IRS Form 2159 walkthrough (Setting Up a Payroll Deduction Agreement)

ฝัง

- เผยแพร่เมื่อ 2 พ.ค. 2023

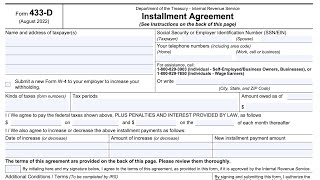

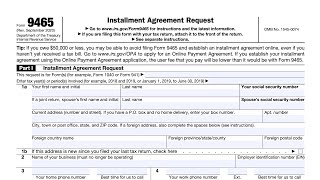

- If you're trying to pay down tax debt, you may have to set up a payroll deduction agreement. If that's the case, you can file Form 2159 to do just that. Here are some guidelines for both taxpayers and their employers.

Taxpayer guidelines

If not already completed by an IRS employee, please fill in the information in the spaces provided on the front of this form for the following items:

• Your employer’s name and address

• Your name(s) (plus spouse’s name if the amount owed is for a joint return) and current address.

• Your social security number or employer identification number. (Use the number that appears on the notice(s) you received.) Also, enter the last four digits of your spouse’s social security number if this is a joint liability.

• If you are a low-income taxpayer, you would qualify for the waiver of your installment agreement fees if you agreed to make electronic payments through a debit instrument (debit payments) by entering into a direct debit installment agreement. This payroll deduction agreement is not a direct debit installment agreement and you are not making debit payments under this agreement. However, if you indicated in the Debit Payments Self-Identifier section of this agreement that you are unable to make debit payments by entering into a direct debit installment agreement, then your installment agreement fees will be reimbursed upon completion of your agreement. Low-income taxpayers, for installment agreement purposes, are individuals with adjusted gross incomes, as determined for the most recent year for which such information is available, at or below 250% of the criteria established by the poverty guidelines updated annually by the U.S. Department of Health and Human Services.

• The kind of taxes you owe (form numbers) and the tax periods

• The amount you owe as of the date you spoke to IRS

• When you are paid

• The amount you agreed to have deducted from your pay when you spoke to IRS

• The date the deduction is to begin

• The amount of any increase or decrease in the deduction amount, if you agreed to this with IRS; otherwise, leave BLANK

After you complete, sign (along with your spouse if this is a joint liability), and date this agreement form, give it to your participating employer. If you received the form by mail, please give the employer a copy of the letter that came with it. Your employer should mark the payment frequency on the form and sign it. Then, your employer should return the parts of the form which were requested on your letter or return Part 1 of the form to the address shown in the “For assistance” box on the front of the form.

If you need assistance, please call the appropriate telephone number below or write IRS at the address shown on the form.

However, if you received this agreement by mail, please call the telephone number on the letter that came with it or write IRS at the address shown on the letter.

Employer guidance

This payroll deduction agreement is subject to your approval. If you agree to participate, please complete the spaces provided under the employer section on the front of this form.

WHAT YOU SHOULD DO

• Enter the name and telephone number of a contact person. (This will allow us to contact you if your employee’s liability is satisfied ahead of time.)

• Indicate when you will forward payments to IRS.

• Sign and date the form.

• After you and your employee have completed and signed all parts of the form, please return the parts of the form which were requested on the letter the employee received with the form.

Use the IRS address on the letter the employee received with the form or the address shown on the front of the form.

HOW TO MAKE PAYMENTS

Please deduct the amount your employee agreed to have deducted from each wage or salary payment due the employee.

Make your check payable to the “United States Treasury.” To insure proper credit, please write your employee’s name and social security number on each payment.

Send the money to the IRS mailing address printed on the letter that came with the agreement. Your employee should give you a copy of this letter. If there is no letter, use the IRS address shown on the front of the form.

Note: The amount of the liability shown on the form may not include all penalties and interest provided by law. Please continue to make payments unless IRS notifies you to stop.

If you need assistance, please call the telephone number on the letter that came with the agreement or write to the address shown on the letter. If there’s no letter, please call the appropriate telephone number below or write IRS at the address shown on the front of the form.

![[ไฮไลต์] "บิว" ภูริพล บุญสอน วิ่ง 100m ชาย รอบคัดเลือก | โอลิมปิก 2024](http://i.ytimg.com/vi/3kUSMfgtQ5s/mqdefault.jpg)

Please feel free to check out our article, where we've written step by step instructions to help you walk through this tax form! www.teachmepersonalfinance.com/irs-form-2159-instructions/

Why I have no Rate and Hours my pay stub..mam and sir..and I saw the Retro base pay..but I didn't received.. I'm Custodian 2019 to 2024,at Kauai High School Kauai Island Hawaii 96766..And also I have garnishment so my credit is affected to me..I have family and I would to support but nothing can chance to apply another loan..What is our benefits as Custodian my Mother and Me as State Government Employees.. Thank you so much..

Can you review please my deduction and taxes in my paycheck..and please access my records.. Let me know my taxable income and none taxable income and others Unclaimed funds.. I'm Juanito Jr M Ordanza..and my mother's name is Juanita M Ordanza...we are Custodian at Kauai High School and State Government... Thank you so much..

I'm not sure that I can help you on this YT channel. Have you talked to a local accountant?