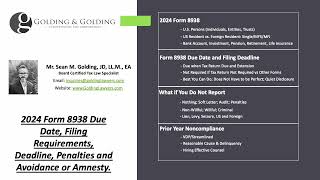

IRS Penalties on Late Filed Forms 5471, 5472, 8621 & 8938

ฝัง

- เผยแพร่เมื่อ 1 ต.ค. 2024

- If you failed to timely file one of these international forms, you could be facing some severe penalties.

The IRS is really interested in knowing what types of foreign financial assets are owned by U.S. taxpayers.

If you own a stock interest in a CFC, make sure to include that Form 5471, or else you are facing a $10,000 penalty!

More videos on these subjects:

How to File Form 5471: • IRS Form 5471 - Beginn...

Form 8621 MTM Election: • How to Complete IRS Fo...

Form 8621 QEF Election: • IRS Form 8621 - How to...

FBAR for Crypto: • Do I Need an FBAR For ...

Form 8938: • How to Complete IRS Fo...

For a larger database of tutorials, please visit our website and search for your question:

knottlearning....

DISCLAIMER: The information provided in this video may contain information about tax, financial, and legal topics. Such materials are for informational purposes only and may not reflect the most current developments. These informational materials are not intended and should not be taken as tax, financial, or legal advice. You should contact an advisor to discuss your specific facts and circumstances. Self-help services may not be permitted in all states or jurisdictions. The use of these materials does not create an attorney-client or confidential relationship. This video does not include information about every topic or issue related to these informational materials.

#IRSpenalties #Form5472 #Form5471

But a shareholder in a PFIC bought through a broker wouldn't know whether their stock IS a PFIC or not.

Further - a US ETF holder wouldn't know whether the ETF filed the PFIC forms correctly.

IRS could claim a single foreign company in the ETF was a PFIC for one year 20 years ago and boom.

This form is a trap

I am a British citizen and live in the UK. I formed a Wyoming LLC in 2011 and have never made a tax return for the :LLC. The LLC has never traded and has no assets. I would like to start to use the company and to apply for ab EIN. Is it possible to get the IRS to excuse any penalties for late or none filing.

what form I can sent for a individual tax return filled late help me with a penalty

A penalty abatement request can be submitted via IRS Form 843

Thank you so much, I managed to send in a 1120-f, 8833 and a 7452 form- but I am not sure it is correct and I and a CPA for my Delaware-based C corp - . Do you take on international clients?