Filing a tax return on behalf of a deceased person

ฝัง

- เผยแพร่เมื่อ 31 ต.ค. 2023

- Subscribe to our TH-cam channel: / @teachmepersonalfinanc...

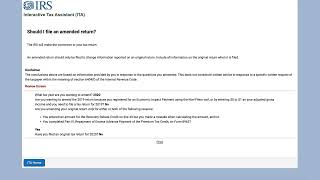

This video walks you through situations you may encounter while handling taxes on behalf of a deceased person. This includes:

-What to do if you're a surviving spouse

-How to file the current year tax return

-How to learn about the decedent's tax history

-How to obtain a tax refund on behalf of the decedent, if applicable

You can go directly to the following IRS pages for more information:

File the final tax returns of a deceased person: www.irs.gov/individuals/file-...

Request deceased person's tax information:

www.irs.gov/individuals/reque...

If you’re looking for tutorials for other IRS Forms that you can file directly through the IRS website, check out our free fillable forms page: www.teachmepersonalfinance.co...

Here are links to articles we've written about other tax forms mentioned in this video:

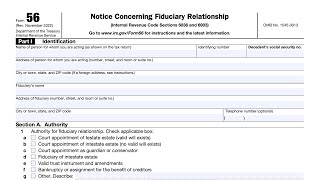

IRS Form 56, Notice Concerning Fiduciary Relationship

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 56 Walkthroug...

IRS Form 4506, Request for Copy of Tax Return

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 4506 walkthro...

IRS Form 4506-T, Request for Transcript of Tax Return

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 4506-T walkth...

IRS Form 8822, Change of Address

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 8822 walkthro...

IRS Form 2848, Power of Attorney and Declaration of Representative

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 2848 walkthro...

IRS Form 1310, Statement of a Person Claiming Refund Due a Deceased Taxpayer

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 1310 walkthro... - แนวปฏิบัติและการใช้ชีวิต

Thank you for this information. My wife recently passed away and this is just what I needed to know. 👍

Can you please group the lectures of common IRS Notices and response? Thank you.

I appreciate the insight and feedback! As I build out a library of content, I am trying to organize these videos in a way that makes sense. Here's what I have right now:

Currently, if there is a video that supports an existing tax form or schedule, I've created a play list around that form or schedule. If the video covers a worksheet, it should be in the play list marked, 'IRS worksheets.' If it's covering a resource I've found on the IRS website, I've put it in a playlist marked, 'IRS Resources.'

This may change over time as this video library evolves, but I strive to make this content accessible and readily available for everyone. Is there a specific question or topic that you're looking for?

Great stuff, but in my case, spouse was also Deceased but I obtained POA and certificate of Beneficiaries for inherited IRA account. Do I have right claim the account? High court appointed me.

If there is no surviving spouse, then the IRS allows a personal representative to file the decedent's final tax return.

I haven't received the personal representative from the probate judge yet for my mother. Should I file an extension or file now?

I know you can’t leave links in comments anymore but if you take a screenshot and then copy and paste the link from your screenshot into your browser it will work. I’ve been trying to figure out my dad’s takes and I’m finding the answers on this IRS site for final taxes. Did you already get your EIN? You have to have the EIN to file. I believe you only need the proof of personal representative if you’re receiving a return, but I’m not positive. If you scroll to the last page of the webpage I’m pasting, you should find what page number to click on for your answer.

www.irs.gov/pub/irs-pdf/p559.pdf

You'd probably want to file for an extension if you don't have everything you need to file on time.

I had a quick question since this is very informmative and I did emailed them already but im the admin of my dads estate and have his prev accountant filing his taxes and i have the letters of admin but i get SSD and she stated the irs wont take a deceased ssn which makes sense so she needed mine since im the admin and have the loa. My question is since its my ssn and i get ssd , im not working , will social security understand or get confused under earnings or is this no need to worry because theyll see it was my dad. Etc. I left a vm with her a week ago but it is a busy time with tax returns. Thanks in advance.

I do not understand your question. What are you trying to achieve?

@@teachmepersonalfinance2169 I have to have an accountant file my dads taxes with my ssn. I get ssd , so i wasnt sure due to the fact im unable to work or make income on my ssd, if ssd would get confused thinking i made what he made last year or if its not a worry since i have to use my ssn to file for my fathers last year. I dont think i could use a EIN for that specific reason. sorry, the question was kind of confusing.

will me using my dads ssn as the admin of his estate confuse MY social security beneifts i get from ssd since i cant make a certain amount a month and filing his taxes for 2023 under mine, would thus put me over the limit. that was what i was trying to find out, would they already or can see that its not my income but his since they cant use a decased person ssn, thats all.

@@charlescarson5318 I don't think that using your father's SSN to administer his estate would impact your Social Security earnings or your record. You may want to discuss specific questions that you may have with the SSA specifically if you're looking to claim unpaid Social Security benefits owed to your father on Form SSA-1724.

@@teachmepersonalfinance2169 Okay, thank you. Yes, that was my main concern. Sorry if it was confusing and thank you for your response.

How do you do it online

If you are e-filing, you should follow the instructions provided by your tax software provider. There should be specific instructions on how to report the person as deceased.

Plz can you help me my mum passed away 2021 What can I,do plz

I'm not sure exactly how to help. However, here is where I would start:

1. Request a copy of your mother's tax transcript. You can do this online or by filing IRS Form 4506-T. Below are links to an article and a video I created to help with that form:

IRS Form 4506-T, Request for Transcript of Tax Return

Article: www.teachmepersonalfinance.com/irs-form-4506-t-instructions/

Video: th-cam.com/video/szu6_cH5QpY/w-d-xo.html

2. If someone did not already file your mother's tax return, then do that. If she was owed a tax refund, you might also need to file IRS Form 1310 (to claim the tax refund), and IRS Form 56 to establish your fiduciary relationship with the IRS:

IRS Form 1310, Statement of Person Claiming Refund Due a Deceased Taxpayer

Article: www.teachmepersonalfinance.com/irs-form-1310-instructions/

Video: th-cam.com/video/CE8hop1CaD4/w-d-xo.html

IRS Form 56, Notice Concerning a Fiduciary Relationship Article: www.teachmepersonalfinance.com/irs-form-56-instructions/

Video: th-cam.com/video/FQhaWogMiYc/w-d-xo.html

Both of my parents died in 2023, my father in January, my mother on October 1st. would I do a return married filing jointly, for them both? Put Deceased at the top with both of their dates of death? I am the Trustee and the daughter. My mom mentioned before she passed, that she had not made out tax returns for them for years. They will most likely not have a bill or a refund, from the financials I have seen. Thank you

According to the IRS, you should still file (www.irs.gov/individuals/file-the-final-income-tax-returns-of-a-deceased-person).

It might also be a good idea to request a copy of their tax transcript, which you can get by filing IRS Form 4506-T, Request for Transcript of Tax Return, where you review their account for accuracy (in this case, just to ensure there aren't any outstanding balances that the IRS may have, based on filed information returns from other sources). I've attached links to an article and video on this form below:

IRS Form 4506-T, Request for Transcript of Tax Return

Article: www.teachmepersonalfinance.com/irs-form-4506-t-instructions/

Video: th-cam.com/video/szu6_cH5QpY/w-d-xo.html

My sister passed 2021 can I fill for here I do have custody of her daughter

@@sabrinaalsadoon1863 If you are your sister's personal representative, then you would be able to. If you know that she was owed a refund, you might be able to file IRS Form 1310 to claim that refund on behalf of your sister's estate (subject to the wishes of her will):

IRS Form 1310, Statement of Person Claiming Refund Due a Deceased Taxpayer

Article: www.teachmepersonalfinance.com/irs-form-1310-instructions/

Video: th-cam.com/video/CE8hop1CaD4/w-d-xo.html