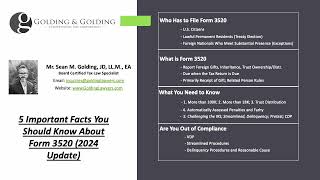

Form 3520: What is it and How to Report Foreign Gift, Trust and Inheritance Transactions to IRS.

ฝัง

- เผยแพร่เมื่อ 27 ต.ค. 2024

- www.goldinglaw...

Form 3520

When a U.S. Person meets the 3520 threshold requirements for filing, they may have to report one or more transactions. The common common reason for filing this IRS form, is to report a foreign person gift. Reportable gifts include transactions involving foreign individuals or entities, such as corporations or partnerships.

It may also include an inheritance, which is also technically a gift.In addition if the U.S. beneficiary receives a trust distribution, the reporting is significantly more complicated than the receipt of a foreign gift.

The form is due to be filed at the same time a persons files their tax return. The failure to properly report the form may result in significant fines and penalties. To assist you, we have developed our own Form 3520 Instructions handbook.