CFA Level 2 | Fixed Income: Bootstrapping Spot Rates from Par Rates & No-Arbitrage Valuation

ฝัง

- เผยแพร่เมื่อ 7 ก.ค. 2024

- Visit www.noesis.edu.sg for more info on CFA prep courses in Malaysia, Singapore, or wherever you are.

☕ Like the content? Support this channel by buying me a coffee at www.buymeacoffee.com/riskmaestro

CFA Level 2

Topic: Fixed Income

Reading: The Term Structure and Interest Rate Dynamics

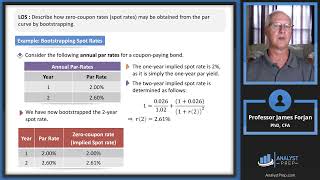

Par rates are the yield to maturities of government bonds that are newly issued (on the run), where the YTM is equals to the coupon rate (i.e. price is equals to par). Through the bootstrapping process, we can extract the spot rates from the par rates. The spot rates (or zero-coupon yields) can then be used to calculate the forward rates, or we can use it to calculate the no-arbitrage value of a risk-free bond.

Visit www.noesis.edu.sg for more info on CFA prep courses in Malaysia, Singapore, Vietnam, or wherever you are.

Facebook: / noesismy

LinkedIn: / noesisklsg

this video is amazing, it suddenly came to my mind what is "no arbitrage", thanks

Superb explanation. Simple and clear. Thank you!

Glad it was helpful!

Great content Fabian, thanks for sharing and all the best on your business!

My pleasure!

Thank you for the simple and clear explanation.

Really well explained! Thanks :)

This video is amazing suddenly I undestood a lot of books about this

best explanation ever! thank you so much

You're welcome!

Superb explanation.

very concise

Thanks, it best. Come on CFA 2

Thanks :) It helped me a lot

Glad to hear that!

Thanks for the explanation in 1 single simple vdo...

You're most welcome, Jasdeep

Great Video Fabian. Please can you describe how to work out the spot rate from par rate. I see the description but I need to see the work out. Looking forward to your response

Hi Ayoola, from minute 03:00 onwards, I showed the workings. Might I ask what work out you're asking about?

Fabian Moa Thanks Fabian.... I eventually got the logic. I was looking for a smarter way to derive the spot rate using TVM on my calculator and avoid solving quadratic equations

спасибо большое за объяснение👍👍👍

Hey Fabian, thanks for sharing such a nice video! Like the idea of timeline - i was like die die memorizing it previously 😂

Ya. It's easier with the timeline

Hi, Fabian. Do you have a fully online CFA L3 program? I'm not in Malaysia/Singapore.

What is the conceptual interpretation of par rates? Also, why is the spot rate higher than par rate? Refer 3.01 m - here why is the first year coupon rate discounted at 4%, shouldn't it be at the 2year spot rate?

Hey Fabian, do you know how to calculate the last exercise (using spot rates) in HP12c? My problem is with inserting different rates to find the pv

Hi Alexandre, I'm not proficient with HP12c, can't help there. Sorry

Thanks a lot for the simple explanation. Question, how can i compute the two-year forward rate starting from 1 and 2 year from now? if i have the spot rate today s2= 5.2316% the procedure is the same as in f1?

To get the 2-yr forward rate starting 1 year from now, you would need the

* 1 year spot rate, S1

* 3 year spot rate, S3

f(1,2) = ((1+S3)^3)/(1+S1))^(1/2) - 1

To get the 2-yr forward rate starting 2 year from now, you would need the

* 2 year spot rate, S2

* 4 year spot rate, S4

f(2,2) = ((1+S4)^4)/(1+S2)^2)^(1/2) - 1

@@FabianMoa Thx a lot

How can I bootstrap in excel, while doing it efficiently as a have a large data set where I have to calculate about 120 periods of spot rates?

VBA would be a more efficient way of doing it.

why dont we need to discount the forward rate to today since it's in the future? eg. at 5:56, the forward rate is 6.4778% - does this not need to be discounted by 4% to get the forward rate in today's/pV terms when buying/selling the bond future?

No need to do that. If you are going to buy the bond forward at T = 1, so you just need to know the 1yr fwd rate in 1 year, which is 6.4878%.

That means a $1 in Year 2 discounted back by 1 year at 6.4778%, or $1/1.064778 = $0.9392 (in Year 1). That is the price you will lock in today (T = 0) to pay in Year 1, if you enter into a 1 year forward contract

@@FabianMoa thanks for the explanation. Does this mean that the current 2Y spot rate will also be 6.4778% in 1 year's time (roll down the curve) if the curve does not change (i.e. interest rates remain the same?)

Hi, Might be a dumb question but the bootstrapping looked like you are deriving par rates from spot rates not otherwise.

Really? It is actually deriving the spot rates from the par rates

Is there a quick way to solve the Spot rate? Cos it seems to me like trial and error?

Never mind I am being an idiot

for spot rate for (S2) I am getting 4.97% can someone please help. Thank you!

Continuing from the workings in the video:

1.052/(1 + S(2))^2 = 1 - 0.052/1.04

1.052/(1 + S(2))^2 = 0.95

S(2) = [1.052/0.95]^(1/2) - 1 = 5.2316%

thank you so much!!

@@FabianMoa This was very helpful!

Is same forward rate and par rate ? Both start in future date ...

Nope. Forward rate starts at a future date. Par rate starts today, just like spot rate

i m confused with when we should compound rates ??

If they use general terms like yield or effective rates, use compounding.

If they use LIBOR for eg, use simple interest

hi! Is the spot rate the same as zero-coupon rate?

Yes, the spot rate is also called the zero coupon bond yield

Thanks for this video - where did you get the par value from?

It's arbitrary. You can use any value you want, such as $100 or 1000 or 500

@@FabianMoa thank you!

@@FabianMoa please could I also ask how you would / should compute this in Excel? e.g. how to set it out re bootstrapping?

th-cam.com/video/YA4MwK2WOtU/w-d-xo.html

Watch from 04:20

It was a feeble explanation and I didn't understand the how the 0.052/1.04 came in there and how did you do it and also the further explanation