Bond Prices And How They Are Related To Yield to Maturity (YTM)

ฝัง

- เผยแพร่เมื่อ 24 ก.ย. 2024

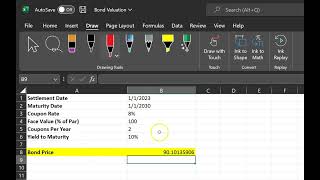

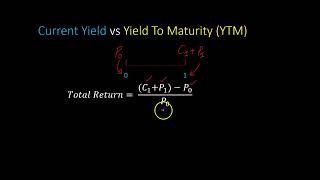

- In this video, you will learn how to calculate the price of a bond. In the process, you will also learn what is meant by a bond's Yield to Maturity (YTM), and why bond prices and yields are negatively related to each other.

This video will also help you understand why/when some bonds trade at a discount (i.e. at a price LESS than their face value), why some trade at a premium (i.e. at a price that is GREATER than their face value), and why some trade AT PAR (i.e. at a price EQUAL to their face value).

Finally, and perhaps more importantly, after watching this video you will clearly understand the distinvtion between a bond's coupon rate and its YTM.

Students will particularly find this video useful in understanding parts of Chapter 8 (Interest Rates and Bond Valuation) of Corporate Finance by Ross, Westerfield, Jaffe and Jordan.

WHAT A CLEAR WAY TO TEACH.....................GOD BLESS YOU!!!

That’s very kind of you. Thank you!

you are so talented in teaching finance! you saved my life in my exam

Clearest explanation of this I have seen yet, and I've been bouncing around multiple videos, audio books, etc. Thank you.

Very clear and concise explanation. Thank you Ikram! I'm a PG student trying to get into finance and this helps. Looking forward for more such videos

Oustanding , excelent explanation

Hopefully this lets me understand your interest rate risk and reinvestment risk video now. I didn't think in the direction of bond prices which was helpful. But I keep getting confused in current yield and yield to maturity. And then people start saying stuff like interest rate went up and I start thinking about bank interest rates going up instead of an investor's required rate of return. My mind is a mess right now lol.

Edit: Wait you have a video on that too what the heck. Actual life saver.

Zan - sorry for the late reply. I hope the series of videos helped clarify the confusion. Reach out to me if they didn't - we can even do a 10-15 minute Zoom session.

This is a very good video. It is clear and avoids ambiguity (which other videos and explanations about these concepts often do). Keep up the good work. The way to go is simple and clear.

I have been struggling with this for months. Thank you so much for making it clear

Nicely explained. Thank you!

God bless you professor, very clear explanation 👏

Thank you so much! You are breaking the concepr down in a much more understandable way!!

the best explanation i have heard, and trust me, i have watched A LOT of videos thank you so much!!

Thank you so much for explaining everything in detail.Keep up the good work !

Thanks so much, your explanation is so intuitive and clear.

Thank you so much for the clear explanation!

Great video!!

Great video, thank you so much.

Very helpful

Awesome explanation! Thank you very much!

you are my FAVVV TEACHERR, THANKYOUSSS

Thanks for educating us sir

Great Explanation

fantastic video. This helps a lot

Excellent content

Thank you so much. could you create a series of videos about a topic of analysis of financial statment, please?

Thank you! I do have a couple of videos on some ratios, but will make more and in the form of a series. Thanks for the suggestion.

great video and appreciate it

Awesome stuff! Thanks Ikram! Can you also please make your magical video on the hypothesis testing and Jarque-Bera Test when you have chance?

thank you so much for those clear explanations, IN CRE DI BLE teaching skills.

Amazing

Good video! I have a question when the rr increased to 10% the value of the Bond became 877, and when It decreased to 6% It became 1147. Even tho the rr changed by the same amount, the price didnt change by the same amount. 1000-877 = 123 dollar price change, and 1147 -1000 147 dollar price change. Is this due to positive convexity in the Bond?

Great question! Yes, bonds vary in their sensitivity to changes in interest rates, and yes it has to do with convexity. You should look into “bond duration” which somewhat captures these ideas.

so which is better? the present value being higher than the face value or the present value being lesser than the face value? Please explain.

Neither is better per se. If you bought the bond at face value and then the price drops because yields go up (which they HAVE over the past couple of years), then by selling the bond you’ll make a loss. However, if you hadn’t bought the bond before, and by it after the prices drop, then you’d essentially be making a higher return (or yield) than the original coupon rate (assuming you hold the bond till maturity and there is no default risk). I suppose you can say that’s “good” in that sense. So it just depends on the perspective.

Does that help?

@@professorikram thank you for taking time to answer. I really want to understand the concept. How do we get the yields or the rate of required return?

@jrs7541 great question! In this video, I treat them as given. In the REAL world, it is not Yield to Maturity that determines the price. Rather it is the price that determines the YTM. People buy and sell bonds in the bond market, and the forces of supply and demand determine the price. If a bond is offering is 3% coupon, but people want 6%, they will demand less of it. This will decrease the price up until the point that where buying at that low price will give you 6%.

Now, if your question is - where does the 6% come from … well that demands on a host of factors, primarily including the rate the government is offering on its bonds (ie the “risk free” rate), the inflation rate and the default risk of the bond. That’s a separate video! 😀

Understandable. Regarding an increase in the required rate, why would the borrower accept something lower than the face value?

Good question. The lower the price is below face value, the greater is the rate of return you can expect from buying the bond. Face Value is fixed at $1,000. the lower you will pay to have claim to that $1,000 (at maturity), the greater will be your (expected) return.

How do you determine the investor's required rate of return? Is it the next best available rate of return on an available safe asset, or maybe fed rate?

Required rate of return is always the next best rate you can get on asset of EQUAL risk! Not necessarily the fed rate.

Thanks

Don't let this setback define your trading journey. Keep working hard and striving for success.

Legend

priceless!!!

2:00

can we say that YTM is equal to discounted rate ?

Bingo! That is exactly right! 👌

@@professorikram no that is not right at every point.

amazing explanation