Do You Pay Tax on Gambling Winnings in the US as a Foreigner? W-8 BEN in a Casino?

ฝัง

- เผยแพร่เมื่อ 24 ก.ค. 2024

- Book a call: calendly.com/worldtaxandy

International Tax - Fundamentals for Beginners: www.udemy.com/course/internat...

Many non-US residents will head to Vegas among many other gambling destinations in the US and will often come away with winnings, be it from poker, slot machines or roulette! But many find when they go to cash out, the casino will withhold 30% of their winnings. In this video I'll explain why this is, and how you may be able to stop this happening, or claim this money back if it's already happened.

You may also be asked by the casino to fill in a W-8 BEN form and I'll provide some info on what this requires. This will be especially helpful if you're from one of the following countries:

Austria, Belgium, Bulgaria, Czech Republic, Denmark, Finland, France, Germany, Hungary, Iceland, Ireland, Italy, Latvia, Lithuania, Luxembourg, Netherlands, Slovak Republic, Slovenia, South Africa, Spain, Sweden, UK

0:00 Introduction

0:46 Why does the casino withhold 30% of winnings?

2:08 Why do they still withhold it knowing I'm from the UK?

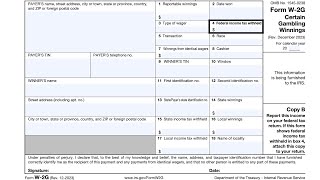

2:52 Proving your tax residency: W8-BEN form

3:15 Tax identification numbers: ITIN and FTIN

5:13 Ideal scenario: you hand over a W8-BEN immediately after winning

6:35 More common scenario: no W8-BEN completed - casino withholds 30%

7:16 How to reclaim the 30% held withheld by the casino

8:01 1040-NR form (non resident tax return to reclaim tax paid)

8:22 Summary

A BIT ABOUT ME

I've been advising on international tax since 2014, and qualified as a Chartered Accountant in 2018. I worked for consulting firms PricewaterhouseCoopers and BDO, before I started a remote international tax consultancy firm, Degen Tax Advisers, in 2020.

I work with online entrepreneurs to help them navigate the complex world of international tax. I work with e-commerce businesses, digital nomads, content creators, tech startups, crypto investors, poker pros and many more in the digital space. Like my clients I'm pretty nomadic. I've lived in the UK, US, Japan, China, Malaysia, Thailand, Vietnam and Singapore. Currently I'm spending most of my time around Southeast Asia.

DISCLAIMER

My videos are for general guidance, education and providing you an introduction to the concepts of international tax. They in no way constitute specific advice to your specific circumstances. I accept no liability for any reliance placed upon the content of these videos or references, therein.

![[ไฮไลต์] ฟุตบอลชาย อาร์เจนติน่า vs โมร็อกโก รอบแบ่งกลุ่ม | โอลิมปิก 2024](http://i.ytimg.com/vi/wE6uYH0yyzM/mqdefault.jpg)

what to do if u allow casino to take taxes out of winnings? my friend lives in Texas but allowed a Casino in Louisiana to keep taxes.. but has lost more through out the year.. and yes I heard the end of ur vid going over this some.. but this is all in the USA, just in a non-resident state.. is there a chance of getting what the casino took back? ... TY for any reply

Hi, this might be possible to claim back by filing Louisiana non-resident tax return. This would report your gambling activity in Louisiana including those winnings, the tax the casino held and any losses. Losses can generally be claimed as a write-off, meaning if the gambler makes a net loss, they shouldn't pay any taxes.

revenue.louisiana.gov/Faq/Details/1006