This Stock's Instant 10% DIVIDEND YIELD Is Life-Changing

ฝัง

- เผยแพร่เมื่อ 8 มิ.ย. 2024

- This dividend stock that yields almost 10% is going to change my life, accelerating my FIRE journey to a new level of velocity. Learn about the flow of money and dividends in my portfolio, and how I approach the dividend game. I'm excited to review my strategy and also take a look at British American (BTI) stock.

#dividend #stock #investing

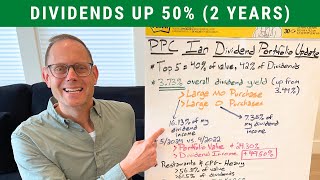

0:00 I just bought British American (BTI), a dividend stock yielding almost 10%.

0:15 Putting money in a stock that yields 10% is really exciting. The cash flow is massive.

0:22 I bought a lot of Altria (MO) in late 2023, and that stock has worked really well for me.

1:02 THE FLOW OF DIVIDENDS

1:20 In my OG days, I started mostly with sin stocks.

1:39 Check out the pinned comment for a link to my Patreon.

2:08 There are many different ways to play the dividend stock investing game.

2:29 Right now, I need more cash flow NOW.

2:42 Three-Tier Flow of Money

3:15 9.5% dividend yield and a PE ratio in the 6s.

3:20 STEP 1: Capital To Deploy

3:23 STEP 2: Put the capital in a higher-yielding, annuity-like stock.

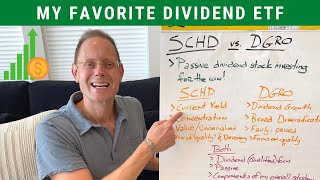

4:22 STEP 3: Use the dividends from Step 2 to fund "forever" ("Core") investments like SCHD, JNJ, and SBUX.

5:05 I have a tranche of Treasury Notes maturing. It was earmarked for SCHD, but I think I'll just put it in BTI.

5:30 KEY: Don't worry about what people think, nor how they perceive you as a dividend investor.

6:46 KEY: Step 2 investments are also "forever" companies. I don't sell them. They are just a different type of investment. They have higher risk.

7:38 Pros and Cons - Option 1 is "sleep-well-at-night", but Option 2 carries more risk (with FIRE coming quicker).

8:00 MY BTI DIVIDEND STOCK PURCHASE LAST WEEK

8:44 The forward PE is in the 6s.

9:13 Starting yield is 9.86%.

9:34 SLIDES FROM BTI INVESTOR WEBSITE

10:05 NOTE: I take out dividends from sin stocks. I generally don't reinvest them back into the company that paid the dividend.

10:28 SLIDE 1: US Combustible Brand Write-Off

11:11 Non-cash impairment charge.

12:14 SLIDE 2: Balance Sheet

12:31 You can see intangible assets tank, due to the write-off of the US brands (combustible market).

13:01 SLIDE 3: Income Statement

13:19 Depreciation, Amortization, and Impairment Costs

14:10 SLIDE 4: Free Cash Flow (It's Growing Really Well!)

14:55 The business is growing from a financial standpoint.

15:27 Adjusted results are growing (adjusted for the impairment charge). Adjusted diluted EPS is up 4% year-over-year.

16:08 Is this really a step 2 stock, or is it a step 3 stock on deep discount?

16:20 Broader society may hate this stock (and want it to go out of business), but the fundamentals show it's doing just fine.

16:56 SLIDE 5: New categories are growing FAST (28% CAGR)

17:40 SLIDE 7: 16% of revenue comes from smokeless!

18:22 The sin stocks trade at low values because people hate them and avoid investing in them.

18:39 A lot of mutual funds cannot even buy these stocks.

19:52 DISCLAIMER AND DISCLOSURE

DISCLOSURE: I am long British American (BTI), Altria (MO), Johnson & Johnson (JNJ), Starbucks (SBUX), and SCHD. I own these stocks (and ETF) in my personal dividend stock portfolio. I'm also long Treasuries.

DISCLAIMER: All information and data on my TH-cam Channel, blog, email newsletters, white papers, Excel files, and other materials is solely for informational purposes. I make no representations as to the accuracy, completeness, suitability or validity of any information. I will not be liable for any errors, omissions, losses, injuries or damages arising from its display or use. All information is provided AS IS with no warranties, and confers no rights. I will not be responsible for the accuracy of material that is linked on this site.

Because the information herein is based on my personal opinion and experience, it should not be considered professional financial investment advice or tax advice. The ideas and strategies that I provide should never be used without first assessing your own personal/financial situation, or without consulting a financial and/or tax professional. My thoughts and opinions may also change from time to time as I acquire more knowledge. These are, as discussed above, solely my thoughts and opinions. I reserve the right to delete any comments for any reason (abusive in nature, contain profanity, etc.). Your continued reading/use of my TH-cam Channel, blog, email newsletters, whitepapers, Excel files, and other materials constitutes your agreement with and acceptance of this disclaimer.

COPYRIGHT: All PPC Ian videos, Excel files, guides, and other content are (c) Copyright IJL Productions LLC. PPC Ian is a registered trademark (tm) of IJL Productions LLC.

IMPORTANT ANNOUNCEMENTS:

Thanks for watching! Please don't forget to "like" and "subscribe". Please let me know in the comments below what you think about the stocks discussed today. And, if you have any suggestions for dividend investors with limited time.

HELPFUL RESOURCES:

Here's my video from late 2023 about Altria (MO). I went HUGE on this stock and (so far) I've been pleased with my investment:

th-cam.com/video/Omn0RBY7qlA/w-d-xo.htmlsi=chkZ1U9hPKAH-fhL

Here's my last video about Starbucks (SBUX), a core stock of mine that is (very) out-of-favor right now: th-cam.com/video/JezBXc_mDjo/w-d-xo.htmlsi=YdJIAEhtyldRp3Hj

PPC IAN INSTAGRAM:

I'm sharing some great content over on Instagram. Check out my Instagram stories and reels. I'm @ianlopuch: instagram.com/ianlopuch/

CHECK OUT MY PATREON:

I'm sharing exclusive bonus content over on Patreon! I offer two tiers: Backyard Patreon and Corner Patreon.

My Backyard Patrons see my stock trades, each accompanied by a blog post write-up. They also have access to 50 historical Patreon-exclusive videos.

In addition to all Backyard Patron perks, my Corner Patrons also have access to my complete dividend stock portfolio (% allocation to each position) AND my complete bond portfolio (% allocation to each position). They additionally enjoy exclusive portfolio update videos, Corner Patreon virtual meet-ups, an exclusive Discord server, and more.

Head on over to Patreon to join today: www.patreon.com/ppcian

PPC IAN EMAIL LIST:

Join my email list today for helpful updates, and a look at some of my historical dividend stock portfolios: www.ppcian.com/my-complete-dividend-stock-portfolio/

PPC IAN TWITTER:

I'm always sharing fun updates on Twitter.

Here's my dividend investing Twitter (I'm @ianlopuch): twitter.com/ianlopuch

COOL DIVIDEND INVESTING MERCH:

I offer some really amazing dividend investing merch: teeshirts, hoodies, mugs, and more! The designs are super stylish and on-point for the dividend stock investing community. Each purchase supports my TH-cam channel: teespring.com/stores/ppcian

Thanks so much, everyone, for your support. I hope you enjoy the video today!

(Disclosure and Disclaimer: I’m long MO and SBUX. Please see video description for all disclosures and disclaimers.)

I am long both MO and BTI. While I am moving towards retirement I am shifting to all income generating investments including CEFs, BDCs and REITS. Im not as worried about growth, and I typically don’t auto drip. When the dividends get paid , I then look where to deploy that cash, wherever there is a discount in the market.

Long on $BTI. Market overreaction. Retail investors stay away from sin stocks nowadays just like they avoided oil stocks during the pandemic, semiconductor stocks in fall 2022, all bank stocks during SVB collapse in spring 2023. $BTI is hugely undervalued now. It also makes a good recession hedging stock to balance tech sector dominated index fund

Great insights! I agree. Thank you for sharing. (Disc: I'm long BTI)

Correct... be contrarian and chill in a crash. 👍

You’re not concerned that it’s been trending downward for the last 3 years, and is overbought in the short term?

I reinvest into my MO position. let it compound

FYI: I am in Europe. BTI opened a shop down my house. Mainly selling Blue. This thing is always crowded I am telling you and not from old people

I don't own BTI, but I am long MO. As someone in my 40s, your points are well-considered. I'm actually disappointed MO has been rising because I loved the 9.5%+ starting yield it was offering for a while. Hopefully, it will pull back again so we can load up 🤑

Enjoyed the deep dive into one stock, wish you had more like it, one on MO would be great too.

Thank you for your kind words!

Nice to see Thug Life Ian back! BTI is my biggest holding. I hope we both do well on this! :)

My biggest concern with tobacco stocks is the decreasing volumes. Profits are being maintained with price hikes, but there is a limit to that.

Yesss BTI is a major sleeper to add to!!! It's not too shiny, but man, free cash flow, almost 10% dividend and they are actually growing! Awesome! Plus, qualified dividends!

I also thought about buying more BTI. The return is mindboggling. Without growth they generate 15% p.a.. ☝️

Ian, I'm at the stage where I'm living off the funds invested. I'm making strides to move money into Roths to keep the government from stealing more of my cash. Over the past few years, My investments have been in ETFs like JEPI, JEPQ, and SCHD. These funds pay out monthly. I can then decide to place money in a safe haven, money markets paying over 5%, or invest back into my core investments. I put some cash into an MYGA that is over 6% and allows my interests to compound tax-free until the MYGA matures. At which time I can roll it or cash out. I can access up to 10% per year without penalty.

Thank you so much for sharing, and congrats on your retirement! (Disc: I'm long SCHD)

Thank you very much, my Master!

Every year I’ve been in the investing world they’re just about to go out of business, but it doesn’t happen.

Super sum up Ian, it’s a solid dividend aristocrat 👍

Great content as usual IAN , we always get a couple of nuggets of knowledge everytime.

Thanks Ian, I bought a ton. My highest dividend stock in my Roth dividend machine. 3rd is Altria

Good price bonus

Great Video as always.

Your positive and kind personality combined with your passion for dividend investing makes you my favorite finance TH-camr hands down.

Always appreciate the good work.

Thanks for the video, Ian. It was interesting.

Thanks for your kind words! It really means a lot!

Ian I've been watching your video since early days and I always appreciate the quality of your analysis and also you're willingness to express contrarian views.

Your kind words mean a lot!!! Thank you so much, my friend.

Hard to believe the US will be smokeless in 30 years.

Yes! I agree. I do think that their 30-year statement is a bit exaggerated. I think there will be a "long tail" to the smokeless future.

@@ppcian Ian, you're so cool. You're one of the few TH-camrs who actually responds to comments.

Yeah no people love beer, cigarettes, cokes, cheeseburgers, and pizza. Everything will kill you even breathing the purest air kills you in the end. 😮 ❤

It won't be.

Hey Ian - I saw that tobacco use went up in 2020 for the first time in 20 years. That was the pandemic year, economic hardship, etc. My outlook is that we will be having harder economic times coming in the future and maybe there is a correlation with tobacco use. I don't know the future but maybe these tobacco stocks have a brighter future than we think. On another note, it's my hope that everyone stops using tobacco (that goes without saying), but as long as I'm investing to take care of my family, I will purchase these stocks if it makes sense from an investment standpoint. Thanks buddy, God bless!

The dyslexic me. I read the bti into b i t landed in another 9% + dividend stock. 😊😂😂, that is not a cigarette company stock . Please look into BIT and give us your feedback 😊

Me too 😊step 3 alway. Great video

Thanks for sharing! Appreciate your kind words!

Just locked in CCOI at 6.7%

Love the dividend history and sustained revenue. Fiber internet for government and financial companies I don't see disappearing

Ian I always appreciate your unique investment thesis. I'm personally not buying BAT due to the industry decline but I love BAT's product Velo. It's the best nicotine pouch by far, in my opinion.

Thanks Ian, good video as usual. Agreed with your approach and insights here. I love buying company shares that have negative sentiment around them, provided the fundamentals looks good. MO and BTI are good examples. Same for RTX 1 year ago, CVS and SBUX now and coal stocks a few years ago, or technology stocks in winter 2022. The market is frequently irrational and overly (selectively) pessimistic. Thanks for your valuable insights.

Thanks for your very kind words, and for your thoughtful comment! (Disc: I'm long MO, BTI, RTX, and SBUX)

Excellent video. I agree BTI & M0 aren't going anywhere.

I have debated CCOI this week, seeing some value plus 6.5% dividend. Likely opeing a position tommorow. Love the channel

Thanks for sharing and thanks for your kind words!

BTI as of 5.15.24 is rated VERY BULLISH on Fidelity. Current payout ratio is -35% !!

The transition away from the "old" like cigs to new products is a little frightening to me. But if they can find their way, buying BTI at these prices could end up being a very good choice!.

Great point! Thank you for sharing! (Disc: I'm long BTI)

Why bti instead of mo.. did I miss that

I’m 24 and a relatively new investor, been educating myself over the last 6 months on all things investing. Just scared myself straight with the GME fiasco and looking to make more sensible plays.

It’s good that you made a mistake at your young age. It won’t be your last. At your age consider investing in QQQ VOO AAPL Msft and Google. Look at debt, bond rating of companies, the mgt and if they’re buying their own stock, how many ETFs are vested. Read the book The Richest Man in Babylon. Or listen in TH-cam for basic principles. I wish you great prosperity

Great!

Thank so much!

GREAT VIDEO !

Thank you for your very kind words!!!

SCHD is a great long term holding

If you get 9.5% plus 1% appreciation thats almost twice what youll get with 91 day t bills Pretty cool!

Do you think vaping will replace cigarettes 20 years down the road?

That is a good question. Based on the current trajectory of new products, it does seem that could be possible. The "new categories" are growing VERY quickly at BTI: th-cam.com/video/ojU8xk8vPG0/w-d-xo.htmlsi=mn9r4p1vCfpD9xzn&t=1018 (Disc: I'm long BTI)

BTI bag holder here. I overpaid for my shares, so I’m looking forward to many, many years of collecting the dividend to compensate.

I've been buying JNJ too. It looks like it's one of the few stocks out there that is still cheap.. everything else is pretty pricey. Owing 94 shares now.

Thanks for sharing! I'm a big fan of JNJ, it's my 2nd largest position (by value). (Disc: I'm long JNJ)

Great video

Thank you!

Been Long BTI for 4 yrs now!

My ADR fee for BTI doubled with the most recent dividend payment. Not sure what's up with that??

Will have to look into it. Thanks for sharing! (Disc: I'm long BTI)

FMAGX, 15% annual rate of return since 1963 inception, have you done better?

I'm a long-time viewer who enjoys and learns from your content. I hold positions in both MO and BTI, but I'm reluctant to buy more BTI. Reading from their website I get the feeling they feel guilty and rather than 30 years, I quote from their website, "Our vision is to Build a Smokeless World and our aim is to become a predominantly smokeless business by 2035." They have all the ESG, Sustainability and "Woke" themes that sorta make me pause and see how it develops.

Long BTI @ 29.71😊

ah damn it was one of the few stocks that I had that you didn't haha we are investing in almost the same things my man

I know you are talking about BTI, do you worry about pan US foreign taxes on the company that you chose in your portfolio? I asked that question because I own BP and every time they give me a dividend I pay foreign taxes on that as well and a transaction fee is like they taking my profit.

This is an interesting question. I own BP as well. based on the US-UK tax treaty, there should not be any foreign tax withholding on such UK-affiliated ADRs. There may be some ADR-related fees (for the ease-of-use of investing via ADR), but those are typically very low. I do see large foreign withholding on Canadian stocks, as there is no tax treaty, but I'm not seeing this with BTI nor BP. Are you based out of US?

@@ppcian yes and I just log in my acct and i see they only do transtion fees but do Bti have trasion fees?

DCA into Total market fund and reinvest dividends. Rinse and repeat.

Good video Ian. Forgive me that I didn't understand one thing tho: Do you prefer MO or BTI ? (disclaimer: I own both, not asking as advice, just didn't understand). Thanks.

Great question. I like both of them for different reasons. I believe MO has a better brand (in the US at least). I like BTI's international presence. In late 2023, I liked MO more (hence the MASSIVE buy order at that time). Right now, in this moment, based on BTI's stance on their US combustibles business (and supporting data in their 2023 annual report that shows US shrinking in real time), I would say I like BTI more. I'm hoping as the year progresses, if things go according to plan, I may have an opportunity to bring the size of my BTI position up there with MO, which would be a game-changer for me. I do think both carry a lot of risk, but I am personally comfortable with the risk for my personal situation, given the rewards/cash flow. (Disc: I'm long MO and BTI)

@@ppcian Thank you so much Ian! I can't appreciate you more for taking the time to really give me a detailed answer. Thank you so much.

For higher yield why not look into CSWC, ARCC, HTGC...i have done very well in those or maybe SPYI?

Will add all of them to my watch list!

Yes, I agree with Suttsd no reason to add a price depreciating asset like BTI when you can have a much more diversified ETF such as SPYI or QQQI giving you more yield with more price appreciation and more tax benefits for the income classification.

I am long on ARCC, HTGC, OBDC, MAIN, GAIN, GBDC, and BIZD, and some other BDCs. I use all the divixenda to buy VOO, VGT and SCHD. I do the same with my covered call EFTs. All in my SEP IRA that I rolled into a traditional IRA.

So good! Ian your videos are fantastic. Honest, sincere and authentic. A few questions, why don’t you invest in mlp’s like $EPD and $ET? Is it the K-1 tax form that bothers you?

Also what role does your wife have in your investment decision making? I ask because my wife has no interest UNTIL she is interested if you know what I mean.

“Honey Altria paid us $430 this month.” Wife: “Really?! That’s great we need a new vacuum.”

Me: “NOOO!”

What do you think about Clean energy etfs? Some decent UK Etfs.

Quick Question do you guys have to pay 15% witholding tax on un US stocks/shares?

Would BTI be considered a yield trap? Seems like the yield is high bc the price is down?

There is a member on your discord presenting themself as you. I believe that’s the case at least.

If it is you can you confirm via this comment! They were messaging me with a screen name like yours but the . moved

Thank you for letting me know. This is NOT me, it is a scam/impersonator. I do have a Discord, but have not been on there for a VERY long time. Thanks for letting me know. Please report the scammer, if there's a way to do so.

Ian, you might be overlooking the debt on this company

Hi Ian I am one of your OG subs from 6 years ago when you had your whiteboard at your old house. Have you considered another "yield now" alternative to BTI in JEPI? I know you are familiar with covered call ETFS and was wondering why would select BTI over JEPI? I use JEPI in a similar strategy as you have laid out in this video in that I use the dividends to invest into other lower yield higher growth companies plus it gives me the option to turn that reinvestment off and tap into the cash flow if needed. JEPI however is not expected to act like an annuity as BTI is and your initial capital should remain fairly intact while getting similar returns. The only pro I can see to BTI is the qualified dividend status. Just some food for thought! Thanks for another great video.

This is a company located in the UK. How much dividend tax withholding percentage will we face as U.S. shareholders?

I believe it is 0% withholding.

@@HankColteris this post 1776 as well?

We dont tax dividends like you do in the US. You get to keep all of what the company pays out. However I am sure you wont get the full amount becuase people like to take some when transferring money ie FX fees and platforms fees

@@Bob_1993 Compare to countries like Canada where my TD stock dividends get 15% whacked by the Cannies

These companies are just buying time until they can get into the legal marijuana business

That is a great point!

The only way to make money on bti is by reinvesting the dividends. The stock chart looks rough.

For ethical reasons not for me but I am drinking up sbux which appears to be on sale

Crazy that smoking is such a big taboo in US.. Should be normal to smoke in cafes, clubs. Same as alcohol. America is in general weird with alcohol and smoking, and kind of makes sense because of the culture. It's pretty geto in most areas and people are just different so they almost have to be controlled.

Hey Ian, instead of investing into bti, why not go for something like an ishares emerging markets dividend etf that pays 7.5 to 8 per cent and is diversified across numerous stocks that your broker won't have access to otherwise?

I sold my tobacco stocks because i feel they are just not worth with capital depreciation in mind.

Just don't. BTI's free cash flow per share has not been growing for 4 years. The company grew its div yield from 3.4 % in 2017 to the levels today for a good reason. Its liabilities increased by 3x in 2017, and its total assets by 4x. Probably an acquisition. They are still paying off these liabilities. How much has the net income grown since then? -3x! A disaster. What about revenue per share? Not even worth mentioning. What about even revenue growth since 2017? +30 %, in 7 years? You better stay away from this junk company. Bad management, by the look of it.

Buying NEP is a better judgment than buying MO or BTI.

Thanks for sharing NEP, I'll take a look. (Disc: I'm long MO and BTI)

I like HIGH yield dividend in Energy, etc.. My biggest investment is PBR, awesome enormous oil company in Brazil, 16% dividend. LPG nat gas 7%, and shipping co NAT 9% yield, and Pfizer PFE ( buy now for dip) 6.5% yield. 3 sectors, diversified. For growth, AI, Google, TSM, SOUN and for 1 or 2x, coal CCARF, Weed TCNNF, and SHMP fish farming tech.

Why can't you just say cigarettes??

I am happy to say the word in real life. I am careful on the Internet not to say words that could be deemed offensive (or "not allowed") to those who control the Internet, even though such words would be applicable to the company being discussed. Hope this makes sense. Wishing you a great day! (Disc: I'm long BTI)

@ppcian I get it. Just unfortunate that we even have to think about censorship to that extreme.

@@caseydresselhouse2456 I'm probably a bit too conservative/risk averse on these things, but better safe than sorry.

3 year chart for BTI is abysmal. 3 yr down 21 pct. 1 yr down 7 pct. Div, yes but value trap??

I’d rather buy JEPI/JEPQ than a sin stock. But that is just me. I hope it works out for the long time.

Thanks for sharing! I do think there are other stocks that can be substituted in the "Step 2". Two others on my watchlist that I've been thinking about for Step 2 are XYLD and FOF. Do think JEPI/JEPQ fit well too! Wishing you all the greatest!

@@ppcianI do the same as you. I have a lot of higher yielders that I then use to buy long term growth and dividend growth. Love the process. GFL is one I think will be big in 20 years. Very small dividend now, but the company is basically taking over waste removal in Canada.

@@Icecold0505 Thank you for sharing!

Love those two, plus RYLD, QYLD and XYLD. I like the covered call income but watch for NAV erosion

We’ve owned it for years. This company will balloon when marijuana is finally legal. They have the infrastructure for producing and sales in place

Weird because BTI is only down since Early 2022. Like a lot. $46 -> $31 current. And 5 year chart shows down 6 bucks. Tobacco is a losing new money investment.

BTI and MO are down over the last year. Tobacco is not a growing industry. Too many better alternative options available.

First ?

You got first! Thanks for your support!

10% over 30 years as an annuity, that investment doesn't make sense. That's 3x your money before taxes. The stock market (at least on average and in theory) with 10% returns doubles every 7 years which 4 doubles in 30 years, that's is 16x your money.

Have you lost your mind? 😂 5-YR total return for BTI is only 17.3%.

By contrast, it’s been 79.7% for SCHD, 96.3% for DGRW and 98.9% for SPY.

You may be leaving a LOT of wealth on the table… if you are going to reach for high yield, wouldn’t you rather grab a diversified index-based fund that has a chance of at least coming close to the market in total return, like JEPQ, BALI or QQQI?

The returns are horrible. This is a typical example of what you call a yield trap. A stock can only have 10% dividend because the market is pricing in future dividend cuts.

The chart on BTI looks questionable, more and more people are leaving these habits. I would never put my money behind habits that kill people and cause suffering.

I honestly don't understand why you're discussing these dubious schemes. There are plenty of options like Eledator and similar ones that are fast and profitable.

Should have bought this years ago instead of LEG. The so-called safe dividend stock. Loss with LEG 😢

What will happen to LEG?

BTI is a terrible stock. Only makes sense if you’re stuck holding it.

It’s risky! Possibly of dividend trap

Any yield more than 3% on stocks are risky or could be dividend trap

Gpix gpiq and thta. All that i need.

Thanks for sharing! I look forward to checking them out!