(EViews10): ARIMA Models (Identification)

ฝัง

- เผยแพร่เมื่อ 17 ก.ย. 2024

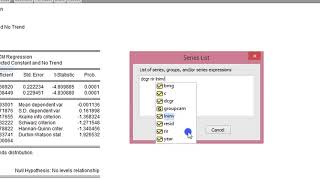

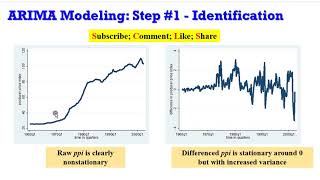

- How can the appropriate model be identified? Since, ARMA/ARIMA is a method among several used in forecasting variables, the tools required for identification are: correlogram, autocorrelation function and partial autocorrelation function. The partial autocorrelation (PAC) measures correlation between (time series) observations that are k time periods apart after controlling for correlations at intermediate lags (i.e., lags less than k). In other words, partial autocorrelation is the correlation between Yt and Yt−k after removing the effect of the intermediate Y’s (measures the marginal impact). To identify the appropriate ARMA/ARIMA model, I have outlines 5 procedures: (1) plot the series to visualise if stationary or not; (2) from the correlogram, calculate the ACF and PACF of the raw data. Check whether the series is stationary or not. If the series is stationary go to step 4, if not go to step 3; (3) take the first differences of the raw data and calculate the ACF and PACF from the correlogram; (4) visualise the graphs of the ACF and PACF and determine which models would be good starting points; and (5) estimate those models. Using EViews10, this video shows you how to identify an ARMA/ARIMA model. Here is the link to the Gujarati and Porter Ex21-1.wf1 dataset (EViews file) used for this tutorial cruncheconometr... datasets-2/. Endeavour to have a Google account for easy accessibility.

Follow up with soft-notes and updates from CrunchEconometrix:

Website: cruncheconometr...

Blog: cruncheconomet...

Forum: cruncheconometr...

Facebook: / cruncheconometrix

TH-cam Custom URL: / cruncheconometrix

Stata Videos Playlist: • (Stata13):Estimate and...

EViews Videos Playlist: • (EViews10):Interpret V...

TH-cam recently changed the way my content will be monetised. My channel now needs 1,000 subscribers. So it would be amazing if you show your support by both watching my videos and subscribing to my channel if you haven’t done so already. Monetising my videos allows me to invest back into the channel with some new equipment so this small gesture from you will be extremely huge for me. Many thanks for your support….CrunchEconometrix loves to teach, support my Channel with your subscription and sharing my videos with your cohorts.

done..

Your channel is truly a hidden gem. You have such a wonderful gift for teaching, and I don't know how to thank you enough.

DONE MAM

Your subscription is deeply appreciated. Kindly tell others too :). May I know from where (location) you are reaching me?

Daira, your subscription is deeply appreciated. Kindly tell others too :). I am very humbled by your positive feedback, May I know from where (location) you are reaching me?

Respected madam I'm learning from your work from 2017. Now awarded doctoral degree from University of Calcutta INDIA. I used vector error correction model learn from u that I used to determine macroeconomic variables impact on Non performing Assets in Indian banking industry. I'will be thankful to you madam. 🙏

Oh wow! Huge congratulations on your Doctoral degree. Well done!...and thanks so much for the encouraging feedback, deeply appreciated!🥰🙏

I didn't find anyone who can explain better than you. Thank you so much ❤️

Thanks Debasis, for the encouraging feedback. Deeply appreciated!

@CRUNCH ECONOMETRIX, words alone cannot express how thankful i am for what you are doing. You have made our life easier. Your videos are very useful and helpful. I can watch the video and call it a day. I just want to tell you that even our teachers advise us to watch your videos, that should tell you how your work is appreciated worldwide. Please keep it up. You are wonderful teacher, Bravo.

Thanks Arrthi for the positive feedback and I promise to do more with God's help. Love you, girl! 💕

Exactly

Really gd expalination step by step vry gd mam

Glad you liked it, Kiran!

Loved your explanation Ma'am! Thank you! You should come and teach Econometrics in the Universities of India. 😄

Hahahaha, thanks for the encouraging feedback, Amrita...deeply appreciated!

I don't know what any of this means but you're saying the right words to help me answer my homework thank you

Hi Anwar, thanks for the encouraging feedback. Deeply appreciated!

thank you!!!!!

it was so hard for me until i found your video

Its my humble pleasure, Insaf and I'm glad to be of help. May I know from where you are reaching me?

thanks very good explanation ....... you are the best

Hahahaha, it's my pleasure Adel...please share my YT Channel link with your friends and academic community :)

Thank you for your explanation ma'am

You are welcome, Rosviana❤️🙏

Great Explanation. Thank you.

Thanks for the encouraging feedback, Fernando. Deeply appreciated! Please may I know from where (location) you are reaching me?

This is really helpful ☺ thank you

You're welcome, Tin😊

loving your contents Ma'am

Thanks you, Sir for the encouraging feedback... deeply appreciated!

thank you so much. you are really help me a lot for my thesis. I am really happy

I'm glad you find the videos helpful, Weka. Kind regards.

this is helpful a lot I am watching it now and i have to make my assignment after it

Glad to be of help, Kumar!

Honestly, you have done a great job,, and I really understood each word and term that you explained in this video, why they do not tell and teach us such this way? Thank you are a really great teacher.

Kindly, Can I have the slides pls? I need them to prepare for the final exam.

Hi Ahmed, thanks for the positive feedback and kind words about my video. Deeply appreciated! But unfortunately the slides are not available to the public. You can always jot some notes while watching. Kind regards.

you are the best

Hahahaha, thanks for the encouraging feedback, Dee! 🥰🙏

I would suggest you to please numerically number your videos along with titles so that it is easy to know the order of videos to watch. Numbering also helps in keeping track of the videos and easy video identification. Thank you for great content

Thanks Kailash!!!🙏

Thnks teacher im from somalia really im understood 100% but before very hard forme

#❤❤❤❤❤❤

Thanks for the positive feedback, Jama...deeply appreciated!

This came in handy. kudos.

Thanks Gasto, for the positive feedback. Please share my videos with your colleagues and may God bless you!

Thank you!! It really helped me

You're welcome, Afra!

thank you so much .your explained it very well

U're welcome, Manori! 💕

I shared your video in my fb.good luck

I found this helpful! Thanks

I'm so glad, Alfitra...thanks!

Thanks very Much. God Bless.

U're welcome, John...may I know from where (location) you are reaching me?

@@CrunchEconometrix South India

Thank you very much Dr. for this explicit explanation. I have been following your tutorials on time series ARIMA model using EViews. I must confess that your videos have really helped me a lot so far.

However Dr. My question is, If the data is stationary at 1st difference from the ADF test result and also stationary from the ACF and PACF pattern after plotting a 1st difference correlogram, but the 1st difference correlogram does not show any significant spike lying outside the 95% CI (i.e. all the spikes of the lags are within the 95% CI) for identification of tentative ARIMA models to be estimated, "WHAT SHOULD BE DONE IN THAT CASE FOR IDENTIFYING TENTATIVE MODELS TO BE ESTIMATED?"

Thank you Dr. as I look forward to learning from you...

Hi Andrew, thanks for the positive feedback. Deeply appreciated. ARIMA modeling as explained in the video is "more of an art than of science". It means we can look at the same data and come up with different specifications. You may need to study the ACF and PACF Table take your decision on the "best" identification approach. Thanks.

@@CrunchEconometrix Thank you ma. My challenge is "There is no significant lag found lying outside the 95% CI for identifying tentative ARIMA models." What should i do?

If that's the case, ARIMA modelling may not fit your data. You can deploy other techniques like ARCH/GARCH if there's heteroscedasticity in the data.

@@CrunchEconometrix Ok Dr. Thank you ma. I really check and there's no heteroscedasticity, no autocorrelation/serial correlation.

@@CrunchEconometrix Dr. I plotted the 2nd difference correlogram and it showed significant lags found lying outside the 95% CI. Is that approach correct? Can i identify tentative ARIMA models from it and continue?.

It was very helpful! Thank you very much!

U're welcome, Kujtim!😊 💕 May I know from where (location) you are reaching me?

@@CrunchEconometrix I'm from Kosovo, but I'm student in Turkey! :D

@@kujtimhameli Awesome, Kuj! I will appreciate if you can spread the word about my YT Channel to your friends and colleagues in both countries. Thanks!

Great video thank you 🙂🙂

Thanks Dula, for the positive feedback on my video. Deeply appreciated! May I know from where (location) you are reaching me?

From Kenya🇰🇪 your video is very well explained ... May i know which software you are using to calculate using the ARIMA models

@@dulamaje EViews. I always indicate the software used in the video title. Thanks for watching and kindly share my TH-cam Channel link with your friends and academic community in Kenya 🇰🇪...thanks 😊

YesI will.... thank you

this is nice....

Thanks Ahmad...kindly share with your students, friends and academic community.

Very easy explanation madam. Thanks for the good stuff.

U're welcome, Bhaskar! ...and tell your colleagues about my Channel too (lol)

I cannot access the data used in your videos. Kindly make it accessible. Very nicely explained.

Some datasets are on my website. Link is shown at the end of videos.

Hello Mam, I am a PhD scholar. Your vedios are really helpful to understand the basics and built further knowledge on it. I am currently working on this particular ARIMA modelling, in which ACF is showing no decline in lags rather it is stable in all the lags, whereas there is decline in spikes/lags of PACF. What do we do in such situations?? pls help

Shiney, kindly study the ARIMA Table again and take informed decision. Thanks.

thanks :)

You are welcome, Harvie😊

Hello madam,this video is great and really helpful.I’m doing my undergraduate research project from arima modeling.My question is,

In correlogram,there are many significant lags in ACF & PACF patterns.How should I select appropriate p and q values in such situations?

Hi Kaushalya, you can use the hints given in this video and apply to what you have.

Hi! I have a question: what happens if when we check the ACF and PACF of a serie (like in 6:39) all lags are within the bands?

I have a serie of 40 observations. Value's range are 0-10. I checked and it is a stationary serie, thus I know it doesn't need a difference. But then, when I chek its correlogram, I don't know what model AR or MA should I incorporate since, as I said, all lags are within the bands.

What do you do in this case?

Kindly watch the clip again and adapt to your results. I can't make that decision for you.

Many thanks for your specific explaination in ARMA Model. Could you please give me sample ARMA data? my main purpose is to know fundamentally how to run this model.

Hi Ca, check my website cruncheconometrix.com.ng/shop or use your data.

How we can check seasonality in time series monthly data and how we can control that ???

No idea.

In my data none of the spikes is significant. What should I do now? Is that mean I won't run ARMA model?

Watch my introductory video on ARMA to fully understand the conditions for using the technique. Thanks.

9999999999999999999 Thanks!!!!!!

U're welcome, Ronaldo! 🙏

Really grateful to you excellent way of explanation

Could you please tell which software you have used

Hi Swapnil, thanks for the positive feedback and kind remarks about my TH-cam videos. Deeply appreciated! Software used is indicated in the 1st line of the video description. Please may I know from where (location) you are reaching me?

I am from India

@@swapnilgupta9644 Awesome! I'll appreciate it if you can share the link to my TH-cam Channel with your students and academic community in India 🇮🇳. May God bless you as you do, amen 🙏

One feedback/suggestion. You are going too fast. If you go slow that would make it much clearer and easier to comprehend. Otherwise good content.

Hi Vikas, thanks for the feedback, grateful. My pace is in-born. Kindly pause and playback for better comprehension. Please may I know from where (location) you are reaching me?

I am from Delhi, India

Very clear explanation.

Should we smoothing the data before correlogarm?

Thank you.

Okki, it's better to use the data the way it is. Smoothing may distort the outcome. My opinion, though.

@@CrunchEconometrix thank you so much, it's so helpful.

@@okkijatnika7224 U're welcome, Okki...please share my videos with your colleagues and academic community. They need to know my Channel exists! 💕 😊

@@CrunchEconometrix sure, I will 👍

@@CrunchEconometrix sure mam

Firstly, thank you for sharing this useful video.

For identifying the stationarity of the series, after indicating to ACF condition you said "The PACF drops immediately after the

first lag. Most PACFs after lage one are not statistically significant.". Is the first condition "ACF decline slowly and data are outside the 95 percent CI" is enough to understand that the series is nonstationary, Or we also need to check the PACF???

Hi Amin, kindly watch the video again as I made great efforts to explain what to look out for. I also advise you read textbooks for better understanding. Thanks.

I have a question for SAC and SPAC both are exponential decay. But there is no lag at all. So, how I can determine degree of ARMA model. I already did the ADF test. Both of them is at 1st difference. So, how? I hope you can answer my doubt. Thank you. 😊

Hi Aida, I have provided the Table and also indicated the source. Kindly study it vis-a-vis your output to know the appropriate specification to deploy. Take care.

Sir, how to step for forcast ARMA subsets model in eviews ?

Hi Joana, I'm not quite clear on your query. Kindly recast, thanks.

Your videos are really nice and informative. But please be a bit slow,u are very fast.

Sorry for that, Jatin...thanks for the positive feedback, deeply appreciated!

Firstly thanks so much you did it great and secondly i have a question how do you select tentative models as we got three lags are significant for each AC and PAC?

Hi Abdi, thanks for the positive feedback on my videos. Deeply appreciated! 💕 You may need to watch this clip again and the rest of the series because I explained the selection process in detail. May I know from where (location) you are reaching me?

@@CrunchEconometrix thanks again teacher i mean we have three significant lags of both AR and MA which are (1,8 and 12) and when you were determining the ARIMA patterns you just selected AR(1 and 8) and MA (1 and 8) and left lag 12 so why you left this lag and took others?

@@abdishakurismailadam3868 I explained why in the rest of the clip. Kindly watch ALL the ARIMA videos to understand how your query is addressed. Thanks.

Hi Mam, hope your okay, I added AR(1) to my equation and all variables are siq. what tests should I do to prove that my model is accurate, like the normal distribution, Breusch-Pagan-Godfrey, and so. ist correct or you suggest something else? Thanks

Hi Khaled, watch my video on ARIMA diagnostics. Thanks.

Thank you so much madam. Really helpful. Any explanation on seasonal ARIMA?

Hi Lady, thanks for the kind remarks on my videos. Unfortunately, I'm not familiar with seasonal ARIMA.

Hello Mam, thanks for sharing this videos. i Have a question. for maximum lag lengths, what should I consider? As You took 24 lags Because you were using Quarterly data. if I am using monthly data how much lags should I take?

Use between 4 and 12.

@@CrunchEconometrix how to determine it? Other example, If we use weekly or daily data?

Afifatul, kindly watch my video on "Optimal lag selection". You will find it helpful.

How to includ dummy variables in an ARIMA model ? for exemple an annual GDP series from 1960 to 2017 with a structural break in 1986, noted Dummy_1986. the log(GDP) is a DS serie. The log(GDP) is stationary at the first difference. The model I try to estimate is like this:

Dependent Variabble: DLOG(GDP)

methode: ARMA Maximum Likelihood (BFGS)

Variables: C @trend dummy_1986 @trend*Dummy_1986

Is this a good model ? or I have to remove the trend and the dummy variables from the estimation ?

thank you in advance for your valuable help.

Hi Dylan, I cannot really comment on whether your model is good or not. You can best answer that by your research objectives and questions. I haven't done ARIMA modeling with dummy variables, you may need to consult widely on the approach to make your research outcome meaningful.

Thank you very much for your answer, madam. You do a great job.

Thank you very much

can we use ADF rather than Correlogram in this case?

U're welcome, Amer. The standard is to use the correlogram. You can seek further clearance from the references given at the end of the video.

Hai ma'am, I wanna ask to you

If the stationary root test unit is at 1st difference, on the correlogram can 2nd difference be used or must it be 1st difference according to the root test unit

Thank you ma'am

I don't understand your query. Are you asking about unit root test or correlogram?

hi, can you tell me what if ACF and PACF don't have the same pattern?

Hi Alicia, study the pattern vis-a-vis the Table of guide and form your decision.

madam after taking the first difference there are no significant lags in my correlogram so what does this suggest

Sunita, I explained the correlogram so, adapt the interpretation to your outcome.

why you didn t choose ARIMA(P 2 Q)or 2nd dif

The variable is stationary at 1st difference, so no need to take the 2nd difference.

please help me, how to change display of this correlogram? Mine the correlogram doesn't full view like this video, so i can't see clearly the best model. Anyone help please

Hi Fajrinrozy, this should not be a problem. To get this same plot: do EXACTLY what I did. Please, may I know from where (location) you are reaching me?

Hi, I am running the model but I still feel confused how to explain my result. At level, in correlogram, most of the ACF are significant, but it keeps decreasing to zero. Same as PACF, my first lag is significant but other lags are not. Is it means they are non-stationary?

Also, at 1st difference, in correlogram, one of my result shows AC and PAC for all the lags are within the bounds so it implies I can't perform an ARIMA estimation? But my another result at 1st difference, in correlogram shows that the ACF is significant but PACF is not, or even it display non-consistent pattern (such as some ACF/PACF are significant in same lag but some of them are not), so how can I explain it? Thank you so much! Your video helps me a lot :)

Wendy, my videos are well-explained. You may need to watch it several times and READ textbooks too for better understanding. Thanks.

@@CrunchEconometrix Thank you ma'am. I have watched your video, and may I ask according to the ACF/PACF after first difference, how can I know they are stationary? Is it seeing the ACF/PACF pattern are consistent? Thank you a lot:)

@@Wendy-kr7dr I'll appreciate it if you pay attention to my explanations. Kindly watch the video again. Thanks.

Thank you for very useful video. How did you identify 24 lags used in correlogram? mine is monthly basis.. how to identify?

Hi Solongo, watch my video on "Optimal lags selection" it will give you a fore-knowledge on determining lag lengths. Thanks for watching my video, deeply appreciated!

If the datasets are annually data, how many lags should be include?

Hi Siti, kindly watch my video on Optimal Lag Selection. Detailed enough to guide you. Thanks.

Why did you choose Arima (1,1,1), Arima(1,1,8), Arima (8,1,1)? Thanks

Hi Kutay, the identification process is clearly explained without ambiguity. I encourage you to watch again and jot some notes. May I know from where (location) you are reaching me?

@@CrunchEconometrix hi, why don't u choose number 2 because it's also significant.. thank you!

Hi Karenina, no reason in particular. I could have picked any.

Hi, I am trying to run the model. At 1st difference, in correlogram both AC and PAC for all the lags are within the bounds so which model should be selected in terms of p,q. Please advise.

Hi Editor, thanks for watching my video. However, I'm always careful suggesting ARIMA models for the reasons I explained in the clip. Nonetheless, yours gives an indication of no significant lags though the series is first-difference stationary. This implies you can't perform an ARIMA estimation. I mentioned this in the prerequisite video. Please may I know from where (location) you are reaching me?

@@CrunchEconometrix Thanks for the response, if not ARIMA, which forecasting tool should I refer to?

I am from Pakistan.

@@editorthecatalystresearchj507 You may try ARCH. Kindly share the link to my TH-cam Channel with your students and academic community in Pakistan 🇵🇰...and stay safe 🙏

@@CrunchEconometrix Great, I'll definitely recommend. Thanks again.

Which size of the time series do you think that is appropriate to model?

Hi Edilson, I don't quite understand your query but you need at least 30 observations.

@@CrunchEconometrix I'm from Brazil and I still learning the English language.

Thanks. You answer my question.

I'm trying to apply the BDS test. And this test needs at least 100 observations.

Hi! Can we use ACF instead of the other? Actually I already applied ACF on my data set to check the stationaroity. So can I continue after that or should I start the process of forecasting from the start?

Hi Sarah, from what I know, the patterns of both the ACF and PACF should be studied to know the structure of ARMA model best suited for your data. May I know from where (location) you are reaching me?

@@CrunchEconometrix Thanks for the reply. I have another question. I have data set from 1991-2017 and I have to forecast for next five years. Will this follow the same pattern or something different?

@@sarahansari1122 Same procedure.

Hi mam, my data is on fifteen minute block data. What lag number should I select?

"15 minute block data"? What does this mean?

If I use yearly data then what number will be used as lags?? for quarterly data you have used 24

Hi Tauhidur, if you have enough time-series, you can use between 4 to 8 lags, otherwise less than 4. It's an empirical issue actually, which depends on if you gave enough series. You can watch my video on "Optimal Lag Selection" for a clearer understanding.

@@CrunchEconometrix thnank you madam! I have 35 observation only(1981-2015). In this sitution using lag 4 or less is reasonable??

Hi Tauhidur, kindly watch my video on "optimal lag selection". It is well explained....

hi, my data at 1.difference 15.lag is suitable and more. arıma(15,1,15) posible?

Go ahead and estimate the model using my guide.

@@CrunchEconometrix are you sure?Isnt it great lag number?

@@murattuna9364 I want to believe that you watched my video on IDENTIFICATION to arrive at lag 15. If you did, and that's the outcome from the ACF and PACF, you can go ahead and estimate the model.

@@CrunchEconometrix very very thank you for answer , i try to finish theisis so it is serious problem. Maybe you are true but limit value is bad ?Maybe I must try different model

@@murattuna9364 You should because I selected 4 "tentative" models before settling for the "best". You can do the same.

Madam do you know pastor chirs.

Hi Isuru, this is an academic platform.

ki banaisos eita? ajaira!

Meaning???

Way too fast

Pause the clip and playback