Build A Machine Learning Trading Model For Profitable Trading | Quantreo

ฝัง

- เผยแพร่เมื่อ 7 ก.พ. 2025

- Build A Machine Learning Trading Model For Profitable Trading #algorithmictrading

Dive into machine learning for trading with Quantreo's comprehensive guide to building profitable trading strategies. Visit my website for more: www.quantreo.com/

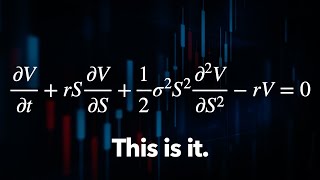

This tutorial covers every essential step, from coding in Python’s Jupyter Notebook to creating signals and managing stop-loss and take-profit thresholds. Learn how to avoid look-ahead bias, and discover the importance of training and testing models correctly.

Using a Support Vector Machine (SVM) model, the video explains data standardization and effective use of regression and classification in financial contexts. While you won’t find “ready-to-use” strategies, you will understand the solid foundations of trading with machine learning, empowering you to develop your own models. Don’t forget to like, comment, and subscribe for more insights!

The video is about Build A Machine Learning Trading Model For Profitable Trading

but also tries to cover the following subjects:

Building Reliable Trading Models

Avoiding Trading Data Bias

Key Steps in Trading Model Coding

✅ Subscribe To My Channel For More Videos:

/ @quantreo

✅ Important Links:

👉 Website: www.quantreo.com/

👉 Find The Code: github.com/Qua...

✅ Stay Connected With Me:

👉 Discord: / discord

==============================

✅ Other Videos You Might Be Interested In Watching:

👉 How to Import Historical Data from Interactive Brokers Using Python: Quick Tutorial | Quantreo

• How to Import Historic...

👉 How to Use Bracket Orders: Take profit and Stop loss on limit orders | Quantreo

• How to Use Bracket Ord...

👉 How to Cancel an Order on TWS Using Python - Easy Tutorial | Quantreo

• How to Cancel an Order...

👉 How to Place Market and Limit Orders on TWS with Python - Easy Step-by-Step Guide | Quantreo

• How to Place Market an...

=============================

✅ About Quantreo:

Create your "Trading Strategies Factory" with the Alpha Quant Program ...

Are you struggling to code your trading strategy?

Are you struggling to backtest a strategy quickly and properly?

Are you struggling to verify the robustness of a trading strategy?

Are you struggling to convert you trading strategies into live trading bots on MT5?

Are you struggling to integrate Machine Learning in your trading strategies?

Are you looking for a premium Quant community?

IF YOU ANSWERED "YES" TO ONE OF THESE QUESTIONS, you should take a look of our Alpha Quant Program !

For collaboration and business inquiries, please use the contact information below:

📩 Email: lucas.quantreo@gmail.com

🔔 Subscribe to my channel for more videos: / @quantreo

=====================

#machinelearning #tradingstrategy #pythontrading #svm #quantreo #financialmodels #algorithmictrading #tradingmistakes

Disclaimer: I am not authorized by any financial authority to give investment advice. This video is for educational purposes only. I disclaim all responsibility for any loss of capital on your part. Moreover, 78.18% of private investors lose money trading CFD. Use of the information and instructions contained in this work is at your own risk. If any code samples or other technologies, this work contains or describes are subject to open-source licenses or the intellectual property rights of others, it is your responsibility to ensure that your use thereof complies with such licenses and/or rights. This video is not intended as financial advice. Please consult a qualified professional if you require financial advice. Past performance is no indication of future performance.

Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use

© Quantreo

Subscribe to the Alpha Quant Program (using this link www.quantreo.com) before the Black Friday (Friday 29th November) to obtain our "Machine Learning for Trading" course for FREE !

Oh finally. Someone who isn't Moon Dev who actually knows what they're talking about! We don't got enough people like you on this website so I appreciate you making these videos. Also, Python is very based.

@@TechThroughHistory thanks a lot for you support. If you liked it, you should definitely think about joining the AQP before Black Friday before it is less than 5% of all we will see on the « Machine Learning for Trading » course I will release! Have an excellent day! I’m still here if you have any questions!

Learning Python myself so I can eventually get into cybersecurity, though for going for data analytics atm. Personal recommendations for job boards or companies to apply too?

@@TechThroughHistory Unfortunately not for cybersecurity sorry. Have a nice day!

😂😂😂

I want to ask you , What do you think about rolling normalization , as the scaling the whole data set at once lead to information leakage by default , that breach the fundamental principle of CPCV test , because we using the same distribution of overall dataset for each spit.

Hi, it is indeed a very good question.

1) Here if you fit your StandardScaler class on the X_train ONLY and you transform your X_test using it, there is not any leakage value. The Data leakage come when you fit and transform on all the features and then separate into X_train and X_test.

2) However, it can be interesting some time to use a rolling normalization especially for trending features (prices for example) but the problem is that you will at this end not have a really standardize features in a lot of case which is the purpose of the StandardScaler. So, you have other advantages and weaknesses and you need to do your choice taking them all into account +the problem you are solving and the features you are using.

By the way, I do not really see the link with the CPCV as the data leakage in the CPCV is removed by removing the beginning and the end of each set and then apply the Standardization if needed, so it is even more restrictive than what I did here as I didn't remove for example the first rows of the test set.

Let me know if you have any other questions!

Have an excellent day!

Hello Lucas , how to subscribe alpha quant Program , I couldn't see the link in discription

@@majdsaud8123 here is the link to join the Alpha Quant Program www.quantreo.com! Let me know if you have any questions!