ไม่สามารถเล่นวิดีโอนี้

ขออภัยในความไม่สะดวก

Bonus Depreciation Recapture - When Business Use Falls Below 50%

ฝัง

- เผยแพร่เมื่อ 15 ส.ค. 2024

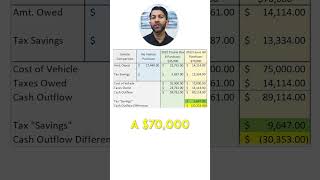

- If you are a business owner and take the bonus depreciation deduction for a business vehicle, you need to continue to track your business usage in subsequent years.

If the business use falls below 50%, you are in for a rude awakening. In the year business use drops below 50%, there is a required bonus depreciation recapture.

For a video on the eligibility of the bonus depreciation deduction, check here:

• 100% Bonus Depreciatio...

For a larger database of tutorials, please visit our website and search for your question:

knottlearning....

DISCLAIMER: The information provided in this video may contain information about tax, financial, and legal topics. Such materials are for informational purposes only and may not reflect the most current developments. These informational materials are not intended and should not be taken as tax, financial, or legal advice. You should contact an advisor to discuss your specific facts and circumstances. Self-help services may not be permitted in all states or jurisdictions. The use of these materials does not create an attorney-client or confidential relationship. This video does not include information about every topic or issue related to these informational materials.

#IRS #Taxes #BonusDepreciation

![[UNCUT] หวั่นขาดความเชื่อมั่น ศาล รธน. วินิจฉัยคดีถอนถอนนายกฯ เศรษฐา | คนดังนั่งเคลียร์ | 14 ส.ค. 67](http://i.ytimg.com/vi/8hKvQe_vh3o/mqdefault.jpg)

Thank you! Your videos are so thorough and presented so well.

Thank you. What happens if you maintain >50% business use associated with the 5-6 year straight line depreciation rule, then fall below 50% business use on year 7? Can you use it 100% for personal use at that point, without any tax consequences?

Great video! Question: I used bonus depreciation on a business truck in tax year 2019. I had 100% business miles during that tax year and deducted 100% of the purchase price as bonus depreciation. In subsequent tax years I was less than 100% business miles, but more than the 50% minimum. Do I have to go back and amend the deduction amount since I did not maintain 100% business miles? Second question, after the five year depreciation term is over, can I drop below 50% on business miles without consequence? Thank you again for sharing your expertise.

Thanks for making this so clear to follow. Another question I have is that if we use this car for business over 50% for the following 5 years. I assume that if we depreciate all of the car value, would we be able to use the car for more personal use without depreciation recapture in year 6?

Best video on the topic.

Glad it was helpful!

Great content! Super valuable, thank you.

Glad it was helpful!

Ok, so if you keep business use above 50% you don't need to adjust the depreciation. Can you still deduct the mileage expense in year 2 if you took the 100% bonus in year 1? Also what happens when you decide to replace the vehicle with another new vehicle in year 2? How much can you bonus depreciate on the new vehicle in year 2?

Hi Jason, can I depreciate the vehicle in my S-Corp if the vehicle is under my personal name?

I love this, super detailed! Is it the same if vehicle is sold/traded in versus just used less than 50%? If John bought his $62k 4Runner in 2021 and depreciated it 100% using Section 179/Bonus Depreciation, then sells it in 2023 for $35k...does he claim the $35k as ordinary income AND have to recapture depreciation on the difference using straight line?

If the asset isn't listed property, do you still have sec 280f recapture? Or any recapture if drops below 50%?

Can you go over recapture if you sell the vehicle

Thank you for this. Best example on the internet, not just TH-cam. So, since business use was reduced to 30% and it seems that mostly all of the depreciation was recaptured as income (minus the 50% for year one), is there anything to recapture in year 3 or does it essentially become a personal vehicle now used for business and no longer requires Depreciation Recapture?

Does the vehicle over 6000lbs have to be an SUV or truck to qualify for bonus depreciation? Thanks for your help!

It doesn't have to be an SUV or Truck, it just has to meet the weight requirements.

What happen you if you stay over 50% after the 100% bonus depreciation.

If you keep the business use over 50%, then there is no bonus depreciation recapture.

@@JasonDKnott thank you. As a sole proprietor is it better to put the car under business name or personal?

@@JasonDKnott would there be depreciation recapture if I transfer a car from my single member LLC to a personal car? My business operated the vehicle for a year and took the full bonus depreciation. The transfer would be for no money.

Thank you😘😘😘