low.

Cheers!

Awesome, thank you for your input! Cheers valicourt! 😁

Best Content and nice whiteboard software.

By the way which software you used in this video

This is the best book ever on the stock market. I read it once a year. Great summary, and exciting concept for your TH-cam-channel. Greetings from Norway (I'm an Norwegian investor for real, haha)

Haha dammit, being called out by the real deal! 😂 I thought my Alexander Rybak music would make a perfect disguise. Seriously though, I'm glad to hear it Sindre. Cheers.

I agree, Jesse Livermores is a good one as well.

make more of this bro. it is simple and practical

Thanks man! I appreciate it 👍

Hi, please can you tell us what business news website is best in order to know how the market will react (major announcements) before trading starts in the morning?

I just bought this book

Thank you👌👌👍👍🙏🙏🙏

Awesome content

😁

Very very nice

Please make same video more

nice, only that nr 2 and nr 5 contradict one another...

LOVE IT

Thanks for the takeaways,keep up the good work :)

Cheers Radzi Rosli! 😁

wow. thanks.

Please summarize trading in the zone

Hi, did he say how many stocks he held at any given time. Did he sell out completely, before buying a new stock? TY

Can you please review 'Your Complete Guide to Factor-Based Investing: The Way Smart Money Invests Today'

Big fan

READING IT NOW FRIEND, APPRECIATE YOUR WORK FROM INDIA...

Old but gold!

Is there any % of the account recommended on the book at the maximum per position or per group of positions?

Please summarise Higher (commodity trading) by Carley Garner - 2016 and if you can also Fooled by randomness by Nassim Nicholas

Can you give a little more detail on how Darvas decided to draw his boxes? How exactly did he decide on what his low and high points were? And on daily or weekly candlestick charts?

Darvas would monitor his stocks daily . When he observed one repeatedly bouncing up and down within a range, that defined a box. For example, if you see something like this - 41-44-43-40-42- 43- 45- 42 - you would say the stock is in a 40 - 45 box. If it then went-44 -45-46- 47-44-48-46- 47- 49- 50- 47- you would say it has formed a new, 44-50 box.

As long as he saw a series of higher boxes he was satisfied, as long as a stock stayed in a box he was not concerned with small up and down moves.

When a stock dropped out of the bottom of a box, and began to form a series of lower boxes, then he would sell the stock.

The idea is to stay with a stock when it is in a rising trend, and not be frightened of meaningless minor fluctuations, but be ready to take profits if it goes into a down trend.

Weekly bar 📊 charts. Please see the graphs in the appendix.

Love your videoes. Love from India.

Great to hear it man, I appreciate it! 😁

Hi , can you record this video with your latest voice , I like your deep voice. ♥️

nice

6:30 i should've never trusted my cab driver😂

Haha 👌

I played back at x.75 and x0.50. You sounded like Hitchcock.

What about exit strategy and reverse short selling?

I think there's quite a bit on exit strategies in my summaries of How to make Money in Stocks and in Trade Your Way to Financial Freedom 😊 Reverse short selling ... you mean going long? Yes, that's what the Darvas Boxes are meant for 👍 Also, more on that in the two previously mentioned summaries.

Really , u r dammn good .

😍

Th and you for your EXCELLENT TEACHING, Swedish Investor! I shall follow your wisest advice! Errr, not being "in the herd" but learning from anyone with wise advices, like Warren Buffett, or you could be added to my wise list of Investors. Anyway i have wondered if you're a Day, Swing, Intraday, Forex, Bitcoin Trader or whatever you did to achieve your $2 million or does it really matter what kind of trader you become? I've been told that it doesn't matter what kind of Trading you choose because becoming an investor trading is universal. Is that correct? Once again, Thank you!

Great summary as usual! But be very careful with this technique! Make some statistical simualtions and you will see how dangerous it can be for your capital. A 5% stop increase a lot the probability to be stepped out and considering commissions and capital gain taxes it is very, very, very hard to make money with this technique

This is one of the 👏 safest methods for beginners in our experience after training 1000s of investors.

Two other principles .. from his book.

1. Only buy stocks making new all time highs. After a major bear market, when almost all stocks are far from all time highs, ok to relax that to include stocks making new 2 year highs .

2. Focus investments. Hold on only a few companies.

so this is more suited to traders than value investing

No......he is not explaining it too well

His box system is not important.

He trend followed in the market leaders....Like Jesse Livermore.

Hey can you please summarize the book trading for a living by dr elder and explain his triple screen trading stratergy

Yes, I might do that! 👍 Just added it to my list of prospects.

Sir please "trading in the zone" book summary ko private se hata diye.

what do u mean 7/11 box???

Question: how can you be a lone wolf if you are buying a stock on the way up?

If a stock goes from being the most unpopular one to being the fifth most unpopular one in the whole index, its price would rise. However, it is still the fifth most unpopular one in the whole index 😉

The Swedish Investor That’s not necessarily true. If interest in other stocks falls the price of the specific stock could still stay low.

@@TheSwedishInvestor but the economic rule of price and demand still dictates that you are buying with the crowd if you buy a stock on the way up.

Much appreciated videos! Are you an investor yourself? Which strategy/book is the one you follow (or follow the most)?

Cheers Alec C! Yes I do invest myself, and has been since 2013. My strategy is not similar to that of Nicolas Darvas, but rather like Warren Buffett, Philip Fisher and Joel Greenblatt. I follow the strategies mostly and I can recommend for instance "common stocks and uncommon profits" by Philip Fisher.

@@TheSwedishInvestor Thanks. I will have a closer look at the book you suggested.

Brother make a video on INTELLIGENT INVESTOR !

th-cam.com/video/npoyc_X5zO8/w-d-xo.html

🧡💛💚💙 The market was way easier to trend back then because trends were constant. The markets would be Green for a long time, then after the first red day, it continues red

Now theres a shit load of algorithm and scum around, theres lots of chop and mean reversion.

🧡💛💚💙

I am from India

Anyone here in the comments from Malaysia? I womder where can I buy paperback books mentioned in the channel? Im interested to buy some of them

CHECK! 30/11/2021

8:14 What is the music?

Fairytale by Alexander Rybak

Now I'm ready to be a millionaire.

Cheers man 🤑

Did you read this book?

Well you fail to mention with this strategy is countless transaction costs and tax implications every time sell

We shouldn't sell in every box. We sell when the stock price falls to lower box.

You will go broke if you take profit to fast, and cut your losses. You need to have big winners.

Unsure about this video. It seemed contradictory to the ‘investment’ approach rather and rather was more trader based!

Thank you anyway

The takeaway I got from this is that he got lucky like someone will occasionally get lucky at the roulette table. All these folks on here giving away free trading advice; surely they should be busy making even more money if it works so brilliantly, rather than trying to generate ads revenue or flogging "training" courses. It's gambling, end of.

Based on the summary, doesn't seem like the book for me. Sounds like a lot of Survivorship bias. "Buy high, sell even higher" has burnt a lot of people.

Buy low and crash to 0 has done the same. Context and results are all that matters

25/2/2020 exiting erricson just before the crash and this video was made in 2018, something's fishy

You can make it quicker if you know how to trade options successfully. The leverage is crazy

Anybody can help me by telling any other great market educational TH-cam channels...????

My (non-biased) suggestion is that you re-watch all the videos on this channel again 😏 repetition is key ...

@@TheSwedishInvestor sir , appreciate your opinion sir

Follow the the trend, but at the same time dont follow the stream?

If a stock goes from "very unpopular" --> "unpopular" it will rise in price (probably). However, you are still being a contrarian because the stock is still unpopular 😉

The logic of the book makes sense but when I try to implement it I always lose money lol

it`s because trading in the market vs just looking at stocks online with no money is the anology of beeing good at the shooting range vs beeing in a real pistol duel. Try with smaler posisjons and have more of them, say 10 different stocks so you dont get so addicted to following one stock ( kill your darlings). also dont have a to tight stopploss. The boxes are in reality often ALOT larger. By this i mean that a stock can have volatility risk thats larger than say 35% before a activ stock change trend. A stock like TSLA had a volatility range of 50%!! before it made the mega trend upwards. I myself have a stopploss at 60%. I never avrage down, but alow myself to buy more if it breaks up. I only buy ultralarge activly traded stocks like TSLA, APPL, Amazone, etc . My point is start smal and learn first to be a smal fish before you grow naturaly in the market.

@@Ikaros23 Thanks, I got much better since I left this comment and now consistently profitable. I don't recommend the box strategy though, why wait until it hits the top resistance if you can enter on a pull-back and have a much more favorable risk to reward ratio. The guy who wrote the book probably didn't have the moving averages available back then, so I guess that made sense for him.

@@whatchitnow I myself lost ALOT of money using this method on trading trying timeing the market and stocks short term in the beginning. Now i use it long term to find stocks that is in a upward trend. that is i use all of the strategy just without the short term thinking. The most important part is to use this in actively traded large stocks like TSLA, Appl etc because these are the only stocks that has large volume and are in growt and is traded on psycology and not primarely fundamentals. I also ignore the news and only follow the price itself. The genius of the method is that it makes you disciplined to kill your darlings and not be brainwashed by your own fallacys and comfirmasjon bias. Whats fucking important is to see that it is impossible to time buttoms in stocks and topps consistently and to instead follow trends when they are more consistent. To me i think this last part is what makes 99.99% of traders turnd to gamblers. They dont realize that the market in the short term is just a casino, but in the long term it is a cashmashine. they just blindly follow the news, and the fear of missing out, and when " autotity figurs/gurus" say they love a stock or buy a stock. The method is genius because it keeps me sane in a crazy world. have a great day!

@@Ikaros23 It is a good strategy, I agree. I'm just saying I found better strategies but if you don't know any better than DARVAS boxes than you could totally use it and still make money. Also agree that weekly charts are best for this strategy, anything less will lead to poorer performance.

Be a salmon, fight through the waves only to be caught by bears.

Hahahaha

Well explained and highly recommendable video so far today sir, indeed in order to get out from a low standard of living you can now start earning more higher passive income when investing with an trading expert who helps you to Acquire more knowledge about trading and also help in growing your profit when trading on your behalf indeed highly one of the best trading expert I've met so far when it comes to risk management and also profiting with right strategy Mr Romero pieto Is the all way forward.

Nicely explained.

His trading pattern is indeed highly recommendable when its comes to profiting.

Kelvin wood doe's Mr pieto accept clients from France 🇫🇷 ?

One of the best trading expert so far who has really helped me in trading Mr Romero pieto.

Good content.

👍

salmon gets eaten by bear just saying

Was $25,000 to $2.2 Million

Good video but try to speak slowly , difficult to get hold of u specially with ur cute swede accent . Rest is all good . Thanks mate

Haha thank you for your feedback Naveed Anwer! Would you mind listening to one of the more recent videos? Please tell me if you think it's still too fast.

U gay

It questions everything Warren Buffett stands for 😭

The only reason we know about this guy is he was lucky. It obviously never happens much. It's like the lottery winner, we know about the winners but never hear about the millions of loosers.

Dumbass, learn something about the markets instead of shitting on them in the comments. Bet you’ve never bought a share in your life😂😂

@@wompwomp7177 I don't think he is completely wrong. The guy had to have an incredible discipline and persistence to achieve such an outcome and a bit of luck too. Many many other who tried surely lost a lot. It ain't easy as some come to think.

I invested in the stock market for several years but never had much success until I started using the Darvas method. Now I look for stocks in a rising trend, if I am wrong get out right away, if I am right ride them as long as they keep going up. So far am up 33% for the year.

🙌🏽🇬🇧