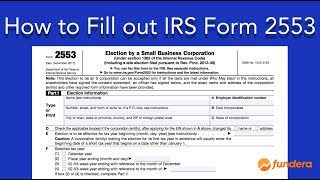

Tax Benefits of an S Corp & How To Elect S Corp Status [IRS Form 2553]

ฝัง

- เผยแพร่เมื่อ 9 ก.พ. 2025

- Are you eager to launch your own online bookkeeping business but unsure where to begin? I provide you with a detailed step-by-step guide to kickstart your journey as a bookkeeping entrepreneur. Discover essential tips, tools, and strategies to succeed in this lucrative field. Watch now and take the first steps towards financial independence and a thriving online bookkeeping business!

Course: How To Start A Bookkeeping Business

hbg-bookkeepin...

USE THIS CODE TO GET $50 OFF: TH-cam

Schedule a Call With Me

www.harrisburg...

Free Digital Downloads

www.harrisburg...

Join Us Weekly For Live Meetings!

hbg-bookkeepin...

Join my Facebook Group

/ 176068125361087

Free Mini Course

hbg-bookkeepin...

PandaDoc gives you the power to start and complete contracts, proposals, quotes, and more in a flash.

Sign up here: pandadoc.partn...

Create viral videos in seconds with Submagic Artificial Intelligence (AI)

Sign up here: www.submagic.c...

How to Become a Bookkeeper in 2024: A Complete Guide for Beginners

• How to Become a Bookke...

10 Proven Strategies to Land Your First Bookkeeping Client in 30 Days

• 10 Proven Strategies t...

Fast-Track Your Success: How to Get Bookkeeping Clients Quickly in 2024

• Fast-Track Your Succes...

[4-Step Checklist] My Proven Process for Onboarding Bookkeeping Clients

• [4-Step Checklist] My ...

Hey, can you do one on a C Corp please?

I actually don't know anything about a C Corp! I need to learn

Zach, great video. Now, the form that we're required to submit to the Internal Revenue Service to declare the business having an S-corp status, must it be filed annually or just once?

Just once