FATCA Form 8938 FAQ: What is a specified foreign asset?

ฝัง

- เผยแพร่เมื่อ 20 ก.ค. 2024

- What needs to be reported as "specified foreign assets" on IRS Form 8938? Find out here.

Things like foreign stock certificates, foreign life insurance, foreign real estate titled in a foreign corporation all need to be reported on FATCA form 8938, along with a host of other items.

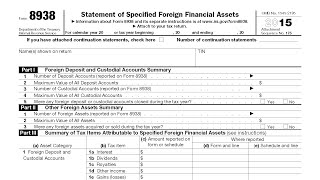

Form 8938 (Statement of Specified Foreign Financial Assets) is used to report specified foreign financial assets. It is filed by taxpayers with specific types and amounts of foreign financial assets or foreign accounts. It can be confusing to know exactly what you need to report, so we created a Form 8938 FAQ list.

1. What are the specified foreign financial assets that I need to report on Form 8938?

It is easier to answer what is not included. See FAQs below.

The examples listed above do not comprise an exclusive list of assets required to be reported.

2. I am a U.S. taxpayer but am not required to file an income tax return. Do I need to file Form 8938?

- No

3. Does foreign real estate need to be reported on Form 8938?

- Personal residence or a rental property typical no. If held through another entity may have Form 5471 or 8865 requirement that flows to Form 8938.

- If the real estate is held through a foreign entity, such as a corporation, partnership, trust or estate, then the interest in the entity is a specified foreign financial asset that is reported on Form 8938, if the total value of all your specified foreign financial assets is greater than the reporting threshold that applies to you. The value of the real estate held by the entity is taken into account in determining the value of the interest in the entity to be reported on Form 8938, but the real estate itself is not separately reported on Form 8938.

4. I directly hold foreign currency (that is, the currency isn’t in a financial account). Do I need to report this on Form 8938?

- Generally no.

5. I am a beneficiary of a foreign estate. Do I need to report my interest in a foreign estate on Form 8938?

- Probably yes.

6. I acquired or inherited foreign stock or securities, such as bonds. Do I need to report these on Form 8938?

- There is a good chance. If you inherited over $100,000 in a year, be sure you likely have a Form 3520 requirement. Penalties for this can be large than Form 8938 penalties

7. I directly hold shares of a U.S. mutual fund that owns foreign stocks and securities. Do I need to report the shares of the U.S. mutual fund or the stocks and securities held by the mutual fund on Form 8938?

- If you directly hold shares of a U.S. mutual fund you do not need to report the mutual fund or the holdings of the mutual fund.

8. I have a financial account maintained by a U.S. financial institution that holds foreign stocks and securities. Do I need to report the financial account or its holdings?

- You do not need to report a financial account maintained by a U.S. financial institution or its holdings. Examples of financial accounts maintained by U.S. financial institutions include:

U.S. Mutual fund accounts

IRAs (traditional or Roth)

401 (k) retirement plans

Qualified U.S. retirement plans

Brokerage accounts maintained by U.S. financial institutions

9. I have a financial account maintained by a foreign financial institution that holds investment assets. Do I need to report the financial account if all or any of the investment assets in the account are stock, securities, or mutual funds issued by a U.S. person?

- Probably not.

10. I have a financial account with a U.S. branch of a foreign financial institution. Do I need to report this account on Form 8938?

- Probably not.

11. I own foreign stocks and securities through a foreign branch of a U.S.-based financial institution. Do I need to report these on Form 8938?

- Probably not.

12. I have an interest in a foreign pension or deferred compensation plan. Do I need to report it on Form 8938?

- Probably, but it also could reference the 3520-A for a grantor's trust.

13. How do I value my interest in a foreign pension or deferred compensation plan for purposes of reporting this on Form 8938?

- Generally fair market value end of year, but there are exceptions.

14. I am a U.S. taxpayer and have earned a right to foreign social security. Do I need to report this on Form 8938?

- Payments or the rights to receive the foreign equivalent of social security, social insurance benefits or another similar program of a foreign government are not specified foreign financial assets and are not reportable.

15. What are the penalties for not filing a Form 8938?

- Up to $10,000 per year.

16. I already file an FBAR. Do I have to file a Form 8938 as well?

-You might.

Parent & Parent LLP

144 South Main Street

Wallingford, CT 06492

(203)269-6699

info@irsmedic.com

![ไหล่อ่อน (Soft Shoulder) - Atom ชนกันต์ [OFFICIAL MV]](http://i.ytimg.com/vi/HUWl53msBQY/mqdefault.jpg)

Interesting! For a junior tax accountant in Australia it's pretty interesting how US taxes on foreign assets work

Thank you

6:45 "Indirect interests in foreign financial assets through an entity" Could this be interpreted as: my fiancee has a checking account in her home country?? She is the entity with foreign financial assets, and my indirect interests is my relationship with her?? By the way, thank you for this enlightening series of discussions.

Sorry for the late response. Assuming your fiance (well I'm so late she's probably your wife by now), is not a US person, the answer would most likely be a no.

Hello, I have another question sir - My mom (a non US person living abroad) bought a $10,000 variable life insurance policy with cash value in the Philippines back in 2016. The policy is on her name as the beneficiary and I (a US Citizen) am on the polity as the insured person. My mom should get the cash value of the life insurance if I die or if she decides to surrender it. During the years 2016-2022 the cash value of the policy fluctuated with the stock market. There were years it went over $10,000.00, other years like 2022 it went below that.

My question is, does that policy even have to be reported to FBAR if I am ONLY the insured and not the beneficiary ( i know that will not make sense, as how can the insured be the beneficiary - lol) or do I still have to include that policy in the FBAR simply because she can surrender it for cash but yet the policy is on her name and I have no signature authority to surrender and cash it for her as the policy is only on her name. I am only the insured person. Am I overthinking? What do you think?

What if I sent money to my mom's bank (she is non US person) so she can pay a builder building a house for our family overseas. do i need to include that in fbar?

Nope. You do not have a financial interest in the account nor are you a custodian. But I wonder about your house ownership. Is it in a corporation or something similar? What is percentage of ownership by US persons like your siblings.

@@irsmedic thank you sir. we bought the lot like 10 years ago and it was titled to my mom, my dad, and myself. it is not in a corporation, it's just a family property. my siblings are non US persons and they are not involved in the house or are in the lot title. in 2019 we started the build and i started sending money to my mom to pay the builder. the house got finished Jan 2022(took longer because of covid). I sent the money to my moms and dads joint bank account. all the money i sent are the ones i earned and were already taxed here in the US . thank you again and please advise if you have any further thoughts on my situation. Is my case considered real estate, which is exempted?