Activity Based Costing Examples - Managerial Accounting video

ฝัง

- เผยแพร่เมื่อ 6 ก.พ. 2025

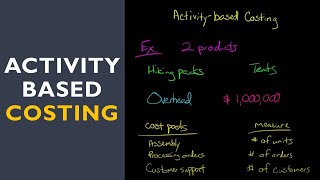

- Activity Based Costing Example - Accounting video by TheAccountingDr is a tutorial video with examples on using an activity-based costing system: 1) calculate the allocation rate and 2) allocated costs (overhead/indirect costs) using the allocation rate. In addition, we calculate the indirect costs per unit of planned products as well as the product costs per unit of planned products (direct materials + direct labor + OH).

Managerial Accounting lecture notes: tiny.cc/nw1enw

Activity-Based Costing terminology review game: tiny.cc/mxgoow

--

Thank you all for your wonderful support. Because of your support we have been able to reach and help numerous accounting students. Please continue to be a part of our mission to help other accounting students be successful by giving our videos thumbs up, giving comments and adding our videos to your favorites.

Subscribe: www.youtube.com...

Friend me on Facebook and post your questions: / theaccountingdoctor

--

For more accounting/how to eLectures (and accompanying lecture notes) similar to Activity-Based Costing Examples - Managerial Accounting video, blog, FAQs and accounting eBooks visit www.TheAccounti....

Activity-Based Costing Examples - Managerial Accounting video: • Activity Based Costing...

--

Please note that videos may require Flash media and may not play on devices without Flash capabilities (i.e. iPad). If you are having difficulty viewing this video on TH-cam, these videos may also be viewed without Flash on my website at www.TheAccounti....

Thanks for checking out my accounting videos. Please subscribe to my channel if you haven't already to receive notices of new video uploads. In addition, I am currently trying to gather input on new video topics that you would like to see next. Visit my website and complete the poll. I would appreciate your input. Subscribe to my email list while you're there. Also, I love getting questions and feedback. Like me on facebook at TheAccountingDoctor and post your questions there. I'm happy to help!

Thanks for checking out my videos. I am glad that you found Activity-Based Costing helpful. I hope that you will subscribe to my channel so that I can notify you when I have more videos to upload.

Join my email list and I'll send you a $2 discount code for the purchase of an eBook!

Let me know if you have any questions; I am more than happy to help.

Thanks for viewing my video on activity based costing examples. I am hoping to get more videos up soon and I will work on getting a video that addresses a second department and FIFO and weighted average method. In the meantime, please subscribe to my TH-cam channel to receive notifications of newly posted accounting videos. Also, visit my website at TheAccountingDr . com for additional accounting resources.

Happy Accounting!

Ok I have an exam tomorrow and you just saved my life. Peacefully. I

Mygosh!!! Thank God I found uuuu!!!! I just followed all the procedures in my handout provided by our school but it turned out the overhead cost and total of all cost per product didn't appear the same of overhead cost total. Thank youuu so muchhhhh!!!!!! 💓💓💓

Notice in the Cost Driver column, neither of the two activities are driven by DL hours. Therefore, it is not needed in determining any of the predetermined overhead rates used to calculate overhead allocated to either of the products.

Please subscribe to my channel to receive notifications of future accounting videos as I have many more planned for publication. In addition, visit my website (address mentioned in the video description above) for additional accounting educational resources.

This video has really helped me in understanding Activity Based Costing. Thank you!!!!!!

you're a genius i understand it now, thank you so much

Thank you for this simple explanation with such a great example, you're a genius!

thank you very much for this. this made my it clear as day for me. i have a Asian professor and i have a lot of trouble understanding her.

Thanxs a lot..This really made my life easier in preparing for my exam

Most welcome 😊

I'v been learning a lot from u so thnx

Glad to hear it

Very clear and easy to understand thank you the video was really helpful

Man, really good video

Appreciate it!

Thanks for the clear and straight forward explanation.

Thank you thank you thank you!!!

You are so welcome!

im ready for my final ~ thanks!😃 u made my life easier ❤

A true genius indeed.

Excellent and comprehensive. These are the steps in my textbook:

1. Identify the major activities that pertain to the business

2. Accumulate overhead costs by activities

3. Identify the cost driver(s) that accurately measure(s) each activity

4. Assign overhead costs for each activity using cost driver rates

Is this the same steps you are doing but in a different order? And when it says "major activities", does that mean the "cost pools"? Or are they two completely different things? Thank you.

Major activities are the activities that products go through to become a finished good. These are the activities that you will calculate an allocation rate for to apply overhead to a product. A cost object is something you allocate those costs to (anything that accumulates costs can be a cost object - i.e. a job, product, service, etc).

Brian Routh TheAccountingDr

Thanks, I noted that you mentioned a "cost object" rather than a "cost pool" like I had originally asked, are they synonymous?

Very nice, hy didnt u touch the labour coat by the way?

This video helped me loads! thank you for making this

Very helpful examples!

This video helped me a great deal! Thank you so much!

This was REALLY helpful thank you

Very helpful examples! Thanks!

Very helpful. Thanks.

This is a great question. Notice in the Cost Driver column, neither of the two activities are driven by DL hours. Therefore, it is not needed in determine any of the predetermined overhead rates for determine overhead allocated to either one of the products.

Please complete the poll regarding future video topics located on my website. I would greatly appreciate your input.

If you haven't already, please subscribe to my channel so that you receive notices when new videos are uploaded.

I have my priorities next month can you please do one more video....thanks a lot This was very very helpful

Thank you soo much sir! This really helped me a lot!

Helpful.. thanks.

what if there are labor mix like skilled and semi skilled worker. how would you find out skilled and semi skilled labor?

Thank you sir

this was extremely helpful!!! thanks so much

Super helpful, thanks!

Thank you very much

Heyy i wanna ask, at 12:48, about the direct material cost, arent you wrong, isnt the correct answer is 900 x 37 for product C because its a direct material cost per unit???

George, that's a great question. However, keep in mind that we are calculating the DM cost PER UNIT.

this is the good discussionon on ABC .Could u plz add some more examples of ABC system and cost of the production department to second department for FIFO n Weighted Average Method .

good video.thanks

Why dont we need that info about labor hours? Is it all abc methods in general?

Thanx a bunch!

Nicely done, good job :)

What about machine hours..is it part of OH or need to be calculated as Direct machine hours or something like that

Machine hours is not actually a cost and would not be included as part of OH costs. It would likely be used as a cost driver IF that is what is driving the OH costs of the company or division.

this is genius helpful thanks ..!!!!!

thanks so much

can plz upload step by step procedure to start a business & to fix a cost for each product plz

Thanks

whats the difference between standard costing and ABC. I understand how to do ABC now but not standard?

Exellent.

so good

thank u

thank u sir

Am I wrong ....total cost for product A is 37100+12000 which adds up to 49100 not 44100

Elizah, I apologize that it is difficult to see but, it's actually $32,100 + $12,000 = $44,100.