Minimizing taxes on inherited IRA

ฝัง

- เผยแพร่เมื่อ 7 พ.ค. 2023

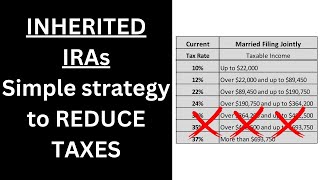

- Since the 2019 law change, if you inherit an IRA from someone who is not your spouse, you have 10 years to withdraw the funds. But most IRAs are comprised of pre-tax dollars. This means that when you take a withdrawal, you generally have to pay taxes. Especially for those who have the ability to control their income, good planning can result in paying a much lower tax rate.

A FEW NOTES - I noticed one error in my tax table after recording. In the 12% bracket for married filers, the first figure should be $22,000 (vs. $20,000). Additionally, don't forget about state income taxes!

👉 RELATED VIDEO - Simple strategy to limit taxes on inherited IRA for a big purchase. • REDUCE taxes on BIG wi...

My professional focus is retirement planning for individuals over age 55. Please visit our website or reach out for a complimentary planning session.

Ted Erhart, CFP®

Financial Planner

Anoka, Minnesota

www.norrislakeretirement.com

/ ted-erhart-cfp%c2%ae-4...

profile.php?...

![พาแม่บินครั้งแรก..เกือบวูบ! ให้เกาหลีเยียวยาใจ I Korea Ep.1 [Seoul] x อุงเอิง](http://i.ytimg.com/vi/waL3__dEQBU/mqdefault.jpg)

RELATED VIDEO - A simple strategy to minimize taxes on an inherited IRA for a big purchase. th-cam.com/video/hsI4_NAXxcM/w-d-xo.htmlsi=mrzdE8CW8Mjo7YJK

A few notes - I noticed one error in my tax table after recording. In the 12% bracket for married filers, the first figure should be $22,000 (vs. $20,000). Additionally, don't forget about state income taxes!

Another option if one or both spouses have 401(k)s: increase 401(k) contribution to maximum of $23,000 or $30,500.

We are drawing from the inherited IRA monthly to cover raising my 401k contribution to the max. It is basically a tax wash between what we pay on the draw and what we contribute tax deferred. Since they don't technically allow a rollover, this is the next best thing and allows us to empty the account within the 10 years without taking a tax hit.

Good move. This is on my "make a video" list.

@@TedErhartCFP We are doing exactly like @papasquat355 doing: draw exact amount to put to our 401(K), 457(B) (at maximum amount for each account for the 4 accounts), and yet when we filed tax return this year, we were told we owned more than $10,000 tax, why? where did we do wrong?

So are you saying to take the most from that account if you need the money and stay under the 89450 cap so you dont fall into the 22 percent tax bracket?.My wife inherited money from a family member and and we took the minimum for the year because we didnt need the money.Its taxed at 20 percent I think.

I have an inherited IRA, and started the RMD last year. I am 59 y.o. and employed. Can I take my next RMD, pay taxes, and put those RMD $ into a traditional IRA. ?

The short answer is yes. But you need to confirm you can take a deduction based on your income and whether you're contributing to another employer based plan (such as a 401k).

In addition to the 10 year rule, aren't RMDs required if the deceased was taking RMDs?

Yes sir. 👍

@@TedErhartCFP Did the IRS waive that RMD requirement at least for a couple of years?

@@tjwiets6691Yes they have because the tax-law was written with some ambiguity. The entire industry is still awaiting final guidance from the IRS for future years.

RMDs waived again for 2024.

Can one who inherits an IRA gift part of it tax free to a family member by rolling it over to their account?

This is a common question. Unfortunately the short answer is no.

What if there are 2 daughters? One daughter gets 50% of the moms IRA and the other gets 50%. Do the daughters work it out by themselves, or is the ira cut in half into two IRA's for them ?

In that case, the financial firm where the money is located would establish an inherited IRA for each of the daughters and split the assets equally between them. Then they each get to decide for themselves the timing of their withdrawals.

@@TedErhartCFP thanks so much

@@bigpoppa4094 My situation was different, my sister and I are the beneficiaries of my fathers traditional IRA that he had been already taking RMD' from. He was 96 years old. His Trust owned the inherited IRA and we both had to split the RMD's and take out the money at the same time each year.

Is there still an irs 10% penalty if you are under age 59.5?

Not for an inherited IRA.

@@TedErhartCFP thank you!

What is a standerd deduction?.

Tax Write off: Standard deduction Line 12 on Tax Form 1040 $14,600 for Single and $29,200 MFJ for 2024.