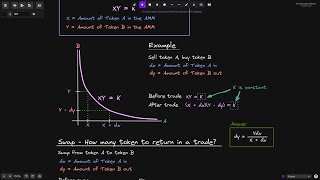

How to Build a Constant Product Automated Market Maker (AMM, Solidity)

ฝัง

- เผยแพร่เมื่อ 21 ก.ย. 2024

- WEB3 MENTORING PROGRAM

👉 Apply here: eattheblocks.c...

3 month mentoring program to become a professional Web3 developer

Build a killer portfolio of Web3 projects to get a 6 figure job

👉 Program: www.notion.so/...

👉 Testimonials: • Testimonials of EatThe...

👉 Questions? julien [at] eattheblocks [dot] com

Code:

solidity-by-ex...

Original content created by Smart Contract Programmer, reproduced here with his authorisation:

• Constant Product Autom...

This video is incredible. It taught me about how AMMs work and most of all, the workflow of smart contract development. 1,000,000 thanks! :)

Thanks

Is the remuneration of liquidity providers automatically calculated according to a formula(amount0 = (_shares * bal0) / totalSupply) when they withdraw liquidity?

i can't find previous video about math. Can you share with me ?

Where did you declare reserveOut?

how do I put this in my website? xd

12:45 when you update the reserves after the swap with "token0.balanceOf" balances, it is still susceptible to price manipulations. User will send tokens directly to the smart contract before the swap, and after the swap is done, reserves will be updated with the incorrect values. Instead, what should be used is "_update(reserve0 + amountInWithFees, reserve1 - amountOut)" if the tokenIn is the token0. No?

guys ICO is over, they are duing the private sale and all sales will end in 2 weeks. It will be listed on exchanges later on