Portfolio Risk and Return - Part II (2024 Level I CFA® Exam - PM - Module 2)

ฝัง

- เผยแพร่เมื่อ 14 ก.ค. 2024

- Prep Packages for the CFA® Program offered by AnalystPrep (study notes, video lessons, question bank, mock exams, and much more):

Level I: analystprep.com/shop/cfa-leve...

Level II: analystprep.com/shop/learn-pr...

Levels I, II & III (Lifetime access): analystprep.com/shop/cfa-unli...

Prep Packages for the FRM® Program:

FRM Part I & Part II (Lifetime access): analystprep.com/shop/unlimite...

Topic 9 - Portfolio Management

Module 2 - Portfolio Risk and Return - Part II

0:00 Introduction and Learning Outcome Statements

4:45 LOS : Describe the implications of combining a risk-free asset with a portfolio of risky assets.

6:49 LOS : Explain the capital allocation line (CAL) and the capital market line (CML).

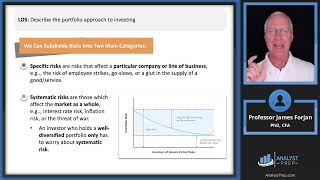

12:08 LOS : Explain systematic and nonsystematic risk, including why an investor should not expect to receive additional return for bearing nonsystematic risk.

16:00 LOS : Explain return generating models (including the market model) and their uses.

24:32 LOS : Calculate and interpret beta.

29:31 LOS : Explain the capital asset pricing model (CAPM), including its assumptions, and the security market line (SML).

39:43 LOS : Calculate and interpret the expected return of an asset using the CAPM.

41:04 LOS : Describe and demonstrate applications of the CAPM and the SML.

48:18 LOS : Calculate and interpret the Sharpe ratio, Treynor ratio, M2, and Jensen’s alpha.

I really like this guy and his teaching style.

You're very welcome! If you like our video lessons, it would be appreciated if you could take 2 minutes of your time to leave us a Google review using this link: g.page/r/CQIlM78xSg01EB0/review

Excellent work Professor. You have explained the topic in a very easy way for the students to understand.

Glad it was helpful! If you like our video lessons, it would be appreciated if you could take 2 minutes of your time to leave us a review here: trustpilot.com/review/analystprep.com

Thank you so much for the video Professor Forjan. I enjoyed watching it and it helps me in understanding the PM section better

Glad it was helpful! If you like our video lessons, it would be appreciated if you could take 2 minutes of your time to leave us a review here: trustpilot.com/review/analystprep.com

wow great explanation on sml and CML. most esp on SML!! great job!

Thanks a ton!

You're welcome! If you like our video lessons, it would be appreciated if you could take 2 minutes of your time to leave us a review here: trustpilot.com/review/analystprep.com

Excellent work Professor

You are welcome! If you like our video lessons, it would be appreciated if you could take 2 minutes of your time to leave us a Google review using this link: g.page/r/CQIlM78xSg01EB0/review

my doubt is can we use beta to tell us how much percent the stock will move in respect to the market such as if the s and p 500 is up 1% for the day how much would apple be for the day ?

Sir, tks for all the good content! -- should we deduct Rm in the M2 computation? Not sure i missed sth, or if there are more than one definition/interpretation. thank you.