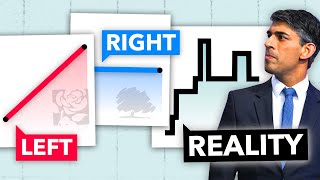

How To Pay Less Tax In The UK (LEGALLY!)

ฝัง

- เผยแพร่เมื่อ 3 มิ.ย. 2024

- If you’re based in the UK and have at least one form of income, then you've probably noticed the sizeable tax bill on your payslip at the end of each month, which is only going to get bigger as personal allowances reduce & tax rates rise.

In times like these, it’s crucial that you act smart and use whatever legal means you can in order to reduce the tax you pay - so in this video, I'll be running through different allowances & methods that you can follow to pay less tax in the UK.

⭐ Get A Free Share Worth Up To £100 With Trading212 (Use It In Your ISA!): www.trading212.com/invite/GvY...

⭐ Sign up for a LISA via Hargreaves Lansdown and claim up to £1,000 for free here: www.hl.co.uk/investment-servi...

The best way to reduce tax paid in the UK is to move to another more favourable tax jurisdiction.

Haha amen!

. . . or become a Drug-trader

Which countries are top 10 best?

@@IbadassI not sure about the top 10 but the top 2 im thinking about moving to is cyprus and united arab emirates aka dubai lol. ive been doing my research on dubai and as it currently stands they pay 0% income tax and the vat is 5% on every purchase which is nothing at all comapred to other countires, i know america alone pay 20% vat on most purchases and then they have income tax, the uk im not too sure about vat as it comes out of the total cost upfront but i think its pretty similar to america

Great stuff Jason. Appreciate you for sharing this info.

Hi Jason, thanks for the video. My suggestion for another video is to explain further on Limited company tips to pay less tax, like what what would be the most efficient way to pay yourself and give a lot more examples of what you could put as an expense

Well done…clear and easy to understand

Good stuff! Thanks Janson ✨🙏🏻✨

Good stuff but just a couple of points. Firstly, I trade not in a ltd company but as a sole trader and I can put all the items that you mentioned against tax. Im talking fuel, a proportion of my home expenses etc. Secondly you can take a pension before you retire.

The issue is the "soft cap" on income, meaning most people won't be able to earn more than £3k a month.

Meanwhile, we live in a country where £500k houses are considered "cheap".

you came up on my recommended yay!!

Will do buddy!

so im abit stuck with limited businesses at the moment in terms of what can be considered tax back. im aware limited businesses pay a 19% tax rate and if im buying business expenses i get about 20% of that back too? If thats the case will there be much saving, also can a car be bought straight up and be considered business expense or does it have to be leasing?

I just want to add for small business operating as a sole trader is better as you can get 12,570 PA while in case of Limited company you don’t get any secondly all the business related expenses can be claimed in case of self employed.

Correct if am saying something wrong

Whoop! Tax 🙌🏻🙌🏻🙌🏻 my favourite subject 🧡😂

Haha knew you’d love it. Someone sent me a nasty DM saying I should pay my taxes lol 😂

Thank you

What happens to my ISA and/or pension money if I decide to retire early or leave the country before the retirement age of 60... let's say at 35 years?

Here is how you pay less tax in the UK .... you pack your bags and leave !

Haha coming up in part 2.. which countries to go to! I heard Panama is good 🥸

Yes which is what we are doing end of next year.

Major miss on the pension contributions. Pensions contributions consist of THREE parts, not TWO. Your contribution, employer contribution, and the tax relief from HMRC which adds 25% to your contribution. No, the tax relief is 20%, not 25%! . . No, it's 25% -~ Example: You contribute £240 per month, HMRC adds £60 per month - That is 25%.

Technically the taxman/woman/non binary person doesn’t add anything at all - it seems to be a common misbelief that your are ‘getting something’ from HMRC - pensions contributions are deducted before tax is applied and invested which means that the tax saving is relevant to your tax rate - so it could be 20%, 40% etc - therefore you are investing the ‘full amount’ of your money rather than the taxed amount if that makes sense.

We pay absurd amounts of tax as the country needs to pay interest on the artificial debt printed into existence by the private central bank who then borrows it to the government by purchasing bonds.

If I'm a higher rate tax payer (40%) does HMRC add more to my pension than if I'm a 20% tax payer?

your pre tax earnings go into the pension, so it’s more beneficial to pay in if you are a 40% tax payer

@@JansonSmith Thanks Janson, time to up my AVC's, fiscal drag is probably putting many people into the higher tax band.

my biggest issue with pensions is that once you die so does the pension, so if you didn't take full advantage of you pension it goes straight back to the government. another issue with pensions and your logic is that yes you do save 25% on tax but if you've paied into a pension for 50+ year the tax rates are more than likely rising through the years so by the time you start using your pension you will be paying into higher tax which cancels out the measly 25% you "save" . correct me if im wrong

I dunno about that, if it’s a SIPP (private) I don’t see why it wouldn’t pass on. Maybe you’d lose the tax benefit but I can’t see it just all going to the government

Money in private pensions are passed on and usually without inheritance tax implications - however, you must tell the provider who you want to leave the money to. It is worth reading up about it. Trusts are another way of protecting from inheritance tax.

The UK is actually super low tax compared to many other countries, tax breaks on private pension contributions are unreal.. the problem is cost of living is still high, and nothing works 😬

And property prices :(. Pension is great but obviously have to wait a long time to get it, by which time much of the purchasing power may have been eroded!

Can you really trust the government not to help themselves to your pension pot over the next 20 - 40 years? The idea of government "borrowing" from private pensions has already been floated.

Other issue is that nearly all pension investments are paper based. I.e. no underlying assets. If the issuing company goes bust, or if the laws change, you are left with nothing.

@@MrEdrftgyuji Most pensions that are registered under FCA are covered under FSCS- Financial Services Compensation Scheme at 100% of the funds value should the pension provider go bust. Defined contributions schemes that most people have now are invested in stocks, bonds, gilts, cash etc so there are of course underlying assets. For example one of my pensions, I invest in 4 funds (100% equities) 2 are trackers with varying holdings that change based on the index. In total I invest across 100's of holdings spreading my risk. And each fund has varying asset allocations with very little overlap reducing risk further. Defined benefit pensions are less protected if the company that handles the money goes bust, you are at the mercy of said company. I am not aware of any protections or regulators that protect these - I should know really because I have 1 defined benefit pension.

Can you have a LISA if you’ve already had a help to buy ISA?

Is it not 22%?

Well I don't pay it as there's nothing in law that says you have to pay it

The tax rates are different in Scotland (which is part of the UK)

OK

Yes and are higher

All in favour of a higher tax higher value economy (Scotland). Not high tax low value (England)

AVOID PENSIONS. I know this as i have spoken to many pensioners.

Pension (Teachers) and AVC worked for me! Afforded me to retire early, tax free lump sum and a good monthly income. The alternative is slogging my guts till I am nearly 67! No thanks

Corporation tax went up to 26% this year remember? 😢

Only if your profits are over £250k. If you can keep them lower through allowable expenses, you’ll still pay 19% ;)

@@JansonSmith Ahhh thanks for clarifying, that's great then! i misunderstood my accountant lol 😆

@@adie.1892 chat to your accountant - there’s marginal relief on profits between the 19% and 25% tax bits so it can get complicated 🙈

Just wonder how many finished watching this vid?

Pension is not a great idea, inflation and a crashing market will destroy it.

Company structure is a great one when you locate the company in a tax efficient location but don't forget the dividend payment allowance and move assets abroad to the tax haven before cashing out.

Isa /Savings is terrible, inflation will devalue it, better off keeping cash which is also tax free and the states prying eyes don't see it... interest is a moot point these days.

A pension, AVCs and an ISA have all worked for me, allowing me to retire early instead of killing myself to reach 67. Living a fairly good standard of living with everything I need.

@@soosayer9893 So you pay into 3 stocks based ponzi schemes in a collapsing economy and you think you are in a good place, poor you really bought into the ponzi scheme, more than most in fact...

@@soosayer9893 nobody cares about your fake anecdotal hearsay...

@@soosayer9893 So how much will your 3 pension schemes be worth when the markets are worth 0?

Do the maths for us...

If you have a side hustle which makes a loss, you get a tax refund. If that correct?

I want to cut down my tax which is approx 1k a month.

I hate this legalised theft..aka tax

You can offset losses against future losses but I don’t think you can get a refund

@@JansonSmith oh. I have a friend who said he gets it back on his wage.