CFA Level II: Equity Investments - Free Cash Flow Valuation Part I(of 2)

ฝัง

- เผยแพร่เมื่อ 22 มี.ค. 2016

- FinTree website link: www.fintreeindia.com

FB Page link : / fin. .

This series of video covers the following points :

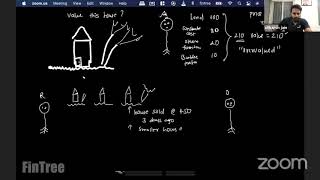

-There are two ways to estimate the equity value using free cash flows.

-An entire firm and all its cash flows (FCFF) are discounted, with the relevant discount rate being the weighted average cost of capital (WACC) because it reflects all the firm’s sources of capital. The value of the firm’s debt is then subtracted to calculate the equity value.

-Only the free cash flows to equity (FCFE) are discounted, with the relevant discount rate being the required return on equity. This provides a more direct way of estimating equity value.

-In theory, both approaches should yield the same equity value if the inputs are consistent. However, the FCFF approach would be favored in two cases.

The firm’s FCFE is negative.

-The firm’s capital structure (mix of debt and equity financing) is unstable. The FCFF approach is favored here because a) the required return on equity used in the FCFE approach will be more volatile when the firm’s financial leverage (use of debt) is unstable and b) when using historical data to estimate free cash flow growth, FCFF growth might reflect the firm’s fundamentals better than FCFE growth, which would fluctuate as debt fluctuates.

-FCFF and FCFE approaches to valuation

-value of a company by using the stable-growth, two-stage, and three-stage FCFF and FCFE models.

-appropriate adjustments to net income, earnings before interest and taxes (EBIT), earnings before interest, taxes, depreciation, and amortization (EBITDA), and cash flow from operations (CFO) to calculate FCFF and FCFE.

-approaches for forecasting FCFF and FCFE.

-approaches for calculating the terminal value in a multistage valuation model

-We love what we do, and we make awesome video lectures for CFA and FRM exams. Our Video Lectures are comprehensive, easy to understand and most importantly, fun to study with!

-This Video lecture was recorded by our popular trainer for CFA, Mr. Utkarsh Jain, during one of his live CFA Level II Classes in Pune (India).

#CFA #FRM #FinTree

![ช่วยพาฉันผ่านเวลา - วสันต์17 [Official MV]](http://i.ytimg.com/vi/HFnntWoqc54/mqdefault.jpg)

why no one else explains like this?! really appreciated!

Very nice presentation. Easily understood

Really helpful. Thank you

Awesome lecture. If you could use actual financial data of a firm to illustrate FCFF, FCFE & so on, it would be even better. Thanks a bunch.

Starboy

Good advice , thanks . Did incorporate this in my subsequent sessions

gzb video sir👌

wish you made a video of wacc from annual report

What is the formula to calculate the instalment payment to bondholders manually?

Interest would have accounted while arriving at CFO. (Interest would have been added to net income to arrive at CFO.) Then why are we adding again to CFO in the right most formula of fcff?

Can someone please explain why we dont adjust CFO for int(1-t) when interest is accounted in financing activities?

sir where is terminal value

Am I confused or?

Shouldn't FCF be equal to 260, why is interest*(1-t) added back in the net income columb should it not be subtracted from the EBIT columb and so on instead?

I think I indeed was confused FCF(Free Cash Flow) is different to FCFF(Free Cash Flow to Firm)

FCFF = After tax operating income + Noncash charges (such as D&A) - CAPEX( Capital expence) - Working capital expenditures = Free cash flow to firm (FCFF)

* NI is net income of company After paying off interest to debt holders (i.e. we subract interest expense to reach net income).

FCFF is cash flow of firm Before paying back interest to debt holders.

So when we calculate FCFF starting from NI, we have to add interest back because we are assuming we have not yet paid interest (yet to pay) to debt holders.

* We do not subtract interest from EBIT as this is Earning Before Interest and Taxes - it does not include interest and taxes (these are not deducted from earnings), so no need of adding it back.

Hope this helps! :)

FCFF less value of debt = value of equity. what about the present value of interest(1-t) cash flows still a part of FCFF, shouldn’t we deduct those too?

Sourabh Gadre PV of interest at interest rate ? It’ll be zero !

Sir.. can I learn CFA by online???

Hi Dimple,

Thanks for getting in touch with us!

The CFA Course can be learned online; we offer online courses for the CFA Program. Click here to see our online courses- www.fintreeindia.com/buy-online-courses/

Best regards,

Team FinTree

Why you show assets on the right side and liabilities on the left side. Should it not be the reverse? Well this is how I learned it back in my days.

thats how it is represented using US GAAP. In india we do it in reverse