Convexity of Bond

ฝัง

- เผยแพร่เมื่อ 28 ก.ย. 2024

- We offer the most comprehensive and easy to understand video lectures for CFA and FRM Programs. To know more about our video lecture series, visit us at www.fintreeindia.com

This Video was recorded during a live classroom session for CFA by our lead instructor Mr. Utkarsh Jain. This video lecture covers following key area's:

1. Memory Technique: "Convexity is a friend of bondholder"

2. Depiction of convexity graphically using Microsoft Excel

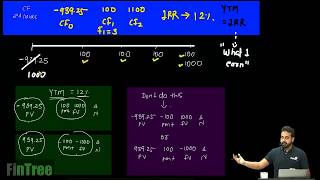

3. Calculation of Effective Convexity

4. Intuition behind the formula of Effective Convexity

5. Calculator shortcut keys for calculating effective convexity.

#CFA #FinTree

Amazing clarity. My compliments.

Very Nicely Explained.. FinTree is also a friend to Finance People.. Keep up your Good Work Sir..

In convexity formula in denominator there is not 2V0 its only v0 as per shwezer... why so ?

why?

It's the same as schweser in the CFAI book as well. However, the solution for change in bond price would be the same as CFAI's formula for change in price includes "1/2" x convexity x ∆yield^2 while in this video they use convexity x ∆yield^2.

Neatly explained

Perfect explaination.

Thank you Sahil!

The bottom of the screen is sometimes covered with your website address. Please take care.

why first number to be made positive at 12:17

God u breathe so heavily! Rest all was amazing!

Why are we saying increasing less, isn't it decreasing less or its same things in this context.

Yes he meant decreasing less and increasing more

Neat 👌

if you're going from 9%-11% why isn't delta Y 2?

Because its not 9 to 11 its from 10 to 9 and 10 to 11 so delta is 1.

You have made 70k people realise that your convexity formula is correct.

Please don't do this, some people might blindly follow you. Very disappointed

what?

wrong formula plz correct the formula

Yes, there should not be 2 in the denominator of convexity. instead we use 1/2 as a multiplier when we calculate % change in bond prices

*friend of THE bond holder

At first I reached on fintrees vdo searching for some tutorial on baII pro calc. And left. Then I bumped into their vdo again for FI and believe me it was worth it. All other vdos incl this one has helped me lot to go through concepts. Kudos fintree 👏👏👏👏

I’m an economist and i’m using this to relate economic theory to finance. Very interesting.

Thanks for a crisp explanation. Got clarity both on the relevance and the calculation of convexity !

You are my guru your videos have helped me so much. Thank you

Fantastic. A complex matter explained very lucidly

sir, here YTM which you are considering what does it means ?, is it IRR or return at the end of a year ?

YTM = IRR for bond investments.

Seems similar to elasticity

9.45*(-1%) + 75*(-1%)^2 will give negative number, how and why we have changed the negative sign to conclude decrease in yield by 1% will increase price by 10.2. why are we saving RCL1 as reverse of sign given in formula?

Edit: Correct formula >> Convexity* (Change in Y)^2 - M.D* (Change in Y)

This is amazing. Thank you so much!

This video was ZABARDAST !

Sir, you are the best teacher. Thank you so much

You are a Gem on earth 🙏🏿💎

Wowwww..❤

Thanks for such a useful and simplified video :-)

1 query please - Is there a name for the prediction of Change in Bond Price by using both Duration & Convexity ?

I would not call it a prediction, but rather an approximation.

And for this approximation I would consider the formula (Delta Price) = - (Modified Duration) * (Delta Yield) being the 1st order approximation (I think this is called also linear approximation) with (Price) = (Reference Price) + (Delta Price) and (Yield) = (Reference Yield) + (Delta Yield), while (Reference Price) being the price corresponding to the yield (Reference Yield).

The second order approximation for the Price versus Yield curve would then be:

(Delta Price) = - (Modified Duration) * (Delta Yield) + 1/2 * (Convexity) * (Delta Yield)²

You can/could continue to improve the approximation by a 3rd order being:

(Delta Price) = - (Modified Duration) * (Delta Yield) + 1/2 * (Convexity) * (Delta Yield)² + 1/6 * (Cubicity) * (Delta Yield)³

And you could continue to the n-th order approximation until you are satisfied with the accuracy of your approximation to the real behavior.

So the name you are asking for could be 1st order approximation, 2nd order approximation, ...., n-th order approximation.

Note: (Modified Duration) is the first order derivative, Convexity is the second order derivative (for to be the second order derivative the leading factor 1/2 is necessary), Cubicity is the 3rd order derivative (for this the leading factor 1/6 is necessary), .....

When you see a real (Price) versus (Yield) curve, for (Modified Duration) to be a positive number you need a - (minus) prefix.

Having seen several videos explaining convexity, there seems to be some confusion in the sense, that some people tend to define another convexity as (CONVEXITY) = 1/2 * (Convexity). This does result in different values for CONVEXITY and Convexity, but the change in price is same, because for to calculate the change in price for Convexity one need to apply (Delta Price) = 1/2 * (Convexity) * (Delta Yield)², while for the valuewise half as large CONVEXITY Delta Price is defined/calculated without the leading factor 1/2 (this got included in CONVEXITY) as (Delta Price) = (CONVEXITY) * (Delta Yield)².

However, an approximation is only useful as long as it does cost you (much) less effort than to determine the real behaviour of price versus yield. In this sense you will tend to stay primarily with the 1st order approximation, because it is easy to fix/calculate by first calculating the Macaulay Duration and then modify the Macaulay Duration into the Modified Duration, both by rather easy to remember formulas. The convexity is already much more difficult to fix, because the assumption here is you DO HAVE for 2 equally spaced (Delta Yield) points the accurate prices. To fix these accurate prices in a real world complex situation is rather difficult/takes quite some effort/time if you are not working with some estimations. But once you have done such effort you have with 2nd order approximation convexity a much more accurate bahavior of the price versus yield behavior which allows you to model/approximate the price versus yield curve within the same failure to a much wider variation in (Delta Yield) and which will hold also over time for a longer period than the simple first order approximation by Modified Duration only.

Nice video

at 4:40 when the yield is increasing:

the bond price is increasing less or decreasing less?

its confusing here

Correct, It should be decreasing less

This is simply awsm

actually good

Your opening statement is fantastic.

Nice, but in todaysmarket who is going to be a bondholder?? Second: a bondholder buying a bond with the idea to keep it till the end, buying the bond will know the ytm, so ... he ll not need to know the price changing.