Data Update 5 for 2024: Profitability - The End Game for Business?

ฝัง

- เผยแพร่เมื่อ 11 มิ.ย. 2024

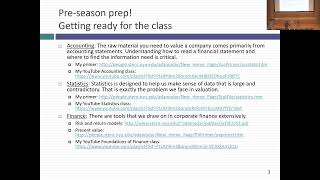

- Following up on my previous data updates, where I looked at the ingredients that moved hurdle rates in 2023, I look at profitability at companies. I start with a defense of profitability and value creation as the end game in business, partly in response to ill-thought through and misconceived notions of stakeholder wealth maximization and its offshoots - sustainability and ESG. I first examine profitability across sectors and regions, by scaling profits to sales (margins) and then by scaling profits to capital invested (accounting returns). I close by comparing these returns to hurdle rates, and concluded that 80% of companies across the globe generated returns that were less than their hurdle rates. If doing good for society requires healthy and profitable companies with surplus profits, delivering those surplus profits is getting harder to do with globalization and disruption.

Slides: pages.stern.nyu.edu/~adamodar...

Post: aswathdamodaran.blogspot.com/...

![4BANG - NOT LIKE US (REMIX) [Official Music Video]](http://i.ytimg.com/vi/HO22cYkha1s/mqdefault.jpg)

“Working at a research university, … , it has no mission, …, incredible waste of resources, is that what you want your business to be?” Aswath is so savage haha I love it

If beating the hurdle rate is harder, all it means is that share capital is less valuable than it was before.

Investment is easier than it’s ever been and it’s getting easier, so a larger pool of capital - and an exponentially larger pool of capitalists - are chasing similar returns. It’s not just business itself that’s become more competitive, the investment pool supply has become more crowded.

I don’t know if that’s “depressing”, although it does mean that genuinely competitive businesspeople are few and far between.

This was a really colorful way of describing the contemporary corporate share market, thank you.

I so in awe and grateful for your generosity and wisdom professor 🙏🙏🙏

Thank you, professor. Very interesting and enjoyable talk.

Really appreciate your sharing, always insightful and helpful.

Excellent! Thanks Prof!

Another excellent presentation!

Well said!

"the Milton Friedman view of corporate finance"😄😄

I really enjoy your lectures thank you! however, I'm confused at 14:28 you said that Eastern Europe and Russia are the most profitable and your reasoning makes sense but I thought based on the numbers that Africa and Middle east are more profitable? Correct me if I'm reading it wrong :)

I think maybe because that part of world has more dictators? dictatorship equals monopoly and high profits.

We're scrambling for the scraps of the table as stakeholders. And acting as the shareholders are getting the gigantic slice of the pie and saying I want that, strikes me as delusional.

Conclusion? Stock market resembles a casino for most industries and we live more and more in "metaverse", because we wished for that.

Maximizing stakeholders wealth will end up exactly the same like communism did.