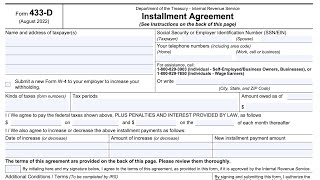

IRS Form 9465 - Installment Agreement Requests for U.S. Individuals

ฝัง

- เผยแพร่เมื่อ 3 ธ.ค. 2020

- All too often a taxpayer files their Form 1040 and has a massive tax bill due with the return. So, what happens if you can't pay the bill?

The IRS offers installment plan options for taxpayers with a balance due at tax time.

This frequently happens for self-employed business owners that don't make sufficient estimated payments during the tax year.

If you owe taxes with your return, there are options to create an installment agreement and pay the balance over a 72-month period.

For a larger database of tutorials, please visit our website and search for your question:

knottlearning.com/

DISCLAIMER: The information provided in this video may contain information about tax, financial, and legal topics. Such materials are for informational purposes only and may not reflect the most current developments. These informational materials are not intended, and should not be taken as tax, financial, or legal advice. You should contact an advisor to discuss your specific facts and circumstances. Self-help services may not be permitted in all states or jurisdictions. The use of these materials does not create an attorney-client or confidential relationship. This video does not include information about every topic or issue related to these informational materials.

#IRS #InstallmentAgreement #Taxes

![บุษบา - วงชานเมือง [LiveCoverVertion] Original : เมนทอล](http://i.ytimg.com/vi/Dm81sKcd9rs/mqdefault.jpg)

Why did you skip lines six through 9?

How would you fill this form if you were paying by checks??

How do you pay the installment agreement fee $107? By check to whom? Please advise!

Is there a income limit for they installment payments? Like if a person made 150k plus do they qualify?

One question: I completed the installment agreement form together with my 1040 and somehow the payments were not deducted. I had to check on the IRS every month and pay online. Why did this happen?

Typically this means the direct debit information wasn't correct on the installment agreement. So there was an issue with the account number, routing number, bank name or account holder name, so the IRS couldn't complete the automatic debit. However, it is not always the taxpayers fault. If you paper file the Form 9465, an IRS employee has to key in the details manually and sometimes does it incorrectly.

They shut my installment pay down online...

Unfortunately this happens a lot. If you miss a payment or get behind on taxes for subsequent years, the IRS may cancel the existing installment plan