ไม่สามารถเล่นวิดีโอนี้

ขออภัยในความไม่สะดวก

Valuation of Contingent Claims: Part I - Binomial Pricing (2024 Level II CFA® Exam -Module 2)

ฝัง

- เผยแพร่เมื่อ 18 ส.ค. 2024

- Prep Packages for the CFA® Program offered by AnalystPrep (study notes, video lessons, question bank, mock exams, and much more):

Level I: analystprep.co...

Level II: analystprep.co...

Levels I, II & III (Lifetime access): analystprep.co...

Prep Packages for the FRM® Program:

FRM Part I & Part II (Lifetime access): analystprep.co...

Topic 7 - Derivatives

Module 2- Valuation of Contingent Claims: Part I - Binomial Pricing

0:00 Introduction and Learning Outcome Statements

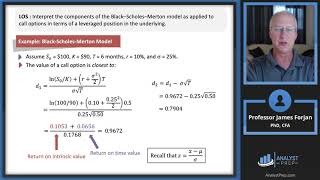

5:30 LOS: Describe and interpret the binomial option valuation model and its component terms.

23:06 LOS: Calculate the no-arbitrage values of European and American options using a two-period binomial model.

38:12 LOS: Identify an arbitrage opportunity involving options and describe the related arbitrage.

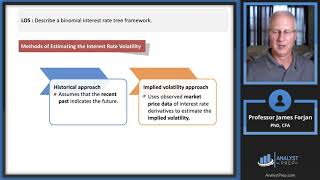

49:44 LOS: Calculate and interpret the value of an interest rate option using a two-period binomial model.

54:21 LOS: Describe how the value of a European option can be analyzed as the present value of the option’s expected payoff at expiration.

Thank you Professor for putting this up😃

For these more complex decks, I think you need a way to point out specific items on the slide while discussing. All verbal is harder to follow on a static deck. I've watched 100% of the L1 videos and all the L2 up to here.

Thank you for your input. We'll do our best to highlight things in post-production moving forward!

I believe reading 37 is Pricing and Valuation of Forward Commitments. Valuation of contingent claims is reading 38 i think you jumped one?

Yeah I couldn't find Reading 37 either.

We have to take care of a few CFA Level updates for 2022 and then we'll get back to CFA Level II video lessons. All videos will be live before the February exam for sure!

May I ask why we only look at how to arbitrage an overpriced call option but not underpriced call option as well as put option scenario ? Please

The arbitrage here is just a theory under the assumptions that the price will be between 25 and 16... But in reality, nothing is guaranteed, right?

will you upload a video on Reading 37 too?

Yes, soon. We have to take care of a few CFA Level updates and then we'll get back to CFA Level II Video lessons. Before the February exam for sure!

Is this the last available reading?

Hi Charlie. We have to take care of a few CFA Level updates and then we'll get back to CFA Level II Video lessons. All videos will be live before the February exam for sure!

Dam i hate this chapter